Is Keurig Dr Pepper's (KDP) Strong Q2 Growth and Reaffirmed Outlook Altering Its Investment Case?

- Keurig Dr Pepper recently reported its second-quarter and six-month 2025 earnings, with quarterly sales rising to US$4.16 billion and net income increasing to US$547 million from a year earlier.

- The company also reaffirmed its full-year guidance for mid-single-digit constant currency net sales growth, highlighting confidence in its ongoing momentum.

- We'll examine how Keurig Dr Pepper's reaffirmed sales growth outlook and improved earnings shape its investment narrative and future prospects.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Keurig Dr Pepper Investment Narrative Recap

For those considering Keurig Dr Pepper as a potential investment, the core thesis hinges on belief in the company’s ability to sustain steady top-line growth despite operational challenges in its coffee segment. The latest earnings report, showing increased sales and reaffirmed mid-single-digit sales growth guidance, does not materially alter the most important short-term catalyst, execution on new product launches to offset pressures in coffee, nor does it fully resolve the ongoing risk from cost inflation and tariffs affecting coffee profitability.

Among recent developments, the July 24 reaffirmation of the company’s full-year growth guidance stands out. Continued confidence in future sales momentum is relevant in the context of soft performance in the coffee business, as it suggests management sees sufficient strength in other segments to balance out these pressures, though risks tied to cost management remain significant.

Conversely, it’s important to be mindful that investors should watch for any persistent challenges impacting profitability in the U.S. Coffee segment, especially if inflationary headwinds continue to pressure costs and margins...

Read the full narrative on Keurig Dr Pepper (it's free!)

Keurig Dr Pepper's outlook anticipates $17.6 billion in revenue and $2.9 billion in earnings by 2028. This scenario requires annual revenue growth of 4.2% and reflects a $1.4 billion increase in earnings from the current $1.5 billion.

Uncover how Keurig Dr Pepper's forecasts yield a $38.35 fair value, a 13% upside to its current price.

Exploring Other Perspectives

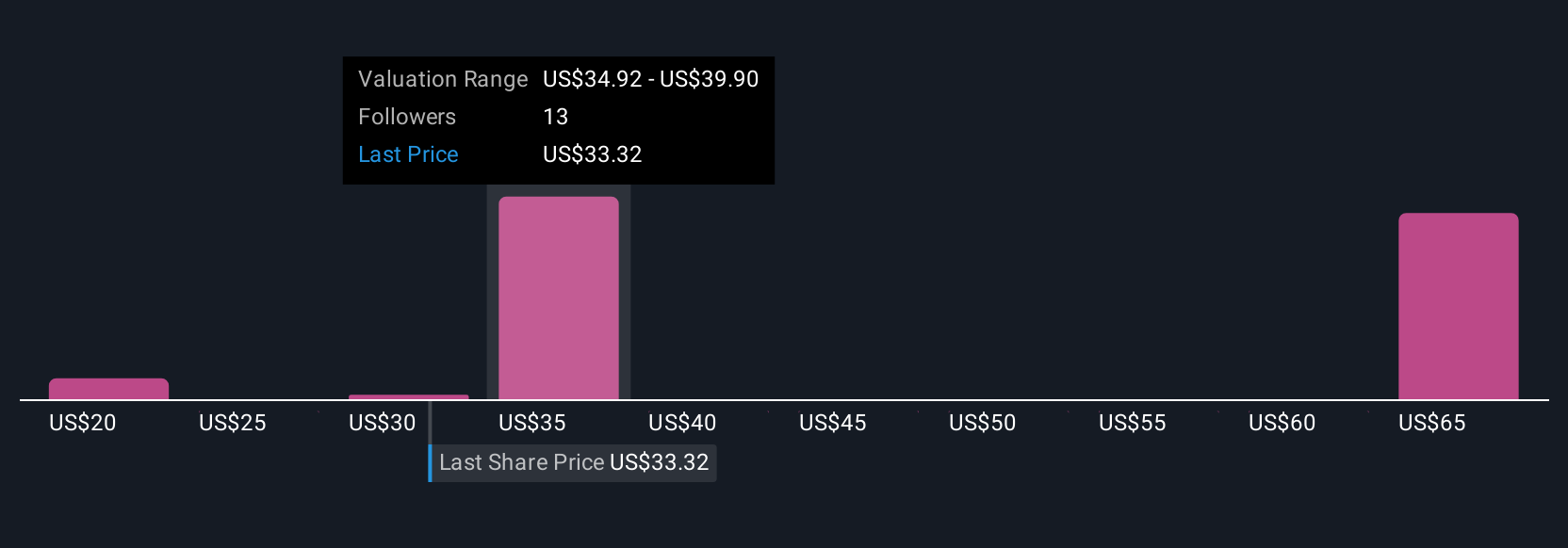

Five community-sourced estimates from the Simply Wall St Community place Keurig Dr Pepper’s fair value between US$20 and US$69.75 per share. Confidence in ongoing sales growth is a recent theme, but wide valuation views highlight why you may want to explore other perspectives on the company’s future.

Explore 5 other fair value estimates on Keurig Dr Pepper - why the stock might be worth over 2x more than the current price!

Build Your Own Keurig Dr Pepper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keurig Dr Pepper research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Keurig Dr Pepper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keurig Dr Pepper's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 25 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English