fuboTV (FUBO) Is Up 14.6% After Expanding Weigel Deal and Narrowing Losses Has the Bull Case Changed?

- In late July 2025, fuboTV announced a new multi-year partnership with Weigel Broadcasting to add seven entertainment and sports networks, while also providing improved earnings guidance for the second quarter, projecting a net loss of approximately US$8 million, an improvement of around US$18 million year-over-year.

- This expanded content deal enhances fuboTV’s offerings in key markets and the updated financial outlook reflects operational progress in narrowing losses.

- We'll now examine how the expanded Weigel Broadcasting partnership and improved guidance may affect fuboTV's overall investment outlook.

Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

fuboTV Investment Narrative Recap

To own shares of fuboTV, you need to believe in the company’s ability to grow its user base and offer compelling content as it pushes toward profitability, despite subscriber and revenue headwinds. The recent Weigel Broadcasting deal expands fuboTV’s library and could aid subscriber retention, while the improved Q2 2025 earnings guidance shows operational progress; however, these developments may not materially change the most pressing risk, which remains sustained subscriber declines, particularly after losing Univision content, and intensified streaming competition. In the short term, maintaining or growing North American subscribers is still the key catalyst, while cost control efforts are crucial to offset declines elsewhere.

Of the recent announcements, the new multi-year partnership with Weigel Broadcasting stands out, as it will bring seven new entertainment and sports networks, including MeTV, H&I, and WCIU, to fuboTV’s Pro and Elite subscribers, alongside local content in the Chicago market. While this adds value to the streaming platform and may help retention or acquisition, it will need to offset headwinds such as projected subscriber declines in both North America and the Rest of World segments. But as investors weigh these positives, an area that requires ongoing attention is...

Read the full narrative on fuboTV (it's free!)

fuboTV's narrative projects $1.8 billion revenue and $195.9 million earnings by 2028. This requires 3.3% yearly revenue growth and a $125.6 million earnings increase from $70.3 million currently.

Uncover how fuboTV's forecasts yield a $4.33 fair value, a 4% upside to its current price.

Exploring Other Perspectives

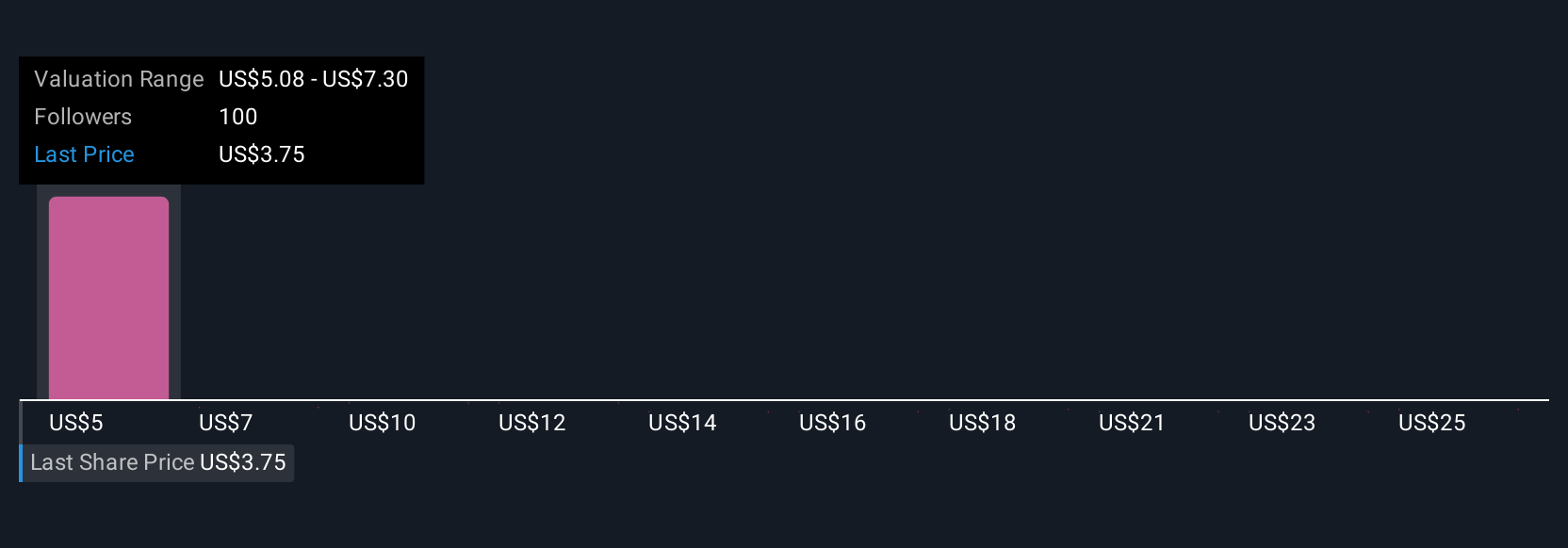

The Simply Wall St Community’s 16 fair value estimates for fuboTV range from US$4.33 to US$27.22 per share. Subscriber declines remain a focus, with investor outlooks reflecting differences in confidence on the company’s ability to reverse this trend.

Explore 16 other fair value estimates on fuboTV - why the stock might be worth over 6x more than the current price!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 21 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English