SIGN UP

LOG IN

Top 2 Real Estate Stocks That May Collapse This quarter

Benzinga·07/28/2025 13:16:07

Listen to the news

As of July 28, 2025, two stocks in the real estate sector could be flashing a real warning to investors who value momentum as a key criteria in their trading decisions.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered overbought when the RSI is above 70, according to Benzinga Pro.

Here's the latest list of major overbought players in this sector.

Uniti Group Inc (NASDAQ:UNIT)

- Uniti Group will report its second quarter financial results prior to the opening of trading on the Nasdaq Stock Exchange on Aug. 5. The company's stock jumped around 34% over the past month and has a 52-week high of $6.31.

- RSI Value: 81.7

- UNIT Price Action: Shares of Uniti gained 0.4% to close at $5.80 on Friday.

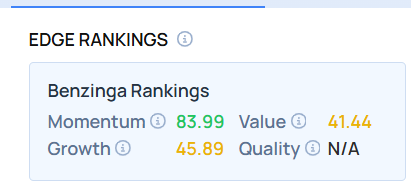

- Edge Stock Ratings: 83.99 Momentum score with Value at 41.44.

Zillow Group Inc (NASDAQ:ZG)

- On July 18, DA Davidson analyst Tom White maintained Zillow with a Buy and maintained a price target of $85. The company's stock gained around 14% over the past month has a 52-week high of $86.58.

- RSI Value: 73.4

- ZG Price Action: Shares of Zillow jumped 1.1% to close at $78.16 on Friday.

Don't miss out on the full BZ Edge Rankings—compare all the key stocks now.

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.