Johnson Controls International (JCI) Reports Mixed Earnings Results With US$310 Million Buyback Completion

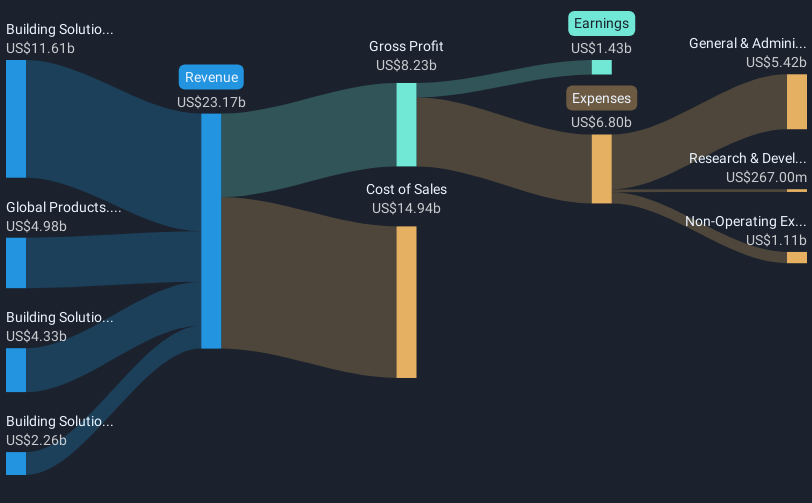

Johnson Controls International (JCI) recently reported a revenue increase to $6,052 million for Q3 2025, though net income fell to $701 million from the previous year. An anticipated organic sales growth and an active share buyback program, with 3.8 million shares repurchased, contributed to a 23% price increase over the last quarter. The broader market trends, reflecting a rally amid positive earnings and eased tariff concerns, likely provided additional support to JCI's rise. While earnings were mixed, the company's proactive share repurchase strategy and revenue growth add weight to its positive performance in a buoyant market environment.

Johnson Controls International has 2 risks we think you should know about.

The recent revenue increase for Johnson Controls International (JCI) to US$6.05 billion, combined with a fall in net income to US$701 million, has implications for the company's future performance. While earnings showed mixed results, the proactive share buyback of 3.8 million shares and anticipated organic sales growth underscore the company's efforts to bolster shareholder value, evidenced by its 23% price increase over the last quarter. However, this surge still positions the current share price at US$103.24, slightly below the consensus analyst price target of US$110.40, indicating potential upside if positive trends continue.

Over a broader five-year horizon, JCI's total return, including share price appreciation and dividends, reached a substantial 199.72%. This reflects strong underlying business strategies and resilience in volatile markets. Comparatively, within the past year, JCI has outperformed both the US Building industry, which returned 14.8%, and the broader US market, returning 17.7%, underscoring its robust position in the sector.

Looking ahead, the company's new organizational model and Lean practices are expected to fuel revenue growth and net margin enhancements, with analysts forecasting an earnings growth of 15.25% annually. However, operational complexities and market pressures could impact these forecasts. The recent news might bolster revenue and earnings prospects by enhancing customer focus and operational efficiency. With the current share price nearing the fair value estimates, investors might see the current valuation as reflective of the company's strategic initiatives and market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English