How Investors May Respond To Hamilton Insurance Group (HG) Appointing Raymond Karrenbauer as CIO

- Hamilton Insurance Group recently appointed Raymond Karrenbauer as Group Chief Information Officer, effective September 15, 2025, to succeed Venkat Krishnamoorthy upon his retirement after six years with the company.

- Karrenbauer brings significant technology leadership and digital transformation experience from organizations such as The Cyber AB, IFG Companies, Axis Capital, and ING Group, positioning Hamilton to further strengthen its IT strategy and infrastructure.

- We'll explore how Karrenbauer's expertise in technology and cybersecurity may influence Hamilton Insurance Group's broader investment narrative and future growth plans.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Hamilton Insurance Group Investment Narrative Recap

To be a Hamilton Insurance Group shareholder, you need to believe in the company's ability to grow profitably in specialty insurance while carefully managing risks like natural catastrophes, competitive pressures, and rating agency assessments. The appointment of Raymond Karrenbauer as Group CIO, though important for IT leadership, is unlikely to materially impact short-term performance drivers or the immediate risk profile, which remains centered on underwriting results and exposure to natural catastrophe events.

Of the recent announcements, the company’s ongoing share buyback program stands out as a relevant indicator for shareholders, as it signals management confidence and helps support book value per share, an important catalyst in connecting capital return actions with shareholder interests. This complements long-term initiatives like Karrenbauer's arrival by focusing on direct value creation for investors.

By contrast, one concern that merits a closer look is the potential impact of downgrades by rating agencies, which could...

Read the full narrative on Hamilton Insurance Group (it's free!)

Hamilton Insurance Group's narrative projects $2.8 billion revenue and $543.4 million earnings by 2028. This requires 5.2% yearly revenue growth and a $219.3 million earnings increase from $324.1 million today.

Uncover how Hamilton Insurance Group's forecasts yield a $24.17 fair value, a 12% upside to its current price.

Exploring Other Perspectives

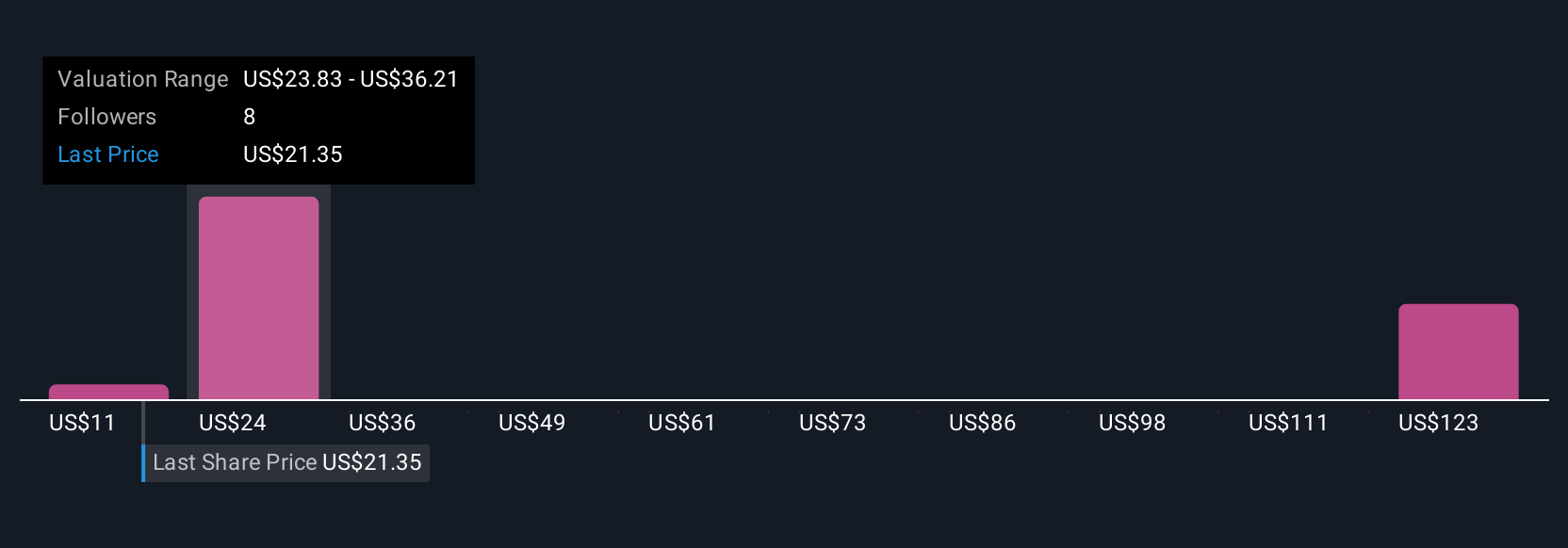

Simply Wall St Community members valued Hamilton anywhere from US$11.44 to US$135.29, with three distinct forecasts. While capital deployment and share buybacks attract interest, risks around rating agency actions could influence HG’s future trajectory and should be considered alongside these varied outlooks.

Explore 3 other fair value estimates on Hamilton Insurance Group - why the stock might be worth over 6x more than the current price!

Build Your Own Hamilton Insurance Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hamilton Insurance Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Hamilton Insurance Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hamilton Insurance Group's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English