Oklo (OKLO) Completes NRC Pre-Application Assessment For Aurora Powerhouses

Oklo (OKLO) experienced a remarkable 199% increase in its total shareholder returns over the last quarter, coinciding with several noteworthy developments. The company's strategic alliance with Liberty Energy and collaboration with Vertiv have reinforced its commitment to providing advanced nuclear power solutions across high-demand sectors such as data centers. Additionally, the completion of the NRC pre-application assessment marked a significant milestone for its Aurora powerhouses. The company's inclusion in multiple Russell indexes signaled growing market recognition. Amid positive market sentiment around corporate earnings and economic growth, these developments likely added weight to Oklo's impressive quarter performance.

We've spotted 5 risks for Oklo you should be aware of, and 1 of them is potentially serious.

Oklo's shares have risen a very large 701.47% over the last year, setting a remarkable benchmark in comparison to the broader US market's 17.5% return, as well as the 15.5% return of the US Electric Utilities industry. This steep increase reflects growing investor confidence in the company's capacity to innovate within the nuclear energy domain, even though Oklo has yet to generate any revenue. Despite these gains, the current share price of $71.01 surpasses the consensus analyst price target of $62.53, suggesting that market optimism might be ahead of perceived fair value.

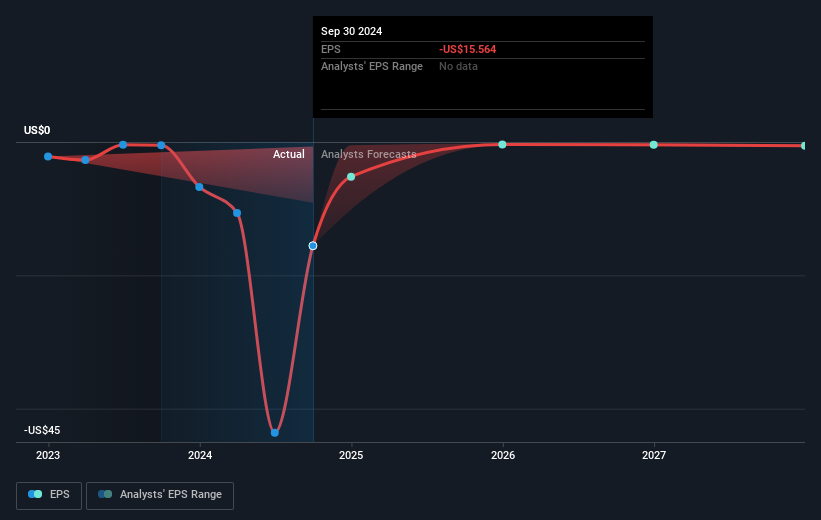

The developments Oklo has undertaken, like forming alliances with Liberty Energy and Vertiv, are crucial steps in expanding its market footprint, yet are not expected to immediately reflect in revenue or earnings as the company remains forecast to be unprofitable for the next three years. The strategic collaborations and pre-application assessment completion may enhance Oklo’s long-term prospects, possibly influencing revenue and earnings forecasts positively. Investors have responded favorably to these potential future enhancements, evidenced by robust share price growth despite an ongoing net loss of $59.40 million reported for 2025. Shareholders should consider the discrepancy between the current share price and price target in the context of Oklo's high Price-To-Book Ratio, indicating caution in valuation.

Assess Oklo's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English