Asian Penny Stocks To Watch In July 2025

As global markets react to favorable trade deal news, pushing indices like the S&P 500 and Nasdaq Composite to record highs, investors are keenly watching developments in Asia. Amidst this backdrop, penny stocks—often representing smaller or newer companies—continue to capture attention as potential growth opportunities at lower price points. While the term 'penny stock' might seem outdated, these investments can offer significant upside when supported by strong financials and robust fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.02 | THB3.97B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$933.81M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.495 | SGD200.62M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.725 | SGD691.2M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.56 | SGD10.08B | ✅ 5 ⚠️ 0 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.95 | THB1.4B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.57 | SGD979.43M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 969 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Rakon (NZSE:RAK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Rakon Limited, with a market cap of NZ$204.94 million, designs, manufactures, and sells frequency control and timing solutions for various applications across Asia, North America, Europe, and internationally.

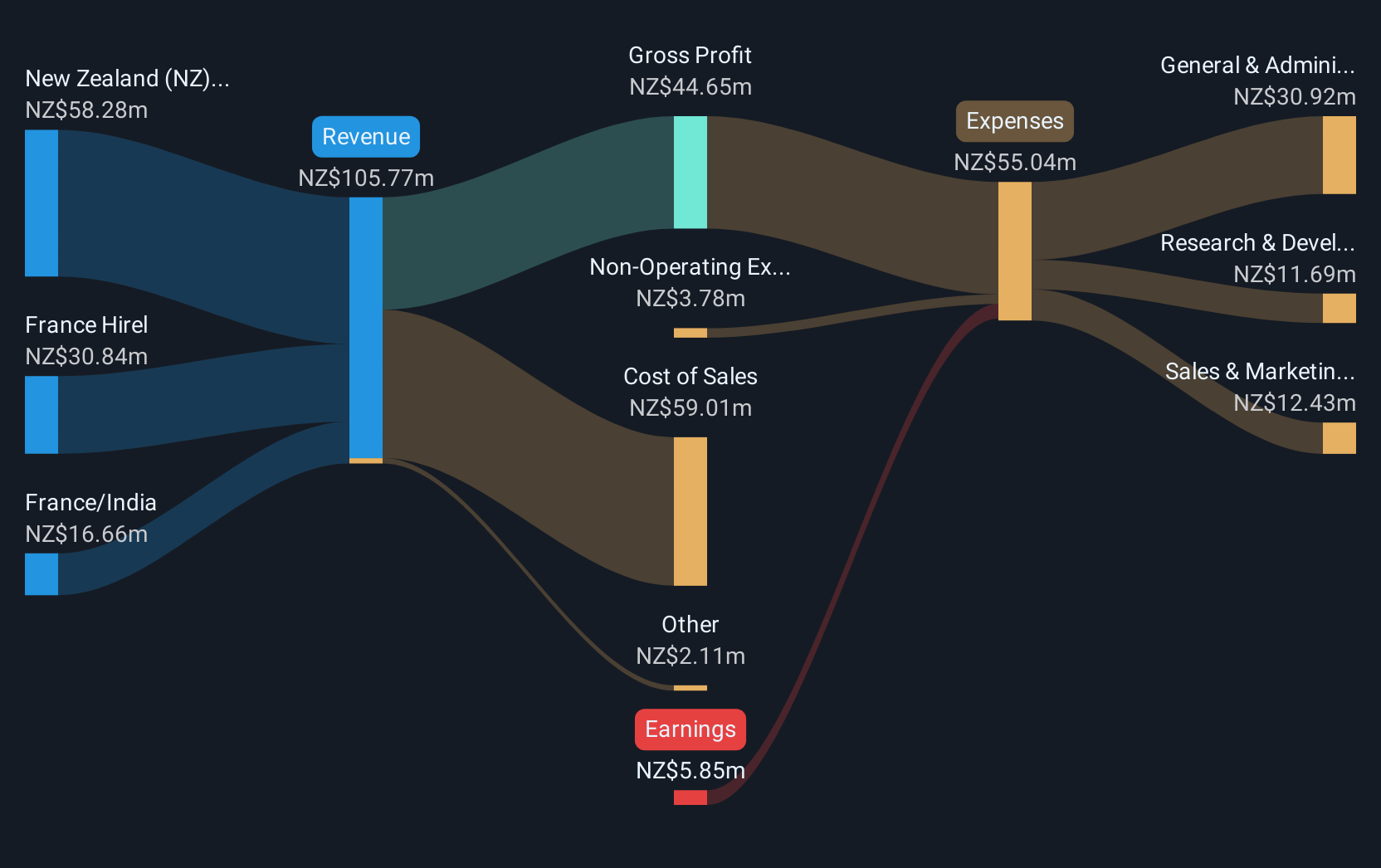

Operations: Rakon's revenue is primarily derived from its operations in New Zealand (NZ$58.28 million), France Hirel (NZ$30.84 million), and the combined regions of France/India (NZ$16.66 million).

Market Cap: NZ$204.94M

Rakon Limited, with a market cap of NZ$204.94 million, operates in the frequency control and timing solutions sector. Despite being unprofitable, the company maintains a strong financial position with cash exceeding total debt and short-term assets covering both short- and long-term liabilities. However, Rakon's earnings have declined over the past year with sales decreasing to NZ$103.66 million from NZ$128.01 million, resulting in a net loss of NZ$5.85 million compared to last year's profit of NZ$4.25 million. The company's management team is relatively new, indicating potential for strategic shifts moving forward.

- Jump into the full analysis health report here for a deeper understanding of Rakon.

- Explore Rakon's analyst forecasts in our growth report.

Dida (SEHK:2559)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dida Inc. operates as a technology-driven platform offering carpooling marketplace and smart taxi services, with a market cap of HK$1.52 billion.

Operations: The company's revenue is primarily derived from its carpooling marketplace services (CN¥753.51 million), followed by advertising and other services (CN¥27.55 million), and smart taxi services (CN¥6.15 million).

Market Cap: HK$1.52B

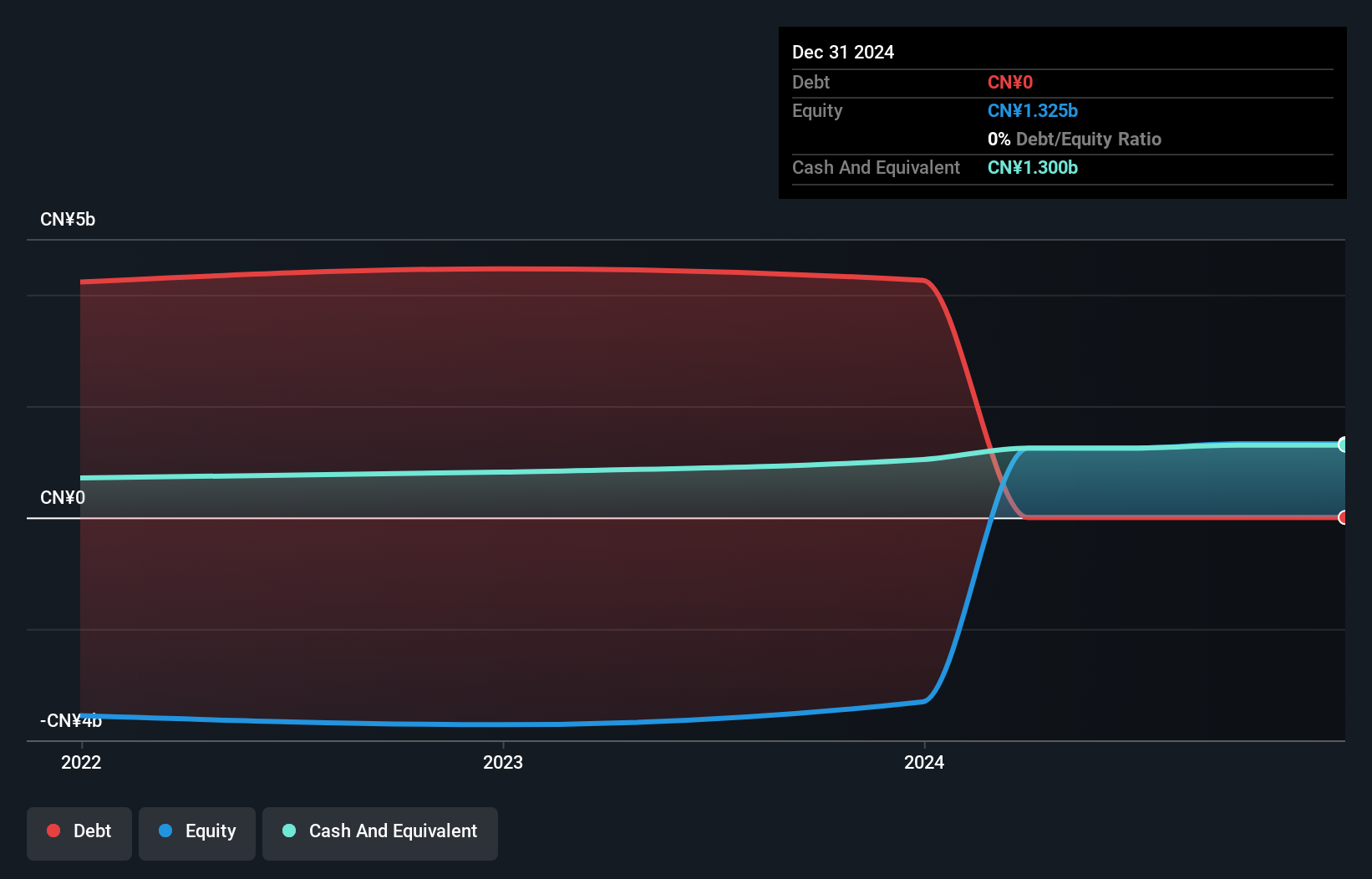

Dida Inc., with a market cap of HK$1.52 billion, operates in the carpooling and smart taxi sectors. The company demonstrates strong financial health, being debt-free and having short-term assets (CN¥1.8 billion) that exceed both short- and long-term liabilities. Despite a 3.4% revenue decline over the past year, Dida's profit margins have improved to 36.9%, while earnings surged by 234.4%, surpassing industry growth rates significantly. The company's Return on Equity is outstanding at 75.8%, supported by an experienced management team and board, with no significant shareholder dilution recently observed, enhancing its investment appeal among penny stocks in Asia.

- Take a closer look at Dida's potential here in our financial health report.

- Gain insights into Dida's historical outcomes by reviewing our past performance report.

Tai Sin Electric (SGX:500)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tai Sin Electric Limited, with a market cap of SGD253.14 million, manufactures and deals in cable and wire products across Singapore, Malaysia, Brunei, Vietnam, Indonesia, Myanmar, Cambodia, Thailand and internationally.

Operations: The company's revenue is primarily generated from its Cable & Wire segment at SGD307.16 million, followed by Electrical Material Distribution at SGD100.03 million, Test & Inspection at SGD30.28 million, and Switchboard operations contributing SGD4.08 million.

Market Cap: SGD253.14M

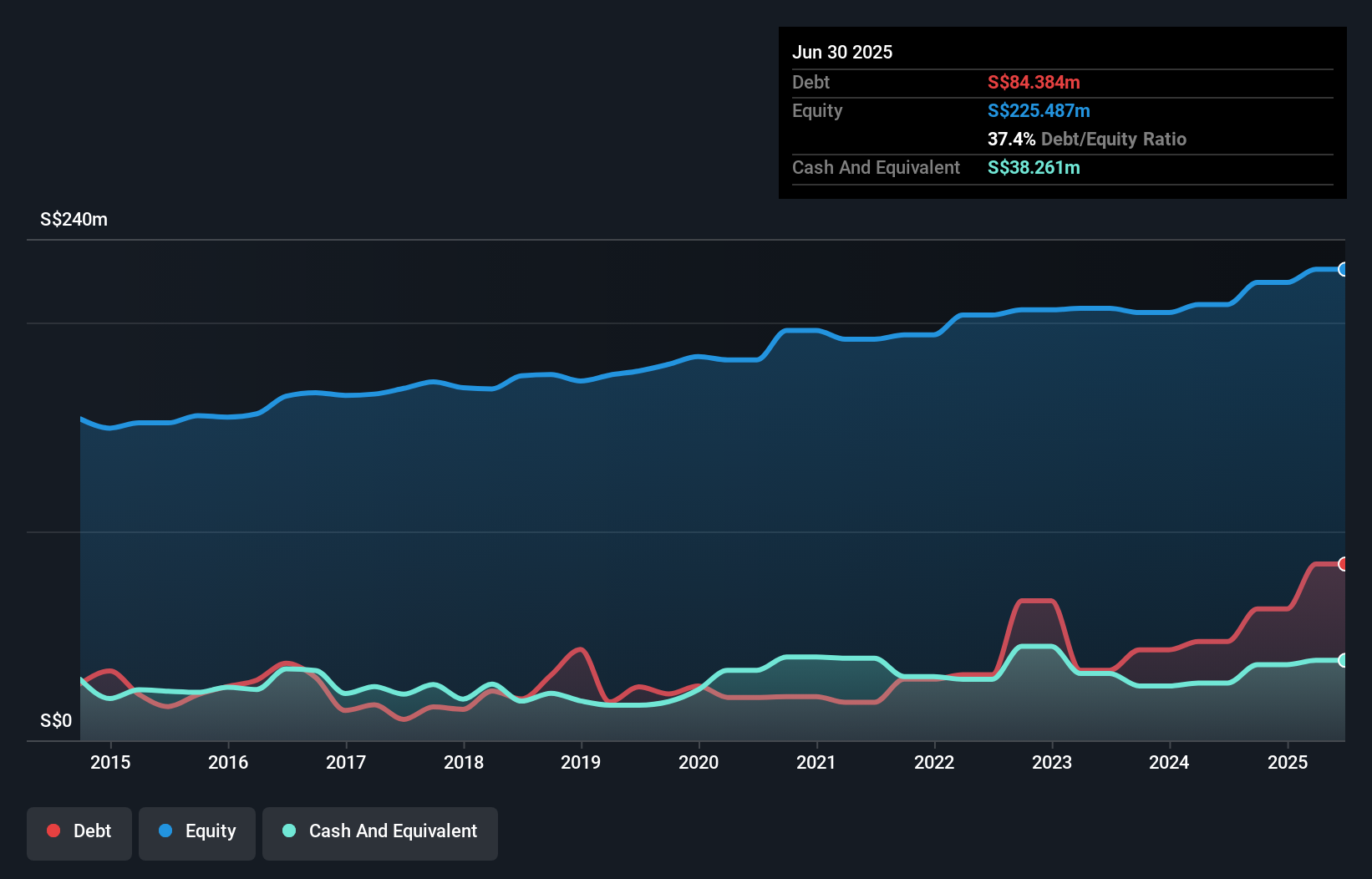

Tai Sin Electric, with a market cap of SGD253.14 million, presents a mixed investment outlook among penny stocks. The company's revenue is primarily driven by its Cable & Wire segment at SGD307.16 million, complemented by other divisions like Electrical Material Distribution and Test & Inspection. Despite an increase in debt to equity ratio over five years, the company maintains strong financial health with short-term assets exceeding both short- and long-term liabilities significantly. Earnings growth of 101.8% last year outpaced industry averages, yet the dividend yield of 4.27% remains inadequately covered by free cash flows, posing sustainability concerns for income-focused investors.

- Dive into the specifics of Tai Sin Electric here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Tai Sin Electric's track record.

Turning Ideas Into Actions

- Reveal the 969 hidden gems among our Asian Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? The end of cancer? These 25 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English