Procter & Gamble (PG) Explores New Consumer Health Acquisitions Following Successful Past Investments

Procter & Gamble (PG) recently indicated a willingness to pursue acquisitions in the consumer health care sector, potentially enhancing their growth rates and margins. During the same week, PG's stock price experienced a 3.41% decline. Meanwhile, the market reacted positively to robust earnings from major tech companies like Microsoft and Meta, contributing to gains in major indexes. The company's executive changes, earnings report, and strategic acquisition discussions could have added weight to broader market movements, which remained generally positive in response to overall strong corporate performances. Despite these significant developments at PG, its share price diverged from the upward trend seen in broader markets.

We've spotted 1 weakness for Procter & Gamble you should be aware of.

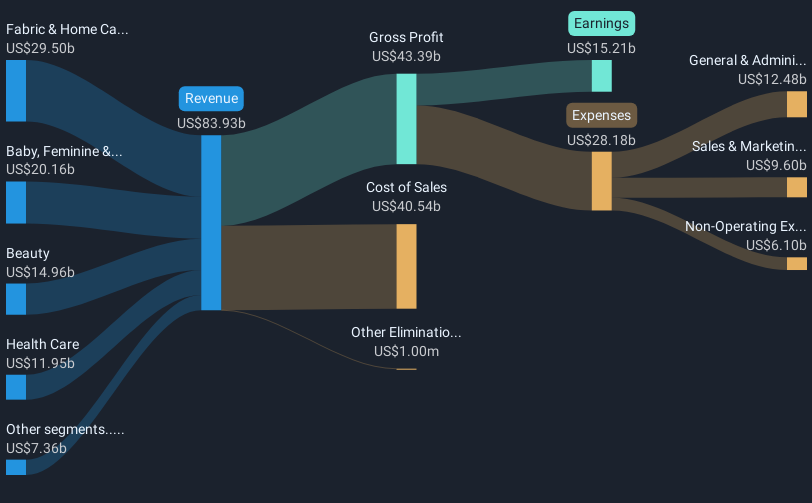

Procter & Gamble's recent announcement to explore acquisitions in the consumer healthcare sector could have meaningful implications for the company's future revenue and earnings. By integrating consumer health products, P&G aims to enhance growth rates and profit margins. This initiative aligns with its focus on targeted innovation and premium product launches to meet demand from an expanding global middle-class. However, these efforts come amid rising cost pressures and intense competition, which may impact their execution and financial outcomes.

Over the past five years, P&G's total shareholder return, including share price appreciation and dividends, was 29.65%. This performance offers a longer-term perspective on returns, in contrast to a relatively flat one-year industry performance of minus 5.3%. The recent 3.41% decline in their share price might not fully reflect the company's potential benefits from strategic moves, especially when considering the current share price of US$152.88 against an analyst price target of US$171.71. The 8.8% potential upside implied by this target suggests a belief in a fair valuation despite recent stock fluctuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English