What to Expect From Iron Mountain's Q2 2025 Earnings Report

Portsmouth, New Hampshire-based Iron Mountain Incorporated (IRM) provides records management, data management solutions, and information destruction services. Valued at $29.4 billion by market cap, the company serves banking, energy, entertainment, healthcare, insurance, law firm, life sciences, retail, and pharmaceutical industries. The global leader in information management services is expected to announce its fiscal second-quarter earnings for 2025 before the market opens on Wednesday, Aug. 6.

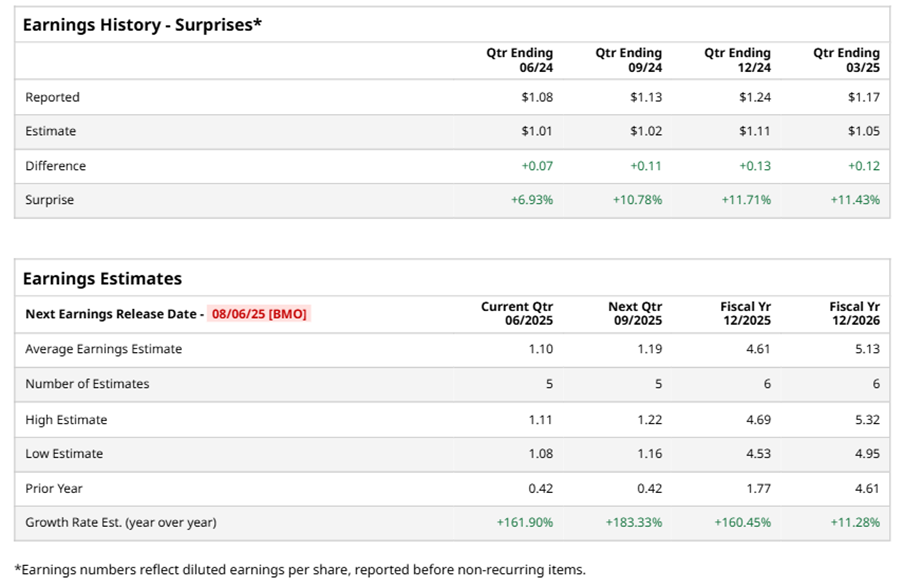

Ahead of the event, analysts expect IRM to report an FFO of $1.10 per share on a diluted basis, up 161.9% from $0.42 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s FFO estimates in its last four quarterly reports.

For the full year, analysts expect IRM to report FFO of $4.61 per share, up 160.5% from $1.77 per share in fiscal 2024. Its FFO is expected to rise 11.3% year over year to $5.13 per share in fiscal 2026.

IRM stock has underperformed the S&P 500 Index’s ($SPX) 14.5% gains over the past 52 weeks, with shares up marginally during this period. Similarly, it underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) 3.7% gains over the same time frame.

IRM's underperformance can be attributed to intense competition from other industry players, which is likely to result in aggressive pricing strategies that could negatively impact the company's performance. Additionally, high interest expenses and negative foreign currency movements remain areas of concern for IRM's prospects.

On May 1, IRM shares closed up more than 2% after reporting its Q1 results. Its adjusted FFO of $1.17 per share exceeded Wall Street expectations of $1.16 per share. The company’s revenue was $1.59 billion, missing Wall Street forecasts of $1.60 billion. IRM expects full-year adjusted FFO in the range of $4.95 to $5.05 per share, and expects revenue in the range of $6.7 billion to $6.9 billion.

Analysts’ consensus opinion on IRM stock is bullish, with an overall “Strong Buy” rating. Out of nine analysts covering the stock, seven advise a “Strong Buy” rating, one suggests a “Moderate Buy,” and one gives a “Strong Sell.” IRM’s average analyst price target is $115.78, indicating a potential upside of 17.3% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English