How Investors May Respond To Johnson Controls (JCI) Raising Guidance After Strong Data Center-Driven Q3 Results

- On July 29, 2025, Johnson Controls International reported third-quarter 2025 earnings, featuring US$6.05 billion in revenue and net income of US$701 million, while raising its annual profit forecast and third-quarter adjusted earnings per share above analyst estimates.

- A standout factor was the company's continued momentum from robust data center demand and the implementation of business simplification initiatives to build future profitability.

- We'll look at how Johnson Controls' profit guidance increase and operational improvements impact its investment narrative and growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Johnson Controls International Investment Narrative Recap

To be a shareholder in Johnson Controls International, you need to believe in its ability to execute operational improvements while capitalizing on rising demand for energy solutions and data center infrastructure. The recent quarterly results affirm the company’s ongoing margin improvements and strong sales, though the most important short-term catalyst, realizing sustained profit growth from new business simplification initiatives, remains exposed to the risk that operational complexity could limit near-term margin expansion. Current results suggest no material change to this risk.

Among the recent announcements, Johnson Controls’ updated full-year profit guidance stands out as most relevant to short-term performance. The guidance raise, on the back of better-than-expected Q3 adjusted earnings and a robust backlog, underpins the narrative that execution of business simplification and digitization can improve margins and support consistent earnings growth.

Yet, some risks warrant greater attention, in particular, the possibility that complexities within current product lines could constrict margin improvements just as execution gains are needed most...

Read the full narrative on Johnson Controls International (it's free!)

Johnson Controls International is projected to reach $26.8 billion in revenue and $3.5 billion in earnings by 2028. This outlook assumes a 4.7% annual revenue growth rate and a $1.5 billion increase in earnings from the current level of $2.0 billion.

Uncover how Johnson Controls International's forecasts yield a $110.40 fair value, a 5% upside to its current price.

Exploring Other Perspectives

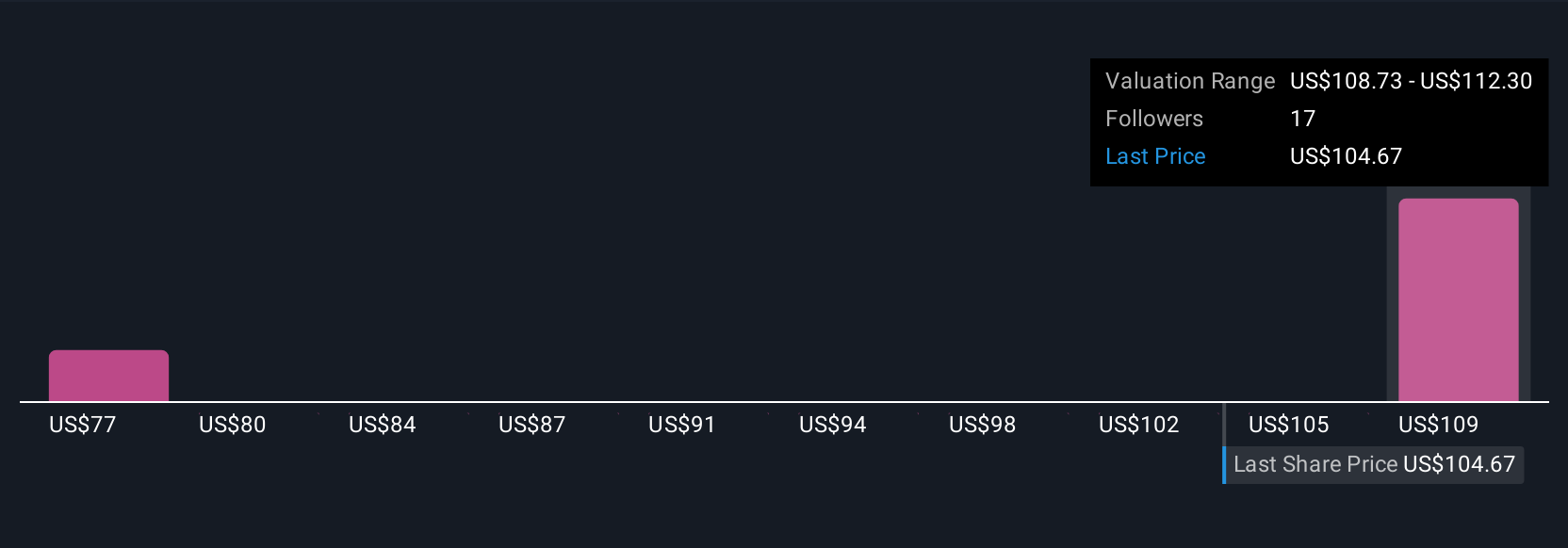

Estimates from the Simply Wall St Community for Johnson Controls’ fair value range from US$75.64 to US$110.40, based on two independent opinions. While investors differ widely, many are closely watching how meaningful operational improvements can overcome internal complexity and influence future results.

Explore 2 other fair value estimates on Johnson Controls International - why the stock might be worth as much as 5% more than the current price!

Build Your Own Johnson Controls International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Johnson Controls International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Johnson Controls International's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English