Can Tom Conrad’s Vision as Sonos (SONO) CEO Reshape Its Competitive Position in Smart Home Audio?

- Sonos recently appointed Tom Conrad as Chief Executive Officer, making permanent his role after serving as Interim CEO since January 2025 and highlighting his extensive leadership background in consumer technology.

- An interesting aspect of this development is Conrad’s influential track record in product innovation and digital platforms, including leadership roles at Pandora and Snap Inc., which may inform Sonos’s ongoing evolution in smart home audio.

- We will examine how Tom Conrad’s appointment as permanent CEO may influence Sonos’s investment outlook and future product direction.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Sonos Investment Narrative Recap

Owning Sonos stock relies on the belief that the company can capture premium smart home audio demand while successfully executing on operational efficiency and innovation. The board's decision to make Tom Conrad CEO formalizes earlier leadership changes, but does not materially change the primary catalyst, Sonos’s margin recovery from recent cost reductions, or the main risk around maintaining revenue stability and product innovation amid past restructuring.

Among recent developments, Sonos announced a multi-year, US$150 million share buyback program in February 2025, with substantial repurchases made since. For investors, these buybacks are particularly relevant as they reinforce confidence in the company’s ability to manage capital returns during a leadership transition and ongoing margin-focused strategy.

By contrast, investors should also be mindful of continued pressure on topline growth, especially as ...

Read the full narrative on Sonos (it's free!)

Sonos’ outlook points to $1.5 billion in revenue and $113.8 million in earnings by 2028. Achieving these targets implies a 1.2% annual revenue growth and a $183.1 million increase in earnings from the current loss of $69.3 million.

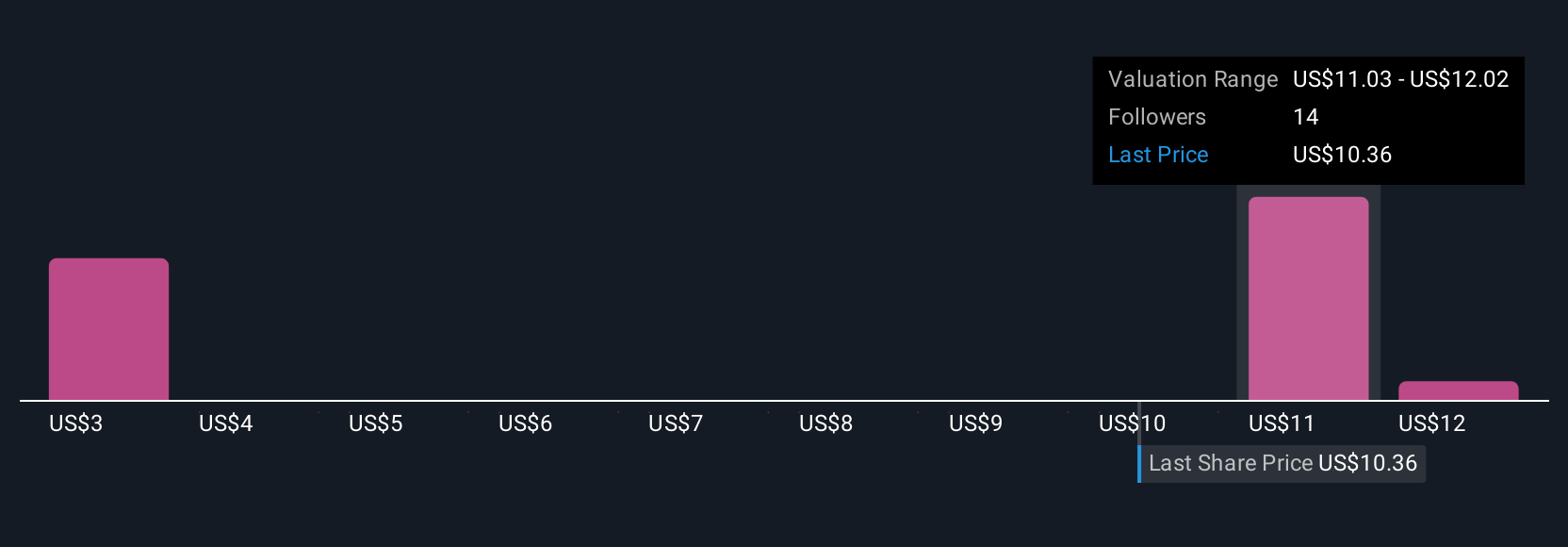

Uncover how Sonos' forecasts yield a $11.62 fair value, in line with its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community range widely from US$11.63 to US$40.09 per share. While opinions differ, the company’s recent margin gains through cost cutting may face pressure without sustained revenue growth, highlighting different paths for Sonos’s performance and inviting you to review other viewpoints.

Explore 4 other fair value estimates on Sonos - why the stock might be worth over 3x more than the current price!

Build Your Own Sonos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sonos research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Sonos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sonos' overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English