JBB Builders International Limited (HKG:1903) Stock Rockets 35% As Investors Are Less Pessimistic Than Expected

The JBB Builders International Limited (HKG:1903) share price has done very well over the last month, posting an excellent gain of 35%. The last month tops off a massive increase of 210% in the last year.

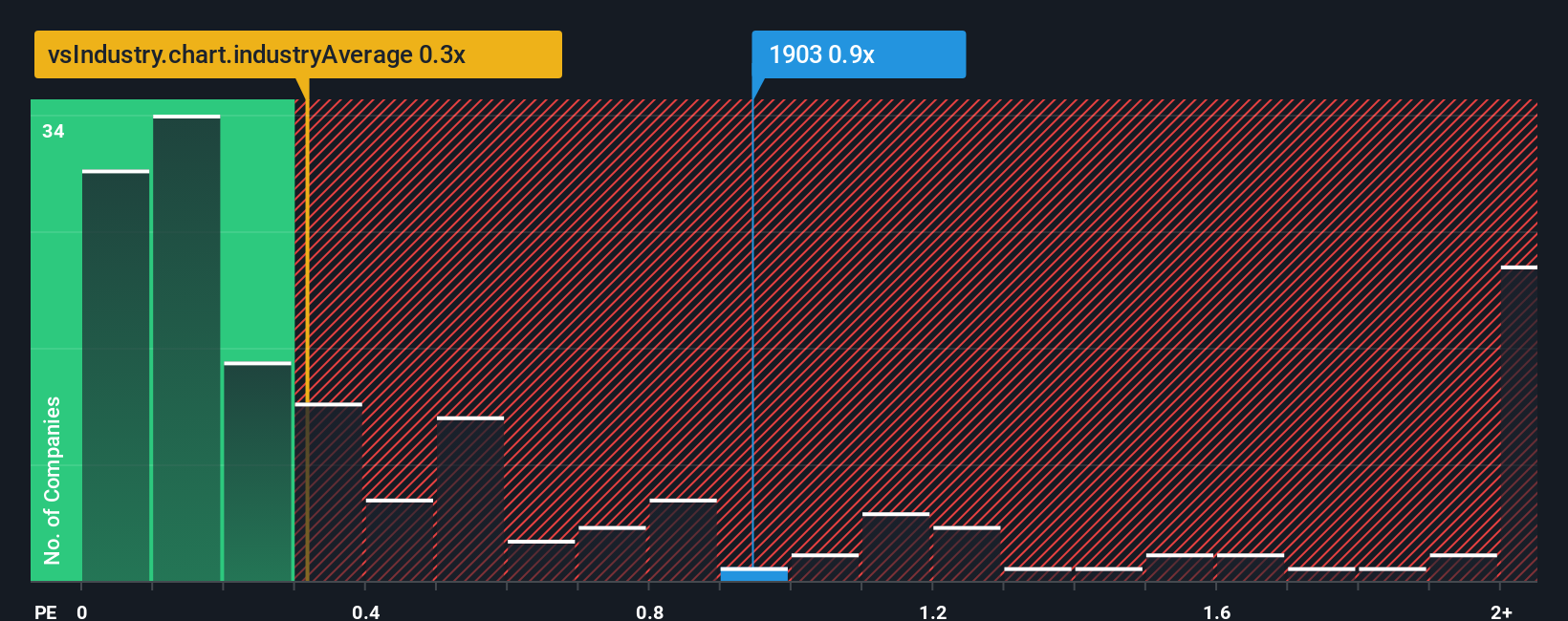

Since its price has surged higher, given close to half the companies operating in Hong Kong's Construction industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider JBB Builders International as a stock to potentially avoid with its 0.9x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for JBB Builders International

How Has JBB Builders International Performed Recently?

JBB Builders International certainly has been doing a great job lately as it's been growing its revenue at a really rapid pace. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on JBB Builders International's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, JBB Builders International would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered an exceptional 90% gain to the company's top line. As a result, it also grew revenue by 19% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 16% shows it's noticeably less attractive.

With this information, we find it concerning that JBB Builders International is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

What Does JBB Builders International's P/S Mean For Investors?

JBB Builders International shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that JBB Builders International currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

We don't want to rain on the parade too much, but we did also find 4 warning signs for JBB Builders International (1 is a bit concerning!) that you need to be mindful of.

If these risks are making you reconsider your opinion on JBB Builders International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English