The Bull Case For Pacira BioSciences (PCRX) Could Change Following Johnson & Johnson Co-Promotion Deal for ZILRETTA - Learn Why

- Earlier this week, Pacira BioSciences and Johnson & Johnson MedTech announced a new partnership to co-promote ZILRETTA, an extended-release treatment for osteoarthritis knee pain, using Johnson & Johnson's early intervention sales force to expand ZILRETTA’s reach across the U.S. healthcare market.

- This collaboration unlocks opportunities for Pacira to extend ZILRETTA’s presence into new physician specialties such as sports medicine, pain management, and rheumatology, potentially reaching more of the estimated seven million annual knee injection patients.

- We'll examine how leveraging Johnson & Johnson’s specialized sales force could influence Pacira’s broader access goals within the investment narrative.

Pacira BioSciences Investment Narrative Recap

To invest in Pacira BioSciences, you need to believe in the company’s ability to drive growth through effective commercialization of its pain management products, particularly ZILRETTA and EXPAREL, and successful access expansion. The new partnership with Johnson & Johnson MedTech is designed to speed up ZILRETTA’s reach to a broader market, addressing uncertainties about uptake, but it does not remove the significant risk tied to customer adoption delays and reimbursement complexities, especially for newer products.

Among recent announcements, the introduction of a permanent J-code for EXPAREL earlier this year stands out as highly relevant, as it directly impacts reimbursement and access, crucial levers for revenue growth in the company’s core surgical and pain treatment portfolio. Both this development and the ZILRETTA partnership highlight Pacira’s focus on making its therapies more accessible, although their effects may take time to fully materialize, given lingering adoption and billing hurdles.

However, despite expanding reach, investors should also be aware that reimbursement and market adoption for products like ZILRETTA remain uncertain in the near term...

Read the full narrative on Pacira BioSciences (it's free!)

Pacira BioSciences' narrative projects $919.8 million in revenue and $155.4 million in earnings by 2028. This requires 9.4% yearly revenue growth and a $259.1 million increase in earnings from -$103.7 million today.

Exploring Other Perspectives

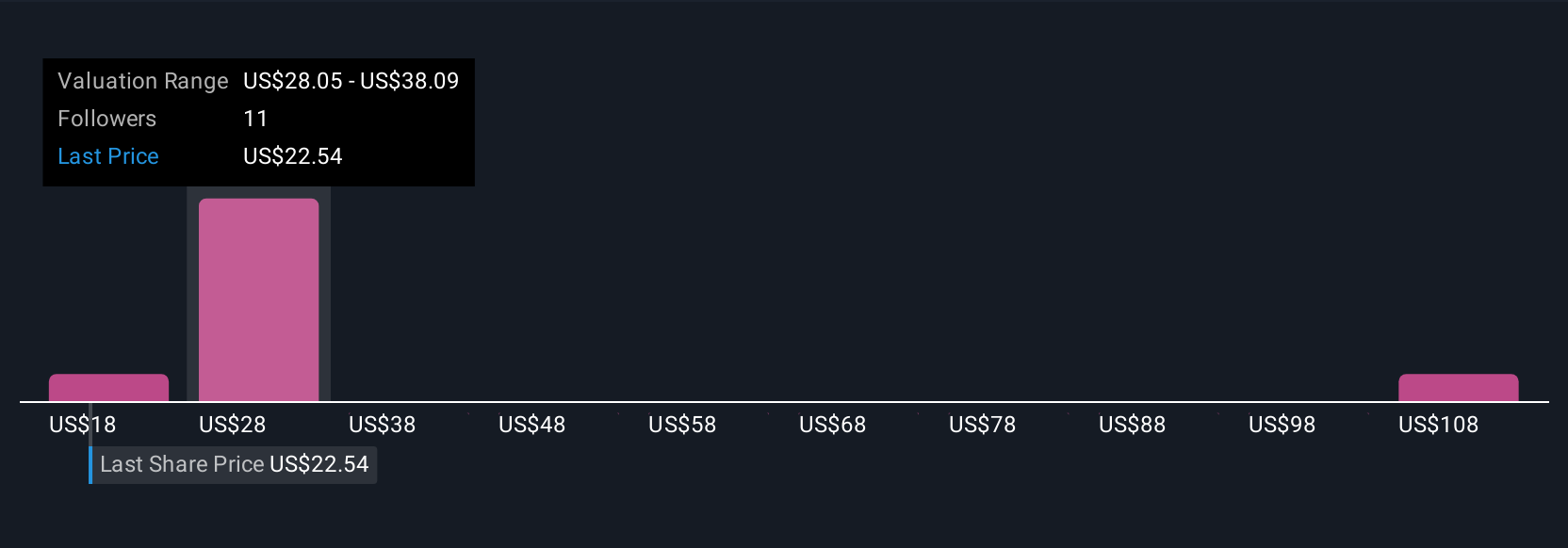

Four fair value estimates from the Simply Wall St Community span US$18 to US$127.24, indicating highly variable views. While access-focused collaborations may support future growth, adoption hurdles could temper near-term expectations, so compare these differing opinions carefully.

Build Your Own Pacira BioSciences Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pacira BioSciences research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pacira BioSciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pacira BioSciences' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English