According to Analysts, This Tech Stock Has the ‘Longest Runway.’ Should You Buy It Here?

Audio streaming continues to hold a bigger place in digital media going into 2025. Statista reports that global music streaming ad spend will reach $6.5 billion this year, as marketers steadily move budgets from traditional radio to on-demand platforms.

Spotify (SPOT) is right at the center of this shift. The stock is up 115% from its 52-week lows, lifting Spotify’s market value to about $126 billion.

Oppenheimer recently moved its rating on Spotify to “Outperform” and set a $800 price target, pointing to the untapped potential in monetizing Spotify’s free tier. Analysts argue this could unlock billions in new advertising dollars and gives Spotify the most room to grow among its tech peers.

Spotify’s Financial Momentum

Spotify combines paid subscriptions with a growing ad-supported tier, which helps the company earn revenue from both dedicated fans and more casual listeners worldwide.

This reach and user loyalty have turned into real market strength. In the past 52 weeks, SPOT shares have jumped 96% and they’re up nearly 45% this year alone.

Right now, Spotify trades at a forward price-earnings ratio of 78x, compared to the sector’s average of 14.2x. This kind of premium shows investors are banking on strong future growth and believe the company can keep building on its momentum.

Spotify’s Growth Engines

Spotify puts a big focus on making listening personal by using advanced AI and machine learning solutions, which sharpen music and podcast suggestions, keep people interested, and help lower the number of users leaving.

Partnerships are another big piece of the puzzle. Multi-year agreements with Universal Music Group (UNVGY) and Warner Music Group (WMG) have expanded Spotify’s music library, improved royalty terms, and introduced more artist-focused models. These deals help control costs, bring in exclusive content, and let Spotify try out new subscription options and tools that help artists connect better with fans.

Spotify is also reaching beyond music. As the official audio streaming partner for the 2025 Esports World Cup, which runs through late August, the company is working directly with the fast-growing gaming industry. This step connects Spotify with new listener groups and lets it roll out different music offerings and special content, especially in regions where streaming is becoming more popular.

Wall Street Reactions

Analysts see third quarter earnings at $2.32 per share, which would be a huge 46% jump from last year. Projections for 2025 and 2026 call for earnings per share of $8.99 and $13.28, pointing to strong growth above 47% each year.

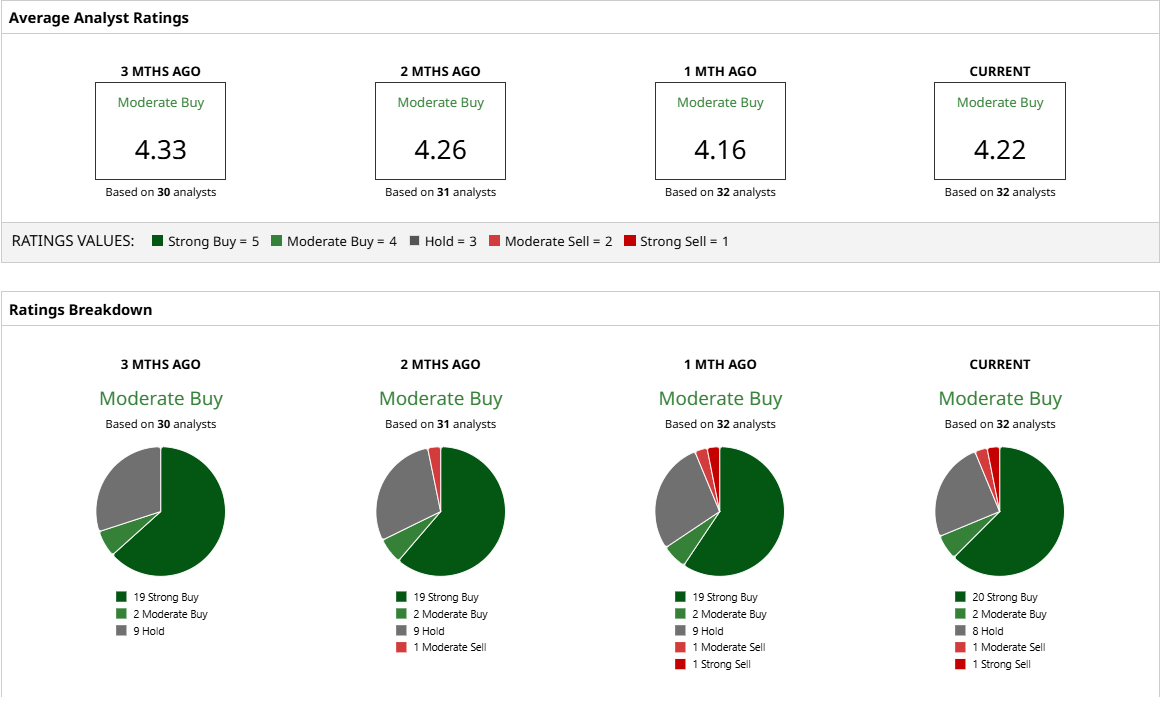

Across the board, analysts are positive, giving Spotify a “Moderate Buy” consensus rating. The average price target is $741.06, which is about 13% above its current price. This shows steady confidence in Spotify’s future from Wall Street.

Conclusion

Spotify’s breakneck growth and bold innovation set it apart as a tech stock with truly rare long-term potential. Yes, the stock has run hot and valuations are high, but there’s substance behind the optimism. For investors who can handle some volatility and believe in Spotify’s ability to keep reinventing the audio experience, this “longest runway” story looks like one of the most compelling opportunities in tech right now.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English