Amazon Quietly Hikes Prices On Everyday Essentials Despite Pledge To Hold Steady Amid Tariff Turmoil: Report

Amazon.com Inc. (NASDAQ:AMZN) has subtly increased prices on everyday items in a move that is in stark contrast to the company’s earlier promise to maintain prices despite the tariffs.

What Happened: Amazon has raised prices on a range of low-cost products by an average of 5% since the initial tariff announcement by President Donald Trump in February, reported The Wall Street Journal. This increase is despite Amazon’s previous commitment to price stability in April.

Check out the current price of AMZN stock here.

A Wall Street Journal analysis of nearly 2,500 items found that while Amazon raised prices on 1,200 of its most affordable household products such such as deodorant, protein shakes, competitor Walmart Inc. (NYSE:WMT) reduced prices on the same items by nearly 2%. The contrasting pricing strategies highlight how major retailers are navigating the uncertainty around tariffs and adjusting their pricing in response.

Amazon struggles to profit from these items due to high shipping costs, vendor consultant Corey Thomas told the publication, while Walmart can absorb losses since in-store shoppers often buy higher-margin products.

The e-commerce giant, however, has refuted the Journal’s findings, stating that the products analyzed do not accurately represent the overall pricing of the company. “We have not seen the average prices of products offered in our store change up or down appreciably,” Amazon said in a statement.

Manufacturers of several products that saw price hikes on Amazon said they had not increased their retail prices. Even U.S.-made items like soups from Campbell Soup (NASDAQ:CPB) were affected. The sharpest single-day price jump for low-cost goods on Amazon happened on February 15, just two days after Trump suggested tariffs could extend to most U.S. trading partners.

Why It Matters: This price hike comes in the context of a broader economic landscape. In June, economists noted that inflation was largely in line with expectations, despite growing tariff-related pressures. However, Amazon’s decision to raise prices subtly may be seen as a response to these pressures.

Earlier in May, Amazon had planned to list U.S. tariff costs on its website, a move that was later scrapped following a call from President Trump who earlier called it a “Hostile, Political Act.” In contrast, Walmart responded to Trump’s tariffs by striving to keep prices as low as possible.

The differing strategies of these retail giants highlight the varied approaches to navigating the complex tariff landscape.

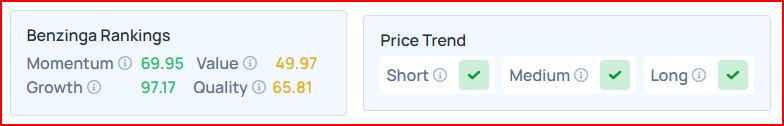

Amazon offers strong Growth, while scoring average on the Value and Quality metrics as per Benzinga’s Proprietary Edge Rankings.

READ MORE:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English