Does Valley National Bancorp's (VLY) Earnings Growth and Dividends Signal Durable Strength Amid Rising Charge-Offs?

- In July 2025, Valley National Bancorp reported a strong second quarter, with net interest income of US$432.41 million and net income of US$133.17 million, both up meaningfully from a year earlier, alongside affirming quarterly dividends for common and preferred shareholders.

- Amid rising charge-offs only slightly higher than last year, the company’s continued earnings growth and dividend stability underscore the management’s ongoing commitment to shareholder returns.

- We’ll explore how Valley National Bancorp’s earnings growth and steady dividend signal potential resilience for its investment narrative.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Valley National Bancorp Investment Narrative Recap

To consider Valley National Bancorp as a long-term holding, investors must be comfortable with its commercial real estate loan exposure and believe the bank can manage asset quality while growing earnings. The recent second-quarter report showcased continued growth in net interest income and net income, but only slightly higher charge-offs suggest the ongoing risk to earnings stability remains largely unchanged in the short term.

Among the latest announcements, the reaffirmed quarterly dividend of US$0.11 per share stands out and supports the story of a stable income stream for shareholders. This consistent dividend policy, combined with strong quarterly results, can help counterbalance investor concerns about near-term loan growth and competitive pressures.

Still, despite the healthy earnings, investors should pay close attention to signs that charge-offs...

Read the full narrative on Valley National Bancorp (it's free!)

Valley National Bancorp's outlook anticipates $2.5 billion in revenue and $815.2 million in earnings by 2028. This scenario assumes 18.5% annual revenue growth and a $449.4 million increase in earnings from the current $365.8 million.

Uncover how Valley National Bancorp's forecasts yield a $10.45 fair value, a 10% upside to its current price.

Exploring Other Perspectives

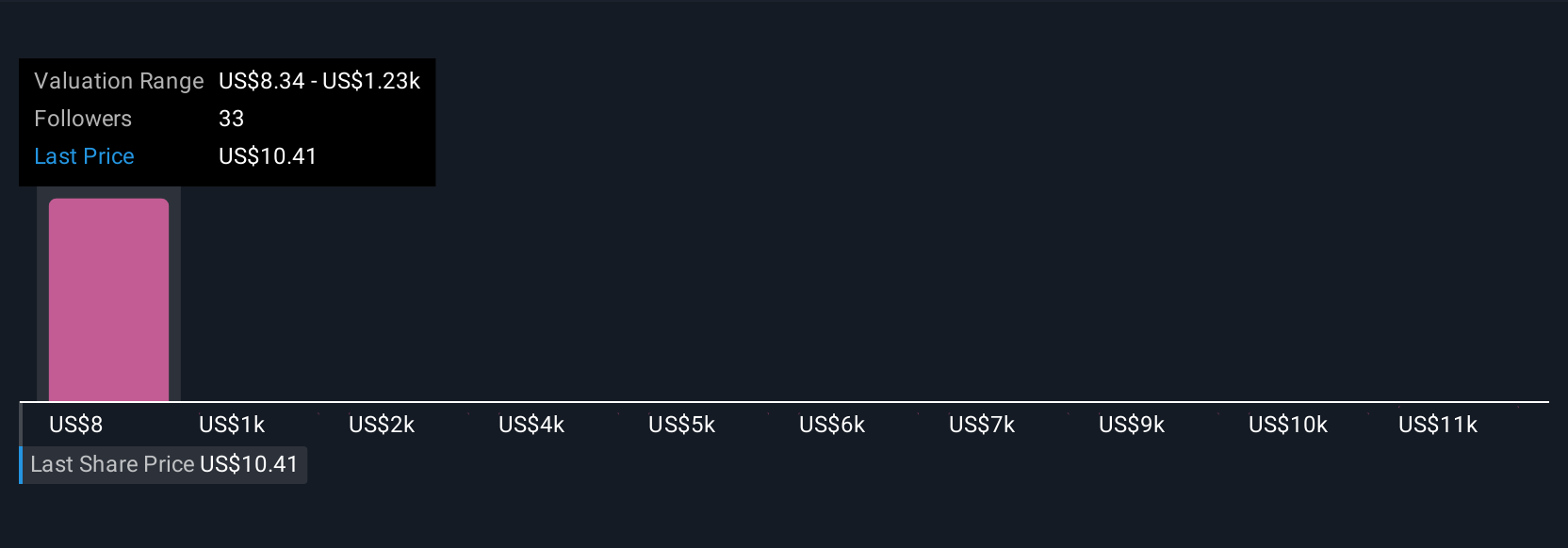

Five distinct fair value forecasts from the Simply Wall St Community range from US$8.34 to a striking US$12,190.04 per share. With recent growth in net interest income as a catalyst, you can review these different viewpoints to gauge how expectations about revenue and risk management shape sentiment on Valley National Bancorp.

Explore 5 other fair value estimates on Valley National Bancorp - why the stock might be worth 12% less than the current price!

Build Your Own Valley National Bancorp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valley National Bancorp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Valley National Bancorp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valley National Bancorp's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English