These Analysts Boost Their Forecasts On Kura Sushi USA Following Upbeat Q3 Results

Kura Sushi USA, Inc. (NASDAQ:KRUS) reported better-than-expected third-quarter financial results and raised its FY25 sales guidance on Tuesday.

Kura Sushi USA reported quarterly earnings of 5 cents per share which beat the analyst consensus estimate of a loss of 1 cent per share. The company reported quarterly sales of $73.965 million which beat the analyst consensus estimate of $71.832 million.

Kura Sushi USA raised its FY2025 sales guidance from $275.00 million-$279.00 million to $281.00 million.

Hajime Uba, President and Chief Executive Officer of Kura Sushi, stated, “The third quarter was a very busy one for us, between rolling out the new reservation system, investigating new market opportunities, and building out our IP pipeline and strategizing on how to get the most out of our Bikkurapon collaborations. I’m extremely pleased with the results on all three fronts, and very proud of the efforts by our team members to capture the full opportunity of the summer season and set ourselves up for a great fiscal 2026.”

Kura Sushi shares fell 13.2% to trade at $75.00 on Wednesday.

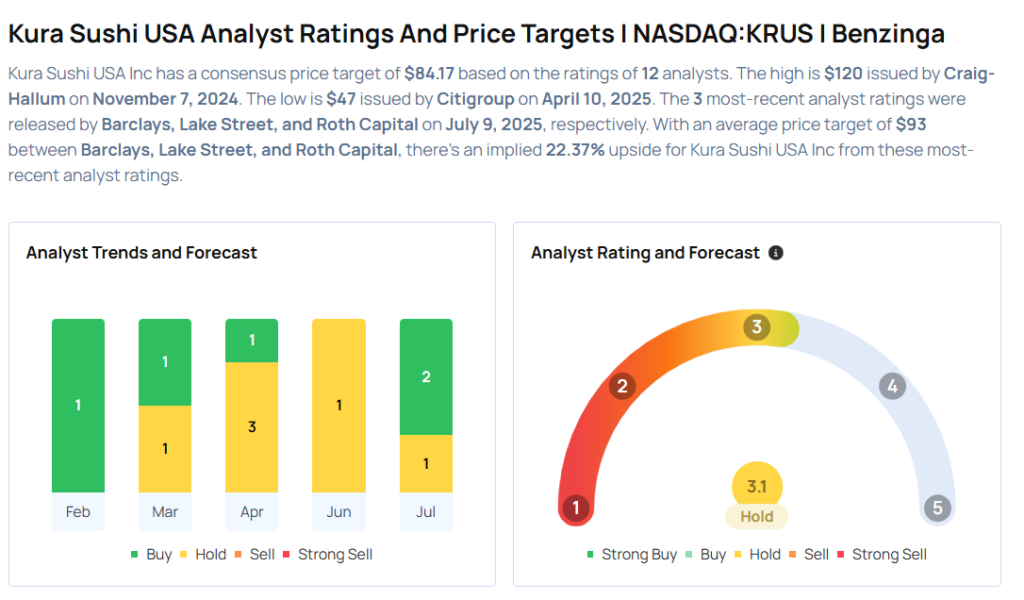

These analysts made changes to their price targets on Kura Sushi following earnings announcement.

- Roth Capital analyst George Kelly reiterated Kura Sushi USA with a Buy and raised the price target from $89 to $106.

- Lake Street analyst Mark Smith maintained the stock with a Buy and raised the price target from $62 to $98.

- Barclays analyst Jeffrey Bernstein maintained Kura Sushi USA with an Equal-Weight rating and raised the price target from $71 to $75.

Considering buying KRUS stock? Here’s what analysts think:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English