We Think Oil-Dri Corporation of America (NYSE:ODC) Can Stay On Top Of Its Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Oil-Dri Corporation of America (NYSE:ODC) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is Oil-Dri Corporation of America's Debt?

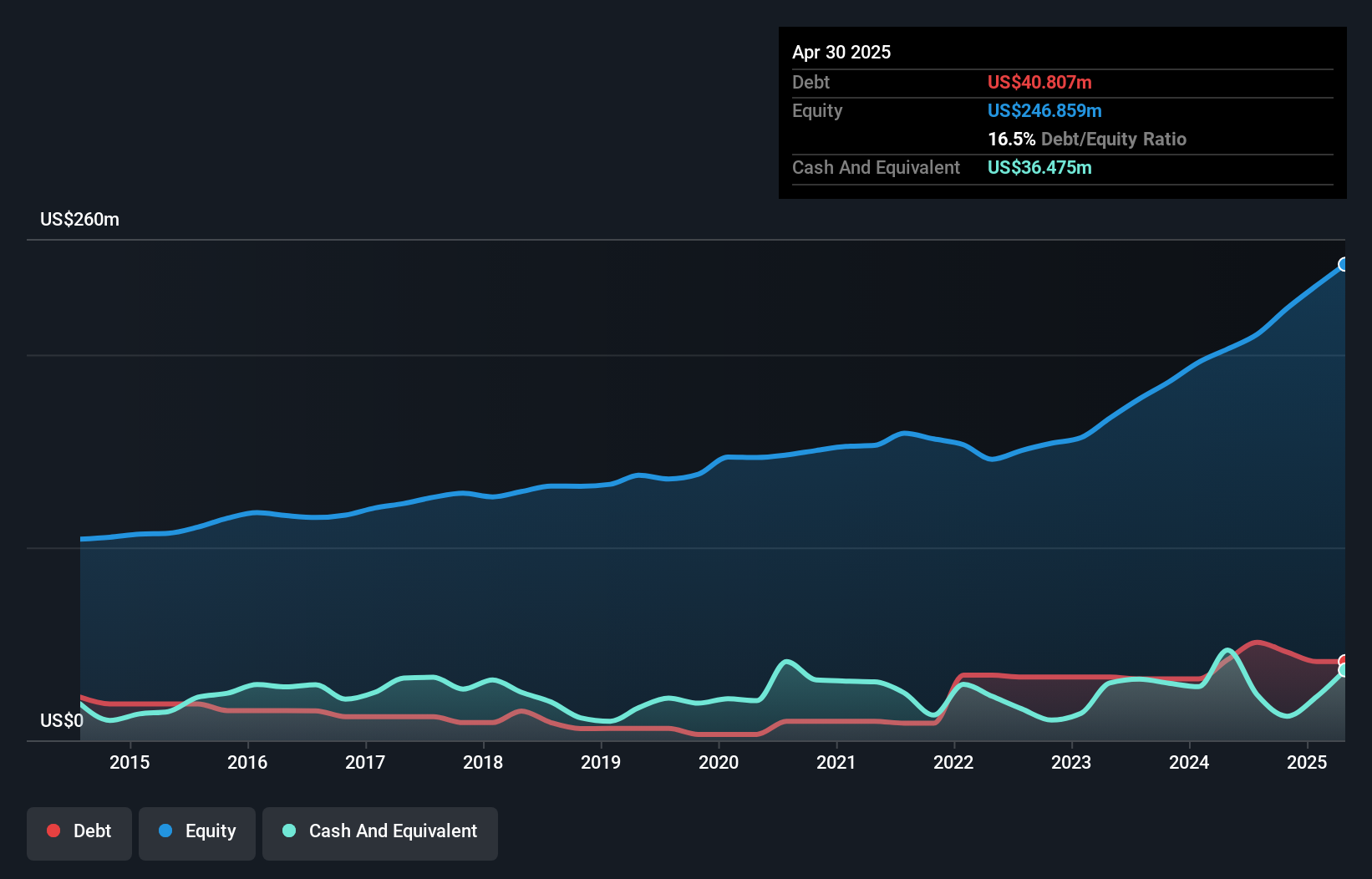

The chart below, which you can click on for greater detail, shows that Oil-Dri Corporation of America had US$40.8m in debt in April 2025; about the same as the year before. However, it does have US$36.5m in cash offsetting this, leading to net debt of about US$4.33m.

How Healthy Is Oil-Dri Corporation of America's Balance Sheet?

According to the last reported balance sheet, Oil-Dri Corporation of America had liabilities of US$57.7m due within 12 months, and liabilities of US$65.0m due beyond 12 months. Offsetting these obligations, it had cash of US$36.5m as well as receivables valued at US$65.5m due within 12 months. So it has liabilities totalling US$20.7m more than its cash and near-term receivables, combined.

Since publicly traded Oil-Dri Corporation of America shares are worth a total of US$838.2m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. Carrying virtually no net debt, Oil-Dri Corporation of America has a very light debt load indeed.

Check out our latest analysis for Oil-Dri Corporation of America

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Oil-Dri Corporation of America has very little debt (net of cash), and boasts a debt to EBITDA ratio of 0.049 and EBIT of 31.0 times the interest expense. So relative to past earnings, the debt load seems trivial. And we also note warmly that Oil-Dri Corporation of America grew its EBIT by 16% last year, making its debt load easier to handle. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Oil-Dri Corporation of America will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the most recent three years, Oil-Dri Corporation of America recorded free cash flow worth 54% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Oil-Dri Corporation of America's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. Zooming out, Oil-Dri Corporation of America seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 1 warning sign for Oil-Dri Corporation of America that you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English