Olaplex Holdings (OLPX) Is Up 23.5% After Board Adds Experienced Executives Jerome Griffith and Pamela Edwards - Has The Bull Case Changed?

- Olaplex Holdings recently strengthened its Board of Directors with the appointments of Jerome Griffith and Pamela Edwards, two executives with deep experience in the retail, consumer brands, and financial sectors.

- This move brings additional leadership and financial expertise that could enhance the company's corporate governance, oversight, and ability to execute its long-term business strategy.

- We'll examine how the addition of these seasoned leaders may shape Olaplex Holdings' investment outlook and support its ongoing strategic transformation.

Olaplex Holdings Investment Narrative Recap

For investors to support Olaplex Holdings, they need confidence in the company’s turnaround strategy, particularly its efforts to drive innovation, stabilize professional channels, and return to sustainable growth. The recent appointments of Jerome Griffith and Pamela Edwards to the board add significant consumer and financial expertise, although this move alone may not meaningfully shift the most pressing near-term catalyst, restoring sales momentum in key markets, or address the largest risk, ongoing international sales weakness, in the immediate future.

Among recent announcements, the company’s Q1 2025 results reported net income of just US$465,000 on sales of US$96.98 million, reflecting continued challenges in profitability and top-line growth. As Olaplex pushes its new product launches and organizational restructuring, the effectiveness of these board enhancements will be closely watched in the context of lagging revenue and competitive pressure in core channels.

But investors should pay close attention to the risk that, despite these new appointments, Olaplex’s international sales could...

Read the full narrative on Olaplex Holdings (it's free!)

Olaplex Holdings is forecast to reach $442.4 million in revenue and $8.1 million in earnings by 2028. This scenario assumes annual revenue growth of 1.7% but an earnings decrease of $4.1 million from the current $12.2 million.

Uncover how Olaplex Holdings' forecasts yield a $2.08 fair value, a 24% upside to its current price.

Exploring Other Perspectives

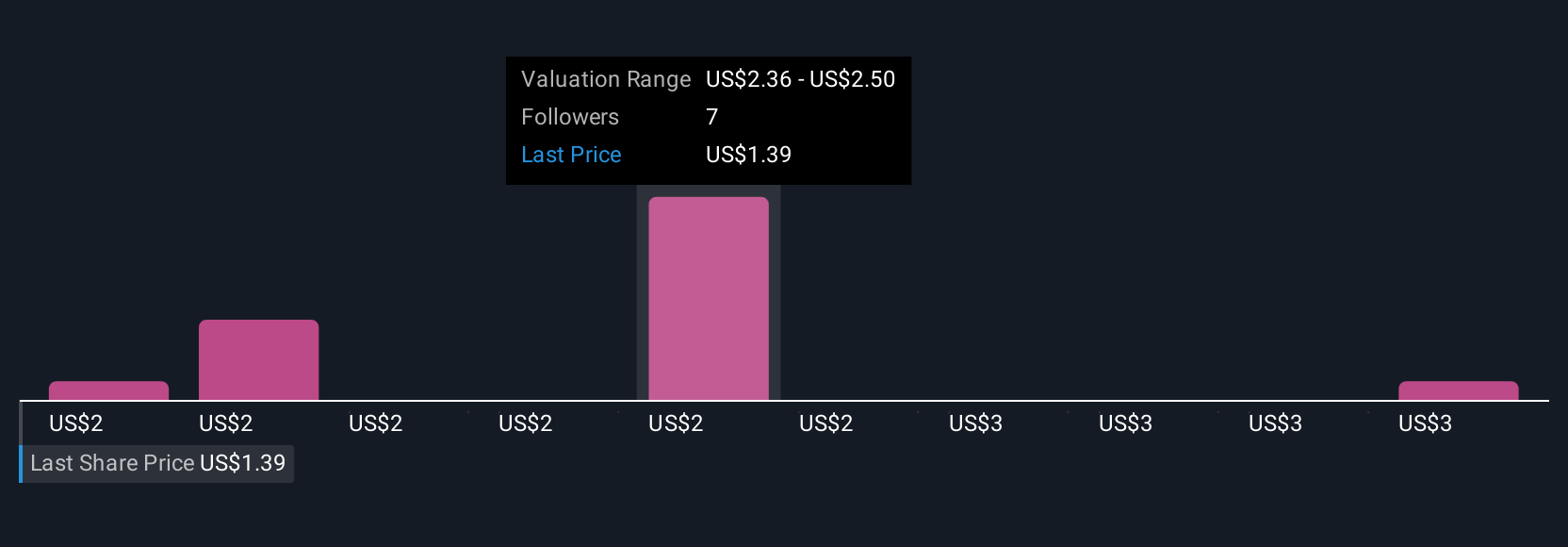

Five members of the Simply Wall St Community place Olaplex’s fair value from US$1.82 to US$3.17 per share. While some see upside, ongoing weakness in key international markets remains a concern for the company’s ability to sustain growth.

Build Your Own Olaplex Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Olaplex Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Olaplex Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Olaplex Holdings' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English