Top 2 Tech Stocks That May Plunge This Month

As of July 9, 2025, two stocks in the information technology sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Zepp Health Corp – ADR (NYSE:ZEPP)

- On May 19, Zepp Health posted first-quarter adjusted loss of $1.13 per share, down from 76 cents per share in the year-ago period. Mr. Wang ‘Wayne’ Huang, Chairman and CEO of Zepp, commented, “In the first quarter of 2025, we are happy to see that our Amazfit revenue grew 10% year over year as we execute against a difficult macro backdrop while sharpening our operating model for long–term resilience. Tariff relief on key smartwatch categories in the United States and our dual–sourcing strategy between China and Vietnam helped cushion some external cost pressures, and the additional Vietnam capacity we brought online further de–risked the supply chain.” The company's stock jumped around 112% over the past month and has a 52-week high of $7.22.

- RSI Value: 88.9

- ZEPP Price Action: Shares of Zepp Health gained 47.1% to close at $5.12 on Tuesday.

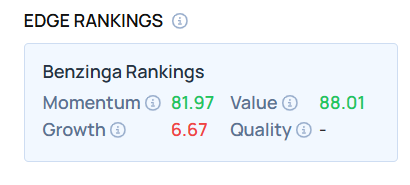

- Edge Stock Ratings: 81.97 Momentum score with Value at 88.01.

SoundHound AI Inc (NASDAQ:SOUN)

- On May 27, Piper Sandler analyst James Fish initiated coverage on SoundHound AI with an Overweight rating and announced a price target of $12. The company's stock gained around 27% over the past month and has a 52-week high of $24.98.

- RSI Value: 73.6

- SOUN Price Action: Shares of SoundHound gained 11.7% to close at $12.71 on Tuesday.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English