Waste Management Analysts Increase Their Forecasts After Strong Q2 Earnings

Waste Management Inc (NYSE:WM) reported better-than-expected earnings for the second quarter, after the closing bell on Monday.

The company posted quarterly earnings of $1.92 per share which beat the analyst consensus estimate of $1.89 per share. The company reported quarterly sales of $6.430 billion which beat the analyst consensus estimate of $6.369 billion.

“As we described at our recent Investor Day, WM is building distinctive platforms to drive competitive differentiation and fuel a powerful, long-term growth engine to create shareholder value. Our second quarter results are a strong demonstration of our progress on all fronts,” said Jim Fish, WM’s CEO. “Our Collection and Disposal business produced robust organic revenue growth and margin expansion, achieving the Company’s best-ever operating expense margin. We also grew operating EBITDA by double digits in both our Recycling Processing and Sales and WM Renewable Energy segments, as the earnings contributions from investments we have made in our sustainability businesses accelerate. Additionally, we continue to integrate our newest segment, WM Healthcare Solutions, and benefit from the impact of WM’s culture and operational excellence on customer relationships, cost efficiency, and financial results.”

Waste Management lowered its FY2025 sales guidance from $25.550 billion-$25.800 billion to $25.275 billion-$25.475 billion.

Waste Management shares fell 0.7% to trade at $233.95 on Wednesday.

These analysts made changes to their price targets on Waste Management following earnings announcement.

- Oppenheimer analyst Noah Kaye maintained Waste Management with an Outperform rating and raised the price target from $260 to $265.

- UBS analyst Jon Windham maintained the stock with a Neutral and raised the price target from $260 to $265.

- BMO Capital analyst Devin Dodge maintained Waste Management with a Market Perform rating and raised the price target from $245 to $248.

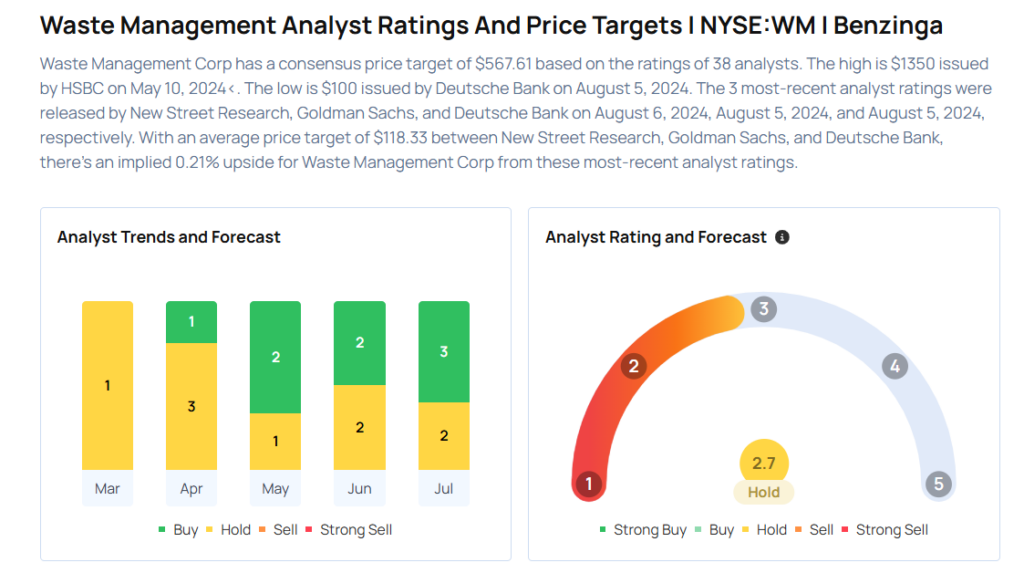

Considering buying WM stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English