EWCZ Marketing Shift Shows Early Wins: Can Growth Reignite Fast?

European Wax Center, Inc. EWCZ has made a decisive pivot to revamp its marketing engine and early signs point to meaningful traction. After implementing a modern advertising effectiveness platform in the first quarter of fiscal 2025, EWCZ reported sequential improvements in new guest trends compared with the same period two years ago. While the lift remains modest, this directional movement is critical for a brand that has struggled to grow traffic in recent quarters.

At the core of this transformation is a push toward data-driven, digital-first marketing. With upgraded measurement tools now in place, EWCZ is able to link media impressions to in-center behavior, enabling smarter allocation of marketing dollars and a lower cost per acquisition. Creative and messaging tests are underway, with initial feedback suggesting the brand’s updated identity is resonating, especially among higher-value, more loyal guest segments.

This effort goes beyond surface-level branding. Marketing execution is being tightly integrated with franchisee operations through new support tools, enhanced guest communication platforms like email and SMS, and the planned launch of a champion ad campaign during the peak summer season. These coordinated efforts aim to strengthen traffic recovery and unlock additional guest visits. While the initiative is still in early stages, management is confident that the company is gaining momentum and its sharpened marketing engine will drive meaningful traffic and sales growth in the second half of 2025.

How EWCZ Compares in Marketing Efficiency

Coty Inc. COTY continues to evolve its marketing strategy by shifting resources toward high-ROI categories like mass fragrances while scaling back in lower-return color cosmetics. In the third quarter of fiscal 2025, Coty emphasized influencer-driven content and campaigns, such as its viral Rimmel UK push, to optimize digital reach with lower spend. However, inconsistent category demand and global channel fragmentation are still impacting Coty’s campaign efficiency.

Another peer, Helen of Troy Limited HELE, is focusing on simplifying its marketing execution and prioritizing investments that deliver the highest returns. Helen of Troy is refining its paid media funnel, driving more earned media and reducing content costs across brands like Drybar and Curlsmith. In the first quarter of fiscal 2026, Helen of Troy reported traction in influencer-backed launches and direct-to-consumer growth, but tariff disruptions and pricing pressure continue to weigh on media performance.

EWCZ’s Price Performance, Valuation & Estimates

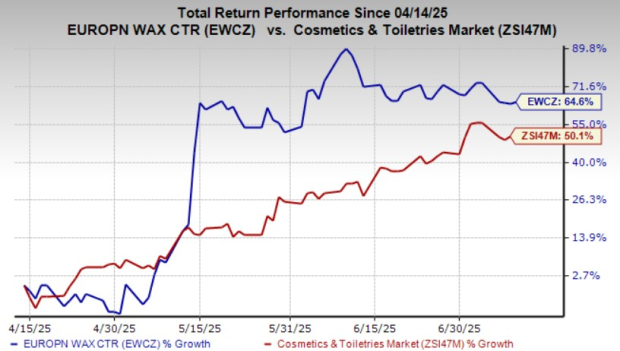

Shares of European Wax Center have gained 64.6% in the past three months compared with the industry’s growth of 50.1%.

Image Source: Zacks Investment Research

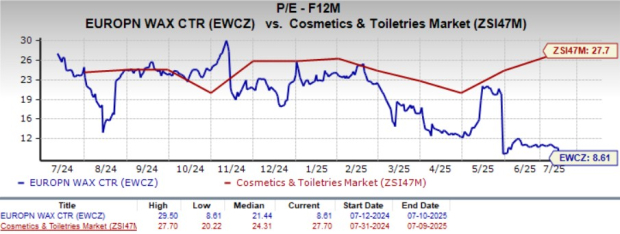

From a valuation standpoint, EWCZ trades at a forward price-to-earnings ratio of 8.61X, below the industry’s average of 27.7X.

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for EWCZ’s fiscal 2025 and 2026 earnings implies year-over-year growth of 35.6% and 8.2%, respectively.

Image Source: Zacks Investment Research

European Wax Center currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

#1 Semiconductor Stock to Buy (Not NVDA)

The incredible demand for data is fueling the market's next digital gold rush. As data centers continue to be built and constantly upgraded, the companies that provide the hardware for these behemoths will become the NVIDIAs of tomorrow.

One under-the-radar chipmaker is uniquely positioned to take advantage of the next growth stage of this market. It specializes in semiconductor products that titans like NVIDIA don't build. It's just beginning to enter the spotlight, which is exactly where you want to be.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Helen of Troy Limited (HELE): Free Stock Analysis Report

Coty (COTY): Free Stock Analysis Report

European Wax Center, Inc. (EWCZ): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English