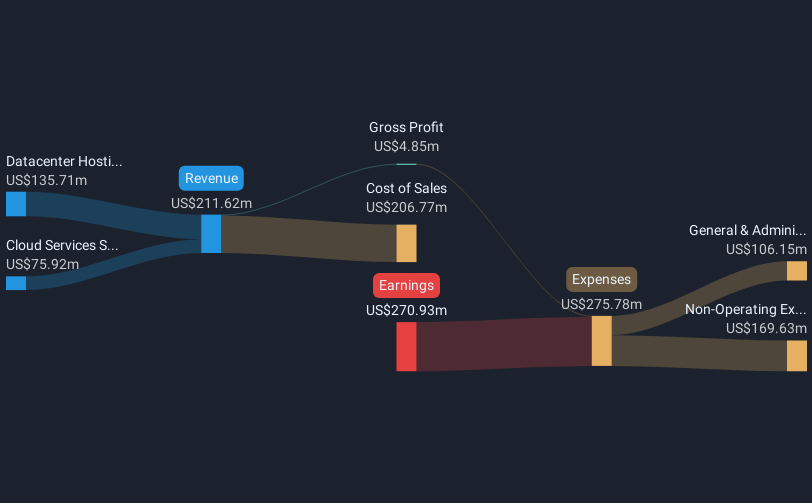

Applied Digital (APLD) Reports US$233M Net Loss Despite Revenue Growth

Applied Digital (APLD) reported strong quarterly sales growth to USD 38 million, yet still recorded a net loss of USD 53 million, albeit improved from the previous year. Concurrently, the company's stock price surged 89% in the last quarter—a remarkable rise coinciding with major partnerships cemented with BASX and ABB for energy-efficient AI infrastructure innovations, and a significant leasing deal with CoreWeave potentially worth USD 7 billion. These developments bolstered investor confidence amidst an optimistic market backdrop where tech stocks have generally thrived, buoyed by strong earnings from industry giants like Microsoft and Meta.

We've spotted 2 risks for Applied Digital you should be aware of, and 1 of them can't be ignored.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent strategic shifts and partnerships discussed in the introduction are poised to significantly propel Applied Digital's narrative forward. The collaboration with BASX and ABB, along with the leasing deal with CoreWeave, is likely to strengthen the company's position in the AI infrastructure sector, potentially translating into increased revenue streams. These advancements might catalyze improvements in earnings forecasts, given the anticipated boost from the outlined capital investments and strategic business model transitions. Such developments are often sufficient to attract investor interest and reinforce both market confidence and stock valuations.

Over the past five years, Applied Digital's shares have experienced a very large total return of 8258.40%, a remarkable increase highlighting strong shareholder value creation over this duration. In comparison, the company's performance outpaced the US IT industry over the past year. While the broader industry saw a more modest return, Applied Digital's share price movements, in the last quarter alone, reflected a significant surge complementing its longer-term ascent.

The stock's 89% quarterly surge, aligned with analyst projections of a future price target of US$14.61, suggests a bullish outlook, but it's crucial to note the current share price of US$10.03 results in a notable discount to this target. This gap may underscore both potential growth opportunities and underlying risks that investors might weigh, particularly in light of the company's current high price-to-sales ratios compared to peers and the industry. As revenue and earning prospects evolve through continued execution of growth strategies, investor sentiment will likely remain closely tied to how well these initiatives materialize economically.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English