Will Diamondback's Permian Surge Fuel a Q2 Earnings Beat?

Diamondback Energy FANG is set to release second-quarter 2025 results on Aug. 4. The current Zacks Consensus Estimate for the to-be-reported quarter is a profit of $2.63 per share on revenues of $3.4 billion.

Let’s delve into the factors that might have influenced the Permian-focused oil and gas producer’s performance in the June quarter. But it’s worth taking a look at FANG’s previous-quarter performance first.

Highlights of Q1 Earnings & Surprise History

In the last reported quarter, this Midland, TX-based upstream player beat the consensus mark on strong production and lower costs, which more than offset a fall in oil realization. Diamondback had reported adjusted earnings per share of $4.54 in the first quarter, well ahead of the Zacks Consensus Estimate of $4.09. Revenues of $4 billion also went past the Zacks Consensus Estimate by 8.1%.

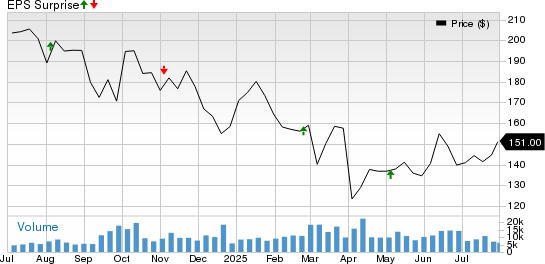

FANG beat the Zacks Consensus Estimate in three of the last four quarters and missed in the other. This is depicted in the graph below:

Trend in Estimate Revision

The Zacks Consensus Estimate for the second-quarter bottom line has remained unchanged in the past seven days. The estimated figure indicates a 41.8% decline year over year. The Zacks Consensus Estimate for revenues, however, suggests a 35.9% increase from the year-ago period.

Factors to Consider

Diamondback is sitting on about 900,000 net acres in the Delaware and Midland regions, with nearly 9.600 drilling locations and production of more than 880,000 barrels of oil equivalent per day. Overall, the wells drilled by the company have extremely low oil price breakeven costs and need the commodity to be less than $40 a barrel to be profitable.

In particular, Diamondback’s $26 billion Endeavor Energy acquisition significantly strengthens its Permian Basin position. The deal provides access to high-quality acreage with lower production costs.

Following the deal, Diamondback Energy is expected to have benefited from higher production during the second quarter. The company continues to churn out impressive volumes from its wide inventory of drill-ready locations in the Permian Basin — America's hottest and lowest-cost shale region. Consequently, our expectation for FANG’s average second-quarter volume is pegged at 884,987.3 barrels of oil equivalent per day (BOE/d), up 86.4% from the year-ago quarter’s level of 474,670 BOE/d.

Why a Likely Positive Surprise?

Our proven model predicts an earnings beat for Diamondback Energy this season. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

FANG has an Earnings ESP of +1.28% and a Zacks Rank #3.

Other Stocks to Consider

Diamondback Energy is not the only company looking up this earnings cycle. Here are some other energy firms that you may want to consider on the basis of our model:

Viper Energy VNOM has an Earnings ESP of +8.56% and a Zacks Rank #2. The firm is scheduled to release earnings on Aug. 4.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Viper Energy beat the Zacks Consensus Estimate for earnings in each of the last four quarters, with the average being 20.4%. Valued at around $10.9 billion, Viper Energy has lost 10.4% in a year.

The Williams Companies WMB has an Earnings ESP of +0.15% and a Zacks Rank #3. The firm is scheduled to release earnings on Aug. 4.

Williams Companies’ expected EPS growth rate for three to five years is currently 13.6%, which compares favorably with the industry's growth rate of 6.9%. Valued at around $72 billion, Williams Companies is up 37.4% in a year.

Coterra Energy CTRA has an Earnings ESP of +1.06% and a Zacks Rank #3. The firm is scheduled to release earnings on Aug. 4.

Coterra Energy’s expected EPS growth rate for three to five years is currently 30.1%, which compares favorably with the industry's growth rate of 19.6%. Valued at around $18.5 billion, Coterra Energy is down 4.3% in a year.

One Big Gain, Every Trading Day

To help you take full advantage of this market, you’re invited to access every stock recommendation in all our private portfolios - for just $1.

Zacks private portfolio services that closed 256 double and triple-digit winners in 2024 alone. That’s about one big gain every day the market was open. Of course, not all our picks are winners, but members have seen recent gains as high as +627% +1,340%, and +1,708%.

Imagine how much you could profit with a steady stream of real-time picks from all our services that cover a number of strategies to suit a variety of investing and trading styles.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Williams Companies, Inc. (The) (WMB): Free Stock Analysis Report

Diamondback Energy, Inc. (FANG): Free Stock Analysis Report

Viper Energy Inc. (VNOM): Free Stock Analysis Report

Coterra Energy Inc. (CTRA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English