GitLab (GTLB) Is Up 7.9% After Launching AI-Driven Duo Agent Platform Beta – What’s Changed

- Earlier this week, GitLab Inc. announced the public beta launch of its GitLab Duo Agent Platform, a DevSecOps orchestration tool enabling seamless collaboration between developers and AI agents, with initial features available to Premium and Ultimate customers across IDEs and the Web UI.

- The platform introduces multi-agent workflows and enhanced context-sharing capabilities, aiming to transform developer productivity by integrating AI-driven assistance directly into daily software development practices.

- Now, we'll explore how integrating intelligent AI agents into core developer workflows could influence GitLab’s future growth potential and investment narrative.

GitLab Investment Narrative Recap

To be a GitLab shareholder, you need to believe that AI-powered developer tools can unlock sustained enterprise adoption and drive expansion within a competitive DevSecOps market. The public beta launch of GitLab Duo Agent Platform is thematically important for showcasing GitLab’s push into intelligent automation, but doesn’t fundamentally change the most important near-term catalyst: successful monetization of AI upgrades in mid-market and enterprise tiers. The most pressing risk remains intensifying competition, which this announcement only partially addresses.

The recent launch of GitLab Duo Agent Platform closely follows the rollout of GitLab 18, which focused on AI integration across DevSecOps workflows. This continuity in announcements reinforces GitLab’s emphasis on embedded intelligence as it seeks to encourage customer upgrades and maintain traction with larger accounts, both critical for revenue growth and reducing reliance on purely manual developer adoption.

Yet, despite growing investment in innovation, investors should be aware that if rival solutions outpace GitLab’s AI offerings, especially as...

Read the full narrative on GitLab (it's free!)

GitLab's narrative projects $1.5 billion revenue and $175.4 million earnings by 2028. This requires 24.3% yearly revenue growth and a $181.7 million earnings increase from -$6.3 million today.

Uncover how GitLab's forecasts yield a $75.74 fair value, a 67% upside to its current price.

Exploring Other Perspectives

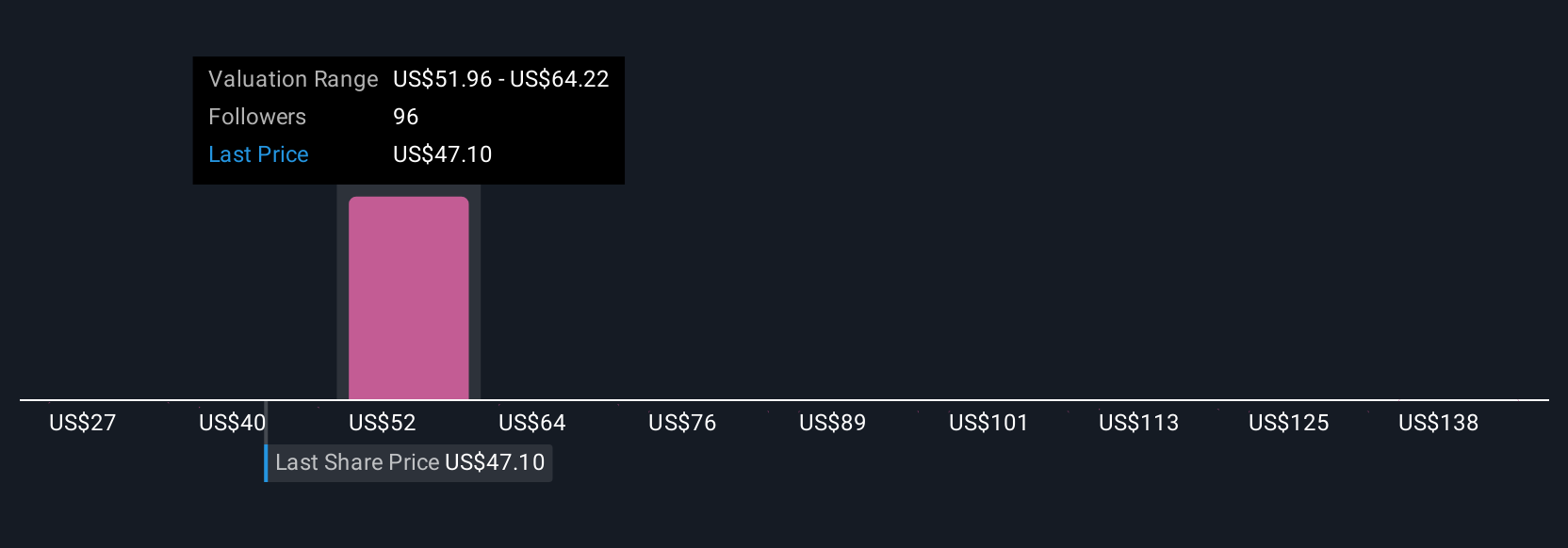

Eighteen fair value estimates from the Simply Wall St Community span from US$27.45 to US$150 per share, reflecting a broad spectrum of outlooks. While many anticipate value uplift from AI-driven product advancements, sustained revenue growth will likely depend on GitLab's ability to convert interest in innovation into genuine adoption and defend its position against stronger competitors.

Build Your Own GitLab Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GitLab research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GitLab research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GitLab's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English