SIGN UP

LOG IN

Wall Street's Most Accurate Analysts Give Their Take On 3 Tech Stocks Delivering High-Dividend Yields

Benzinga·07/23/2025 12:35:35

Listen to the news

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the information technology sector.

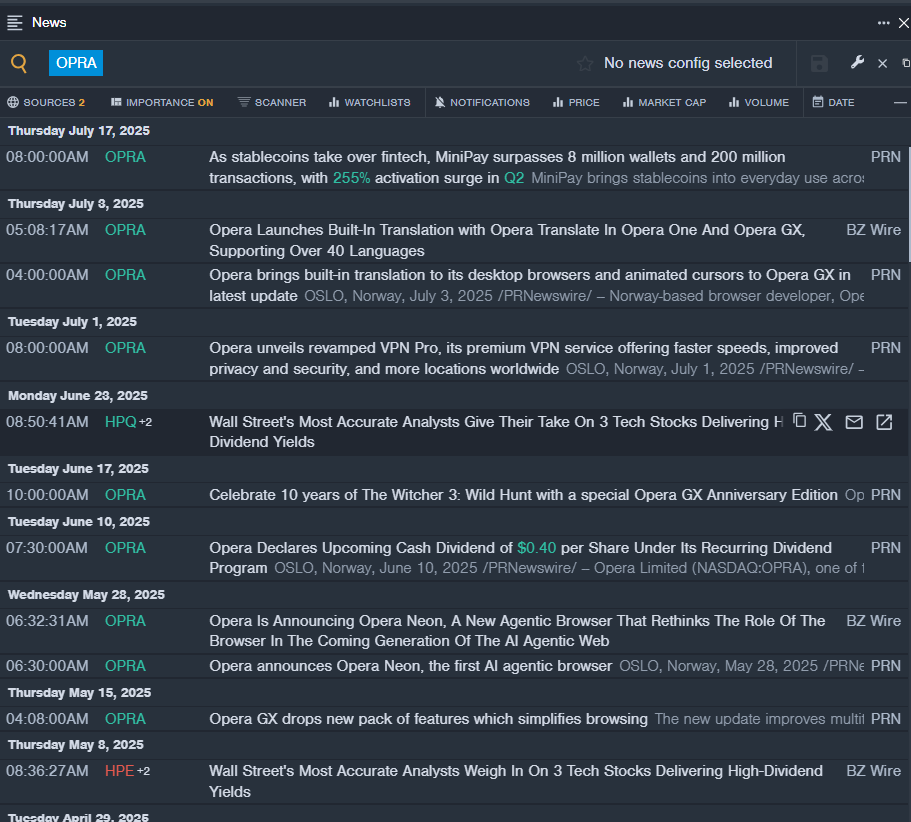

Opera Limited (NASDAQ:OPRA)

- Dividend Yield: 4.57%

- Goldman Sachs analyst Eric Sheridan maintained a Buy rating and cut the price target from $26 to $22.5 on April 14, 2025. This analyst has an accuracy rate of 78%.

- TD Cowen analyst Lance Vitanza maintained a Buy rating and increased the price target from $25 to $28 on Oct. 30, 2024. This analyst has an accuracy rate of 77%.

- Recent News: On May 28, Opera announced Opera Neon, the first AI agentic browser.

- Benzinga Pro’s real-time newsfeed alerted to latest OPRA news.

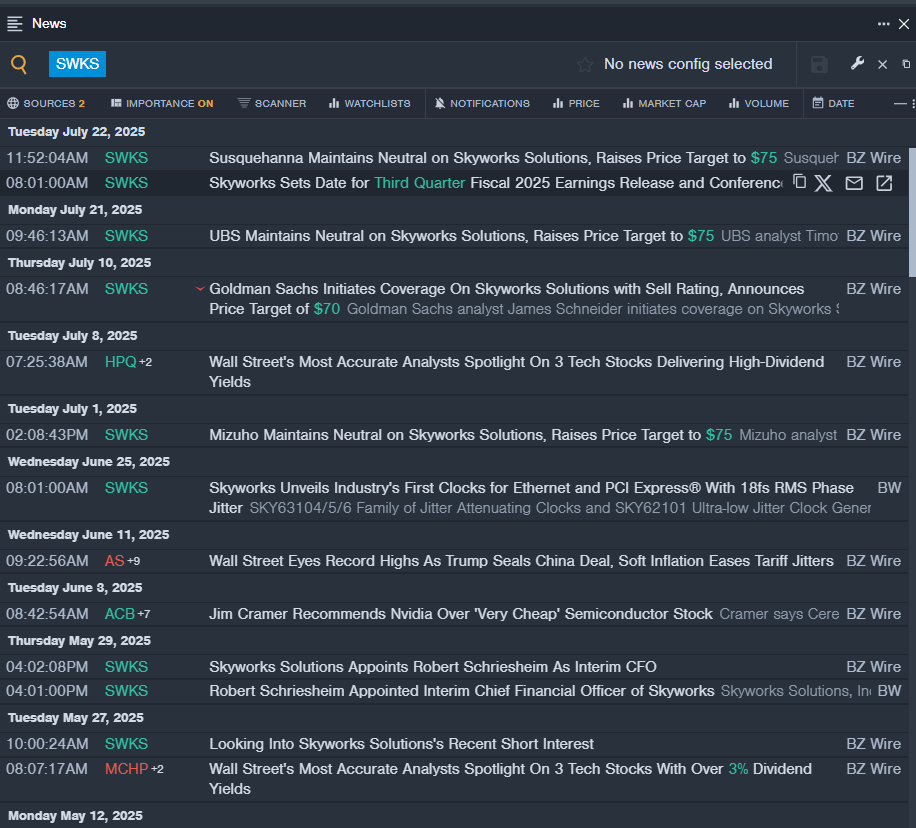

Skyworks Solutions, Inc. (NASDAQ:SWKS)

- Dividend Yield: 3.82%

- Susquehanna analyst Christopher Rolland maintained a Neutral rating and raised the price target from $60 to $75 on July 22, 2025. This analyst has an accuracy rate of 77%.

- UBS analyst Timothy Arcuri maintained a Neutral rating and increased the price target from $65 to $75 on July 21, 2025. This analyst has an accuracy rate of 80%.

- Recent News: Skyworks Solutions will host a conference call with analysts to discuss its third quarter fiscal 2025 results on Aug. 5.

- Benzinga Pro's real-time newsfeed alerted to latest SWKS news

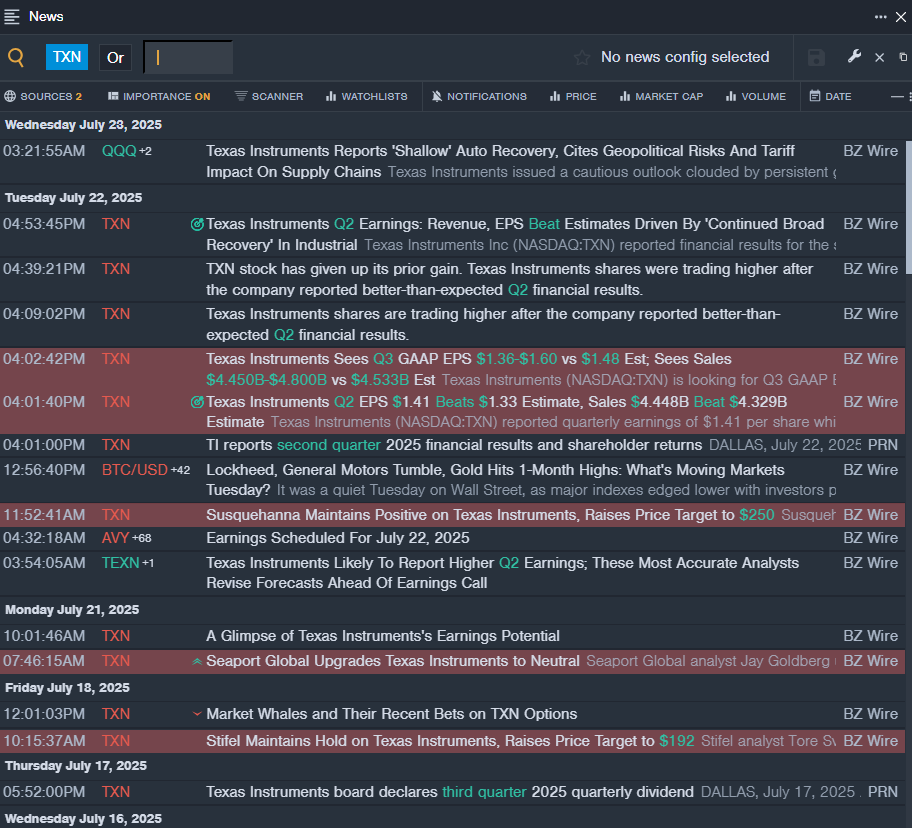

Texas Instruments Incorporated (NASDAQ:TXN)

- Dividend Yield: 2.53%

- Susquehanna analyst Christopher Rolland maintained a Positive rating and increased the price target from $220 to $250 on July 22, 2025. This analyst has an accuracy rate of 77%.

- UBS analyst Timothy Arcuri maintained a Buy rating and raised the price target from $245 to $255 on July 14, 2025. This analyst has an accuracy rate of 80%.

- Recent News: On July 22, Texas Instruments reported better-than-expected second-quarter financial results.

- Benzinga Pro’s real-time newsfeed alerted to latest TXN news

Read More:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.