Gorman-Rupp (GRC) Is Up 10.2% After Strong Q2 Results and 302nd Straight Dividend - Has The Bull Case Changed?

- The Gorman-Rupp Company recently reported strong second-quarter 2025 financial results, with sales rising to US$179.05 million and net income reaching US$15.8 million, and declared its 302nd consecutive quarterly dividend of US$0.185 per share, payable in September.

- This consistent dividend record highlights the company’s long-standing focus on shareholder returns even as earnings growth continues.

- Against this backdrop, we'll explore how Gorman-Rupp’s impressive profit jump and ongoing dividends shape its current investment narrative.

What Is Gorman-Rupp's Investment Narrative?

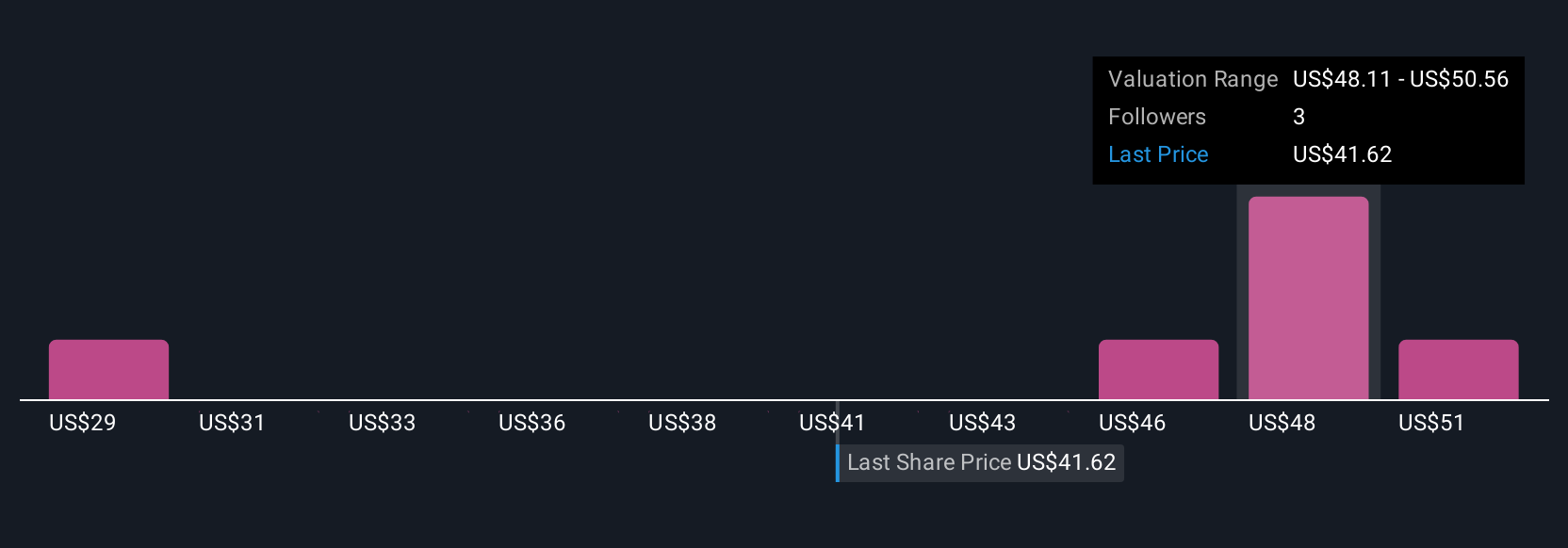

For Gorman-Rupp shareholders, the big picture has always revolved around consistent dividends, steady management, and quality earnings. The recent jump in second-quarter profits and another uninterrupted dividend underline these themes. In the short run, the strong earnings release and continued dividend show the company’s resilience, which is reflected in the recent share price rally. While this news highlights ongoing operational momentum, potentially shifting near-term sentiment positively, some fundamental risks remain. Gorman-Rupp’s high debt levels and comparatively low return on equity still stand out as concerns, especially as the stock now trades above estimates of fair value. So, while the earnings beat and dividend affirmation have strengthened the near-term outlook, these long-standing risks shouldn’t be overlooked by anyone weighing the current investment opportunity.

But even with this momentum, high debt remains an important risk investors should know about. Gorman-Rupp's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Build Your Own Gorman-Rupp Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gorman-Rupp research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gorman-Rupp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gorman-Rupp's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English