Further Upside For Worthington Steel, Inc. (NYSE:WS) Shares Could Introduce Price Risks After 30% Bounce

Worthington Steel, Inc. (NYSE:WS) shares have continued their recent momentum with a 30% gain in the last month alone. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 5.8% in the last twelve months.

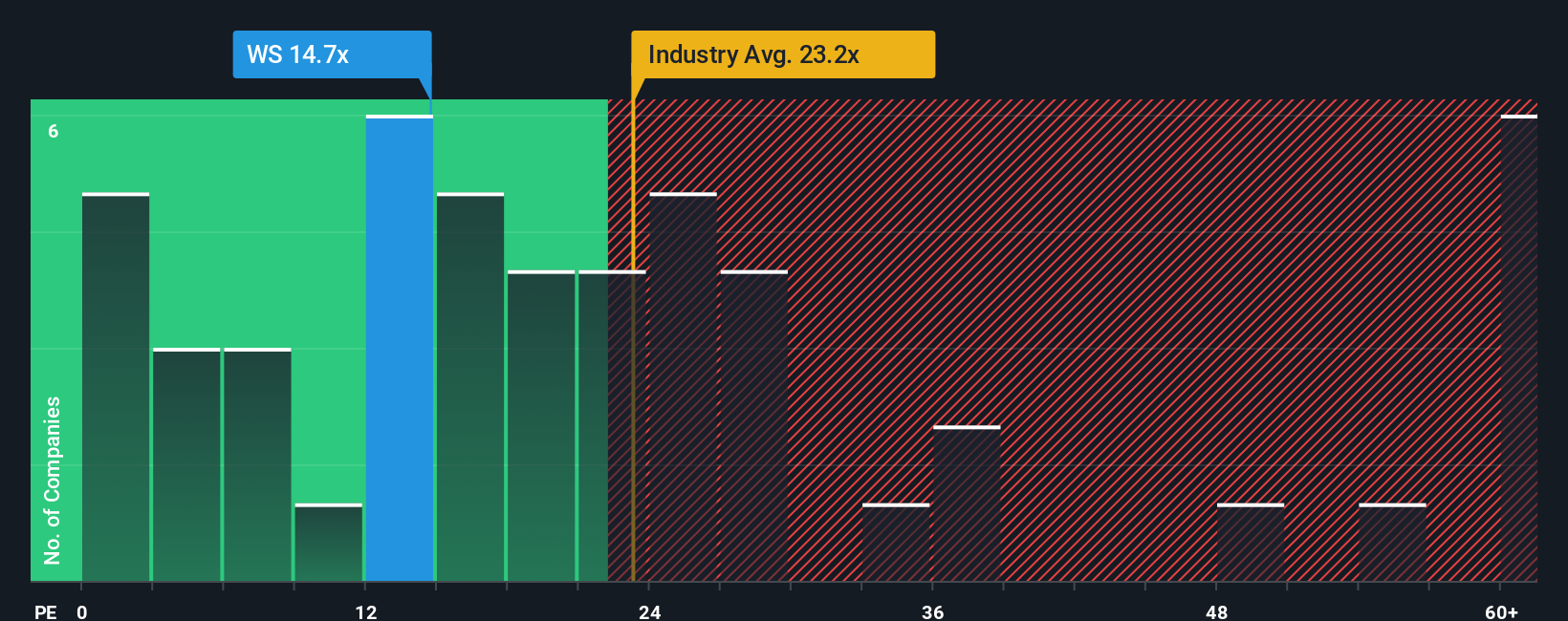

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 19x, you may still consider Worthington Steel as an attractive investment with its 14.7x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Worthington Steel could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Worthington Steel

Is There Any Growth For Worthington Steel?

There's an inherent assumption that a company should underperform the market for P/E ratios like Worthington Steel's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 29%. The last three years don't look nice either as the company has shrunk EPS by 39% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 16% per annum during the coming three years according to the dual analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Worthington Steel's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite Worthington Steel's shares building up a head of steam, its P/E still lags most other companies. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Worthington Steel currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Worthington Steel with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English