High Growth Tech Stocks In Asia With Promising Potential

Amid a backdrop of muted reactions to new U.S. tariffs and mixed economic data, Asian markets have shown resilience, with the Chinese stock market experiencing gains due to hopes for further stimulus measures. In this environment, identifying high-growth tech stocks in Asia involves looking at companies that demonstrate strong innovation capabilities and adaptability to changing trade dynamics while maintaining robust financial health.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 30.19% | 29.63% | ★★★★★★ |

| Shengyi Electronics | 22.99% | 35.16% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 24.51% | 23.48% | ★★★★★★ |

| Fositek | 29.16% | 36.17% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 27.31% | 28.63% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| Marketingforce Management | 26.39% | 112.30% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Innovent Biologics (SEHK:1801)

Simply Wall St Growth Rating: ★★★★☆☆

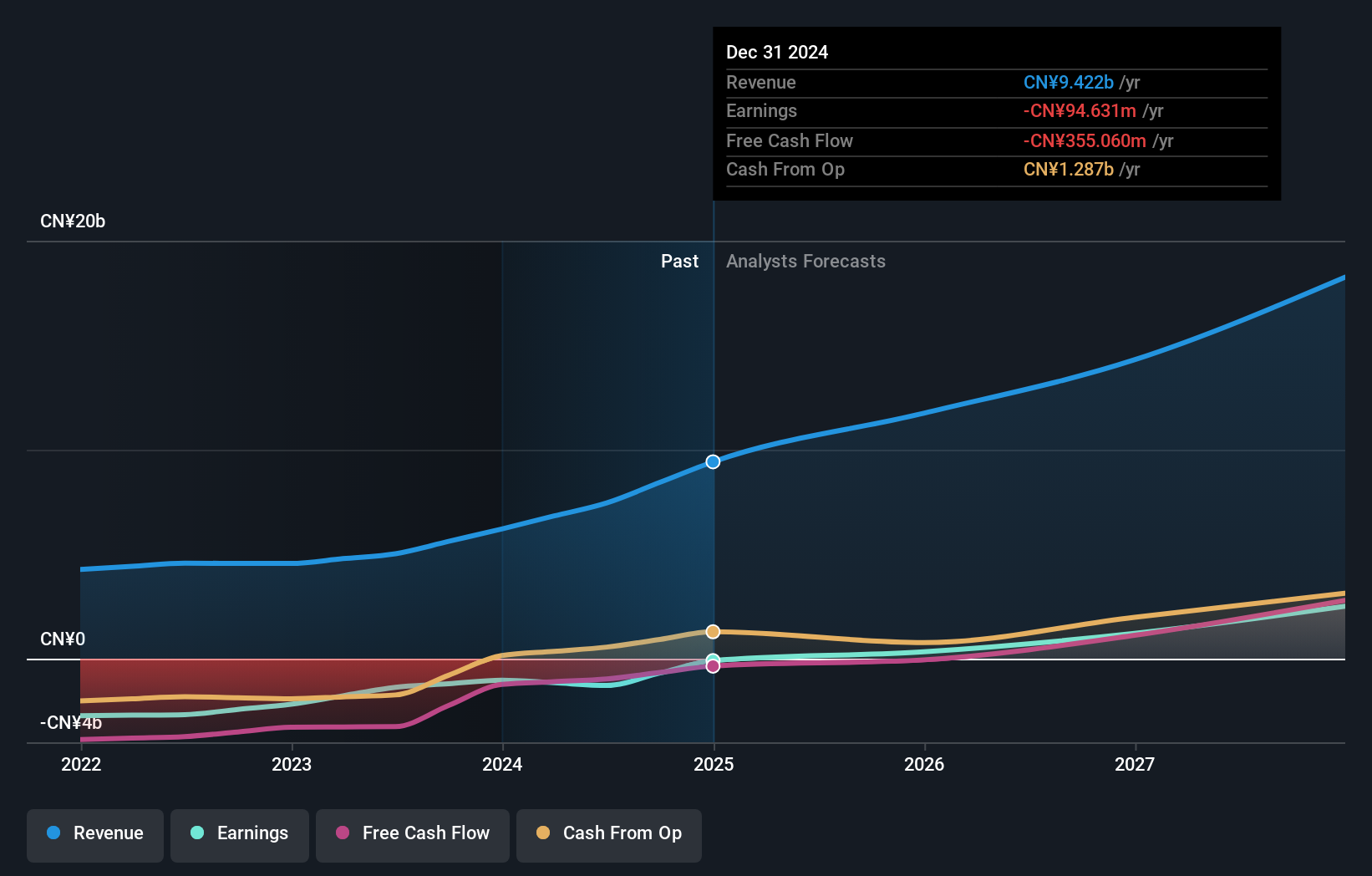

Overview: Innovent Biologics, Inc. is a biopharmaceutical company focused on the research and development of antibody and protein medicine products across China, the United States, and internationally, with a market cap of HK$147.35 billion.

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥9.42 billion.

Innovent Biologics has recently made significant strides in addressing China's growing obesity and diabetes epidemic. With the approval of mazdutide, a novel dual GCG/GLP-1 receptor agonist, Innovent is at the forefront of providing innovative solutions for chronic weight management. This drug not only aligns with national health priorities but also demonstrates substantial efficacy in reducing body weight and improving metabolic health, as evidenced by its pivotal GLORY-1 study results. Moreover, Innovent's successful HKD 4.31 billion equity offering underscores robust market confidence in its strategic direction and R&D capabilities, positioning it well for future growth within Asia's biopharmaceutical sector.

Marketingforce Management (SEHK:2556)

Simply Wall St Growth Rating: ★★★★★★

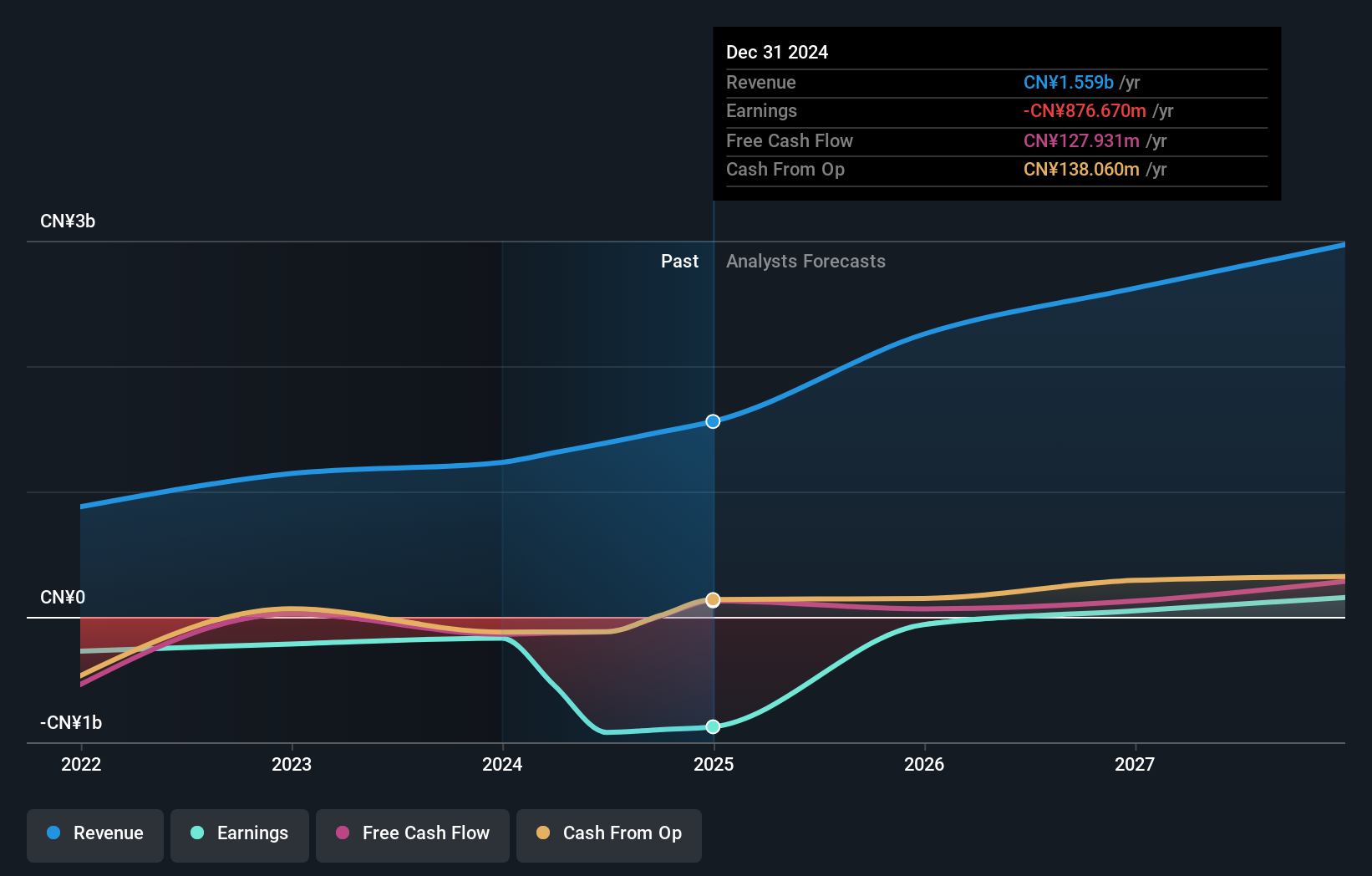

Overview: Marketingforce Management Ltd offers software as a service (SaaS) solutions in China and has a market capitalization of HK$13.25 billion.

Operations: Marketingforce Management Ltd generates revenue primarily from its AI + SaaS Business and Precision Marketing Service, with the AI + SaaS segment contributing CN¥842.16 million and the Precision Marketing Service adding CN¥716.43 million.

Marketingforce Management, poised for robust growth, is expected to showcase a revenue increase of 26.4% annually, outpacing the Hong Kong market's average of 8.1%. This impressive trajectory is complemented by an anticipated earnings surge of 112.3% per year. Despite current unprofitability, these figures suggest a swift move towards profitability within three years—a notable achievement in the competitive tech landscape. The firm's commitment to innovation is underscored by its significant R&D investments, aligning with broader industry trends towards enhanced digital marketing solutions. As Marketingforce prepares to announce Q1 results on June 3rd, these developments could signal strong future prospects in high-growth tech sectors across Asia.

- Click here to discover the nuances of Marketingforce Management with our detailed analytical health report.

Understand Marketingforce Management's track record by examining our Past report.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

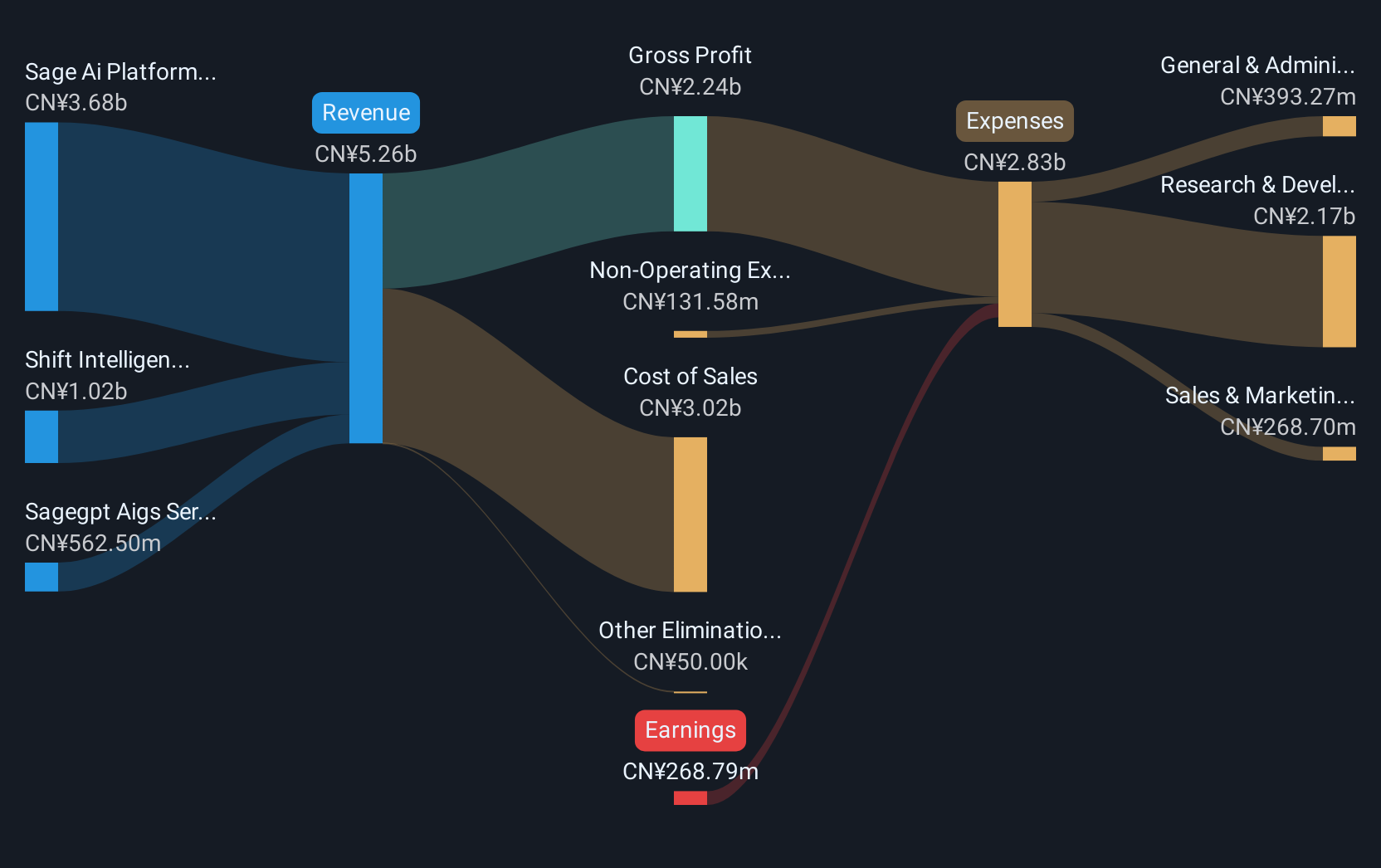

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market cap of approximately HK$27.35 billion.

Operations: The company generates revenue primarily through its Sage AI Platform, contributing CN¥3.68 billion, followed by Shift Intelligent Solutions at CN¥1.02 billion, and SageGPT AIGS Services at CN¥562.50 million.

Beijing Fourth Paradigm Technology, amidst a dynamic corporate reshuffle, including the recent appointment of Mr. Liu Zhuzhan and a significant auditor change to CL Partners CPA Limited, is positioning itself strategically within the tech sector. These governance adjustments coincide with robust financial forecasts, projecting an annual revenue growth of 22.5% and an impressive earnings increase of nearly 97% per year. This financial trajectory is further supported by the company's proactive amendments to its articles of association, potentially enhancing operational flexibility and governance standards. Such strategic moves could be pivotal in navigating the competitive landscape of high-growth technology markets in Asia.

Where To Now?

- Access the full spectrum of 474 Asian High Growth Tech and AI Stocks by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English