The Bull Case For Madrigal Pharmaceuticals (MDGL) Could Change Following $500M Credit Facility From Blue Owl Capital

- In July 2025, Madrigal Pharmaceuticals announced it secured a US$500 million senior secured credit facility with Blue Owl Capital, consisting of an immediate US$350 million term loan (a portion of which refinances previous debt), a US$150 million delayed draw facility through December 2027, and an option for an additional US$250 million in incremental facilities for future business development.

- This non-dilutive financing enhances Madrigal’s ability to advance its pipeline and signals increased financial flexibility for potential drug development and market expansion.

- We'll assess how this flexible US$500 million credit facility directly supports Madrigal's pipeline investment and bolsters its overall investment narrative.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Madrigal Pharmaceuticals Investment Narrative Recap

To be a shareholder in Madrigal Pharmaceuticals, you must believe in its ability to dominate and expand the MASH market, leveraging Rezdiffra's first-mover advantage and pushing pipeline advances into later-stage liver diseases. The recent US$500 million facility meaningfully strengthens short-term liquidity, reducing financing risk for ongoing development, yet does not materially alter the biggest near-term catalyst: the upcoming European Commission decision on Rezdiffra, nor the primary risk, which remains competitive pressure from semaglutide.

The June 2025 CHMP recommendation for Rezdiffra in Europe stands out as the most relevant recent announcement, since the new credit facility ensures Madrigal is equipped to invest in regulatory and commercial rollout if approval goes ahead. This access to capital may support expansion but does not remove regulatory or pricing uncertainties, which are still critical factors for the company's growth milestones.

However, investors should note that if reimbursement negotiations in key European markets become more challenging than expected, it could affect Rezdiffra’s launch trajectory and...

Read the full narrative on Madrigal Pharmaceuticals (it's free!)

Madrigal Pharmaceuticals' outlook anticipates $2.0 billion in revenue and $676.0 million in earnings by 2028. This requires 83.7% annual revenue growth and a $1,067.6 million increase in earnings from the current level of -$391.6 million.

Uncover how Madrigal Pharmaceuticals' forecasts yield a $425.00 fair value, a 40% upside to its current price.

Exploring Other Perspectives

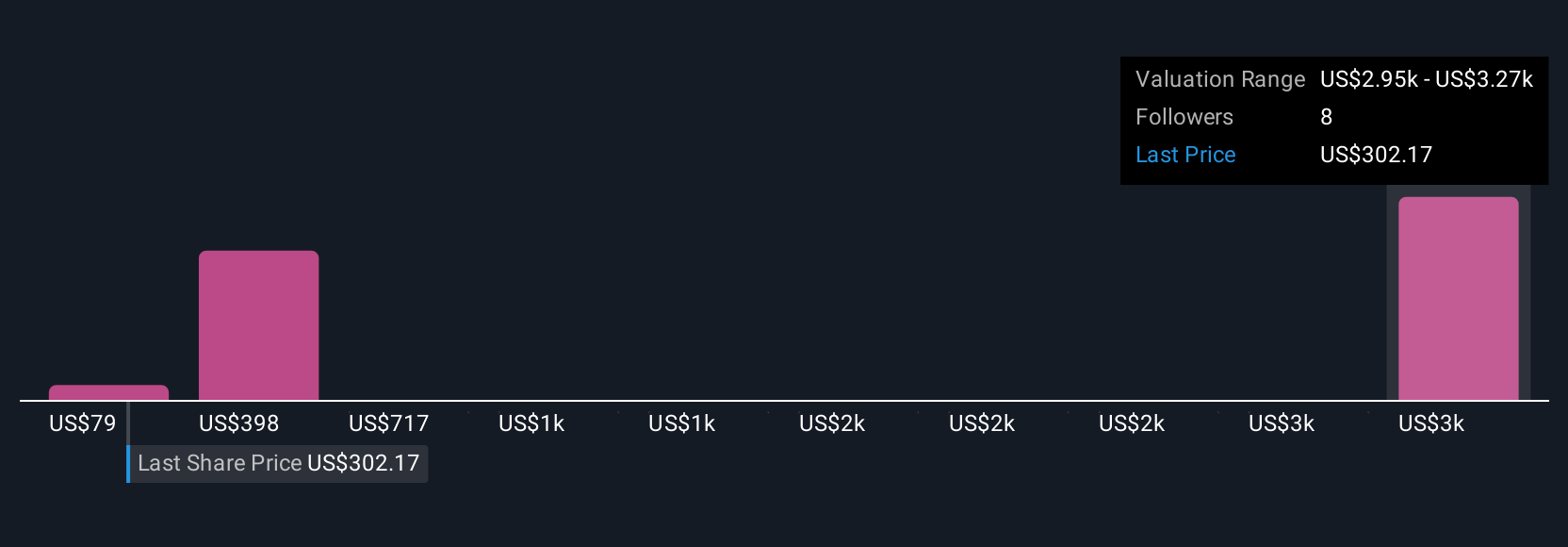

Simply Wall St Community members estimate fair value between US$78.91 and US$3,269.79 across three perspectives, showing wide variability. As new liquidity supports international expansion, outcomes from pending European regulatory decisions could have a broad impact on future sentiment.

Explore 3 other fair value estimates on Madrigal Pharmaceuticals - why the stock might be worth over 10x more than the current price!

Build Your Own Madrigal Pharmaceuticals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Madrigal Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Madrigal Pharmaceuticals' overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English