GL-Carlink Technology Holding Limited's (HKG:2531) 25% Share Price Surge Not Quite Adding Up

GL-Carlink Technology Holding Limited (HKG:2531) shares have continued their recent momentum with a 25% gain in the last month alone. The annual gain comes to 105% following the latest surge, making investors sit up and take notice.

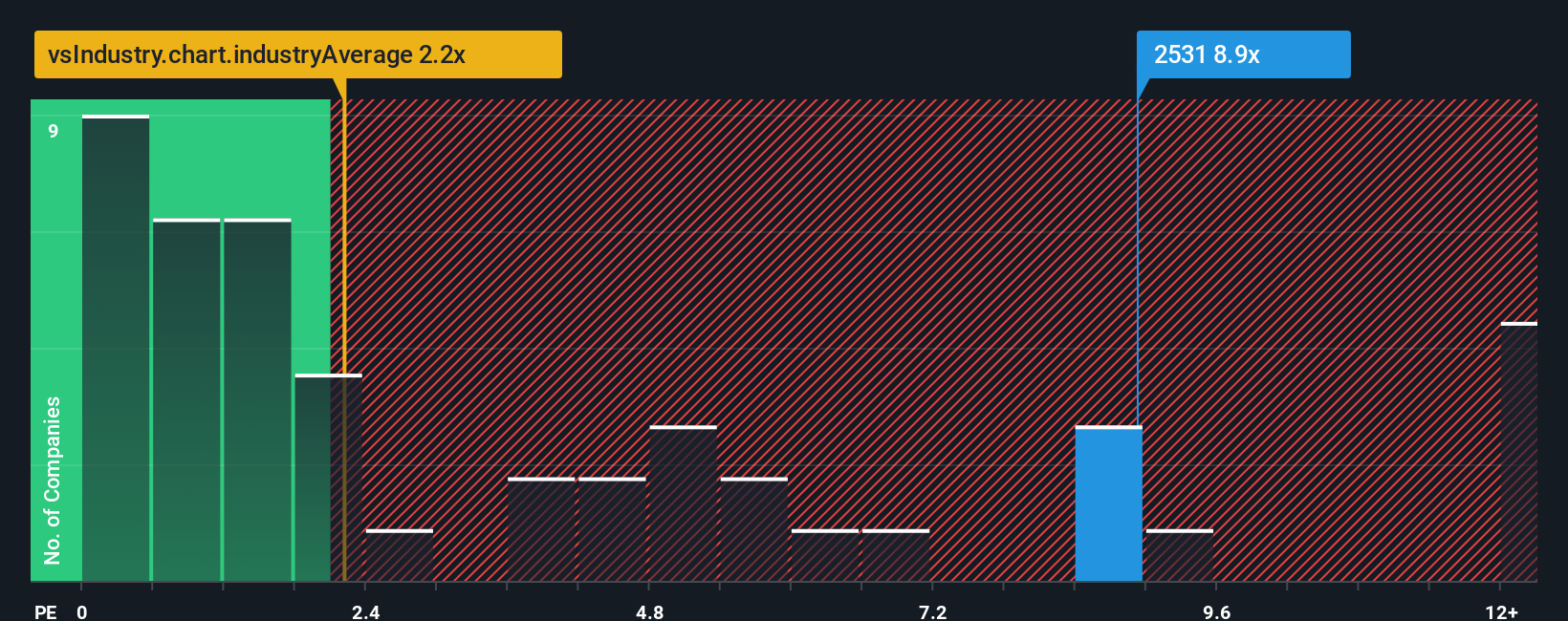

Following the firm bounce in price, you could be forgiven for thinking GL-Carlink Technology Holding is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 8.9x, considering almost half the companies in Hong Kong's Software industry have P/S ratios below 2.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for GL-Carlink Technology Holding

How Has GL-Carlink Technology Holding Performed Recently?

GL-Carlink Technology Holding has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on GL-Carlink Technology Holding will help you shine a light on its historical performance.How Is GL-Carlink Technology Holding's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like GL-Carlink Technology Holding's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 25%. Pleasingly, revenue has also lifted 114% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

It's interesting to note that the rest of the industry is similarly expected to grow by 29% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it interesting that GL-Carlink Technology Holding is trading at a high P/S compared to the industry. Apparently many investors in the company are more bullish than recent times would indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as a continuation of recent revenue trends would weigh down the share price eventually.

The Key Takeaway

The strong share price surge has lead to GL-Carlink Technology Holding's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into GL-Carlink Technology Holding has shown that it currently trades on a higher than expected P/S since its recent three-year growth is only in line with the wider industry forecast. Right now we are uncomfortable with the high P/S as this revenue performance isn't likely to support such positive sentiment for long. Unless there is a significant improvement in the company's medium-term trends, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

It is also worth noting that we have found 2 warning signs for GL-Carlink Technology Holding that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English