Modern Healthcare Technology Holdings Limited's (HKG:919) Share Price Boosted 26% But Its Business Prospects Need A Lift Too

Despite an already strong run, Modern Healthcare Technology Holdings Limited (HKG:919) shares have been powering on, with a gain of 26% in the last thirty days. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.9% in the last twelve months.

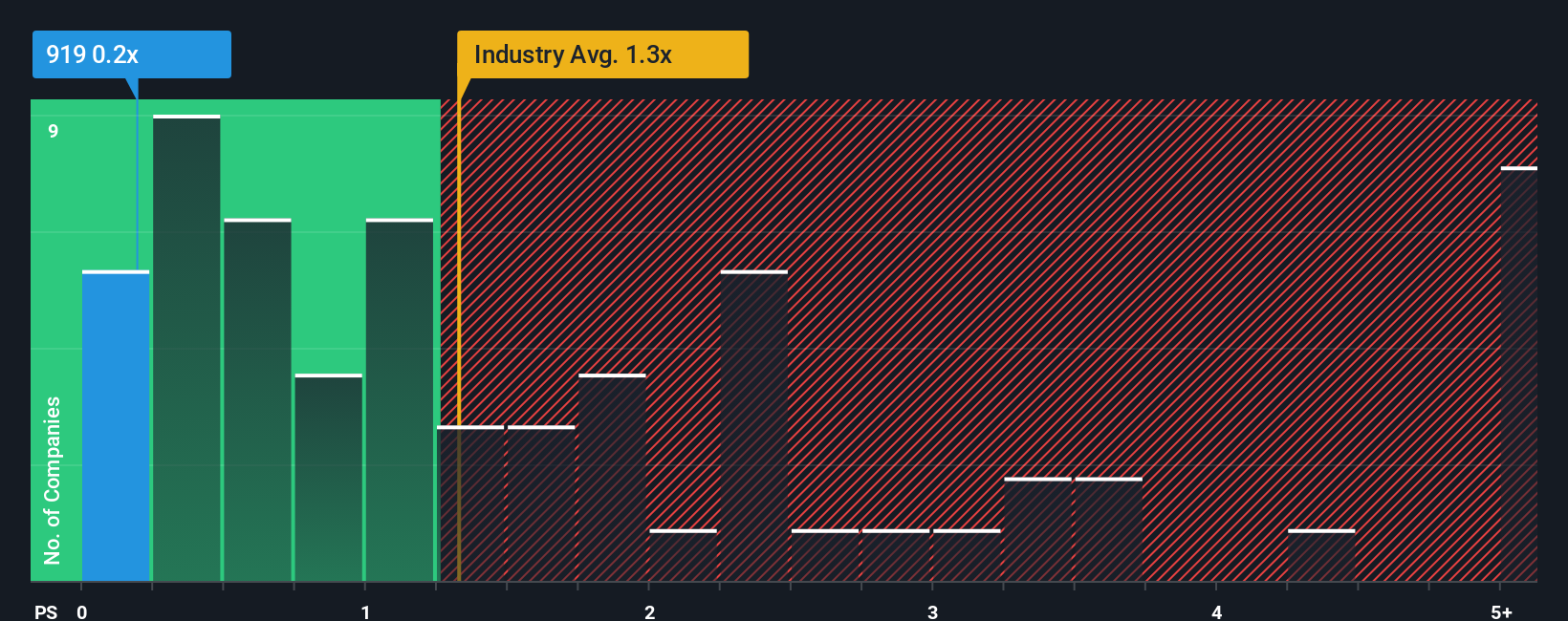

Even after such a large jump in price, given about half the companies operating in Hong Kong's Consumer Services industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Modern Healthcare Technology Holdings as an attractive investment with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Modern Healthcare Technology Holdings

How Modern Healthcare Technology Holdings Has Been Performing

For example, consider that Modern Healthcare Technology Holdings' financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Modern Healthcare Technology Holdings' earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Modern Healthcare Technology Holdings?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Modern Healthcare Technology Holdings' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 30% in total over the last three years. So while the company has done a solid job in the past, it's somewhat concerning to see revenue growth decline as much as it has.

Comparing that to the industry, which is predicted to deliver 13% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in consideration, it's easy to understand why Modern Healthcare Technology Holdings' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Modern Healthcare Technology Holdings' P/S

The latest share price surge wasn't enough to lift Modern Healthcare Technology Holdings' P/S close to the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Modern Healthcare Technology Holdings confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Modern Healthcare Technology Holdings (at least 1 which is potentially serious), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Modern Healthcare Technology Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English