How Investors Are Reacting To Nebius Group (NBIS) $2 Billion AI Infrastructure Plan and Share Amendments

- On July 24, 2025, Nebius Group N.V. announced an upcoming Annual General Meeting with proposed amendments to its Articles of Association, focused on reducing authorized shares and clarifying capital reduction procedures.

- This move comes as the company signals major infrastructure investment and forecasts a return to positive adjusted EBITDA, highlighting its commitment to supporting global AI industry growth.

- We'll explore how Nebius Group’s substantial US$2 billion capital expenditure plan in AI infrastructure shapes its future investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Nebius Group's Investment Narrative?

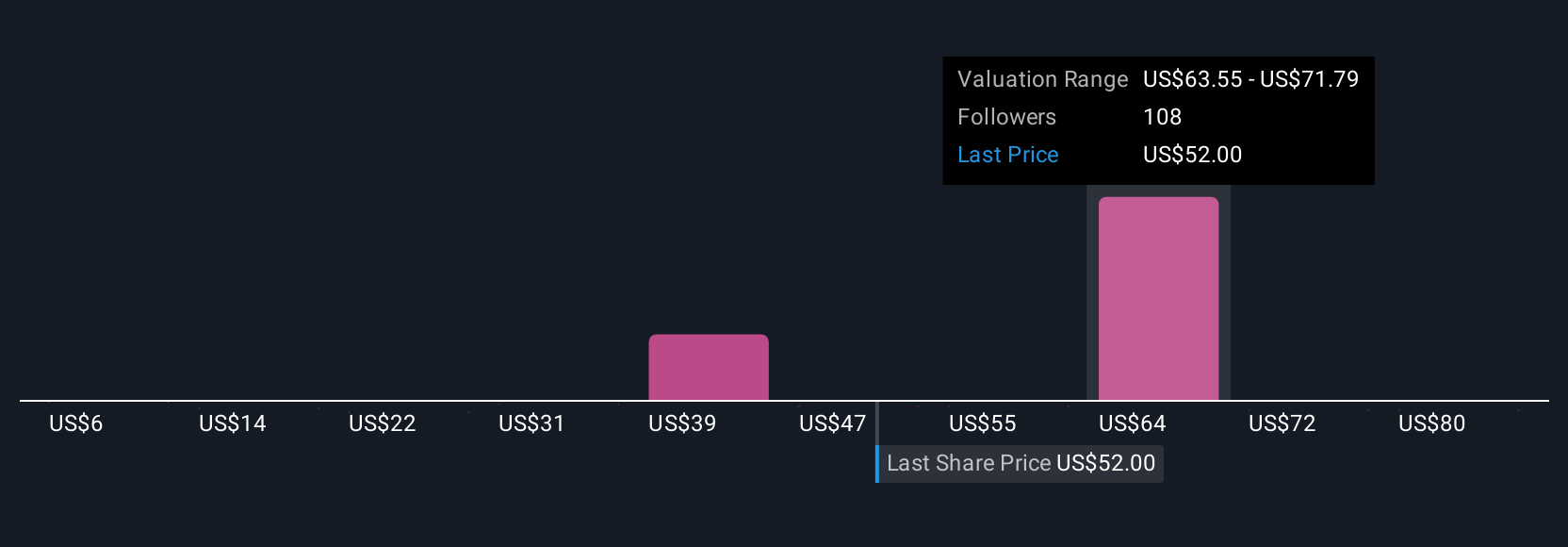

For investors considering Nebius Group, the big-picture story hinges on the belief in persistent AI-driven infrastructure demand and the company’s ability to translate rapid revenue growth into sustainable profitability. The proposed amendments to the Articles of Association, aimed at reducing authorized shares and clarifying capital reduction processes, are largely administrative and do not appear to materially shift near-term catalysts or risks. The focus remains on the US$2 billion capital expenditure in AI data centers, Nebius’s expanding global presence, and management’s guidance of a return to positive adjusted EBITDA in the latter half of 2025. Primary short-term catalysts include continued revenue acceleration and execution of large infrastructure projects, while biggest risks still involve the company’s track record of losses, an inexperienced board, volatile share price, and ongoing dependence on external financing. Although these governance changes may improve corporate clarity and flexibility in the long run, they likely do not alter the existing risk-reward balance in a material way as reflected in recent price moves.

However, board inexperience and lumpy earnings remain risks investors need to keep in mind.

Exploring Other Perspectives

Explore 25 other fair value estimates on Nebius Group - why the stock might be worth less than half the current price!

Build Your Own Nebius Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English