What Allison Transmission Holdings (ALSN)'s CARB-Compliant Transmission and Military Contract Mean for Shareholders

- In July 2025, Allison Transmission Holdings announced its 4000 Series fully automatic transmission is now available with the CARB low NOx compliant PACCAR MX-13 engine for Kenworth and Peterbilt trucks, and was awarded a multi-million US dollar contract for the second phase of the Next Generation Electrified Transmission program by the Ground Vehicle Systems Center.

- These advancements position Allison at the forefront of both emissions-compliant commercial vehicle solutions and next-generation hybrid-electric military propulsion, potentially expanding its reach in two distinct markets.

- We'll examine how Allison's new CARB-compliant transmission pairing could influence the company's growth outlook and industry positioning.

The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Allison Transmission Holdings Investment Narrative Recap

To be a shareholder in Allison Transmission Holdings, you need to believe the company can leverage its engineering strength to expand in both emissions-compliant commercial trucking and emerging military electrification markets. The latest CARB-compliant transmission launch and defense contract underscore progress on key growth drivers but do not fully address the near-term risk of slowing demand in the medium-duty truck market, which continues to weigh on revenue outlook.

Among the recent developments, the pairing of the Allison 4000 Series automatic transmission with PACCAR’s CARB low NOx engine is most relevant. This move further differentiates Allison in the emissions-focused trucking sector, aligning with regulatory shifts and potentially supporting future sales if fleet operators accelerate adoption in response to tightening emissions standards.

However, it is important for investors to be aware that while product innovation supports growth, the risk of a broader decline in truck demand could still ...

Read the full narrative on Allison Transmission Holdings (it's free!)

Allison Transmission Holdings is expected to achieve $3.5 billion in revenue and $833.4 million in earnings by 2028. This outlook is based on a 3.0% annual revenue growth rate and reflects a $79.4 million increase in earnings from the current level of $754.0 million.

Uncover how Allison Transmission Holdings' forecasts yield a $103.56 fair value, a 15% upside to its current price.

Exploring Other Perspectives

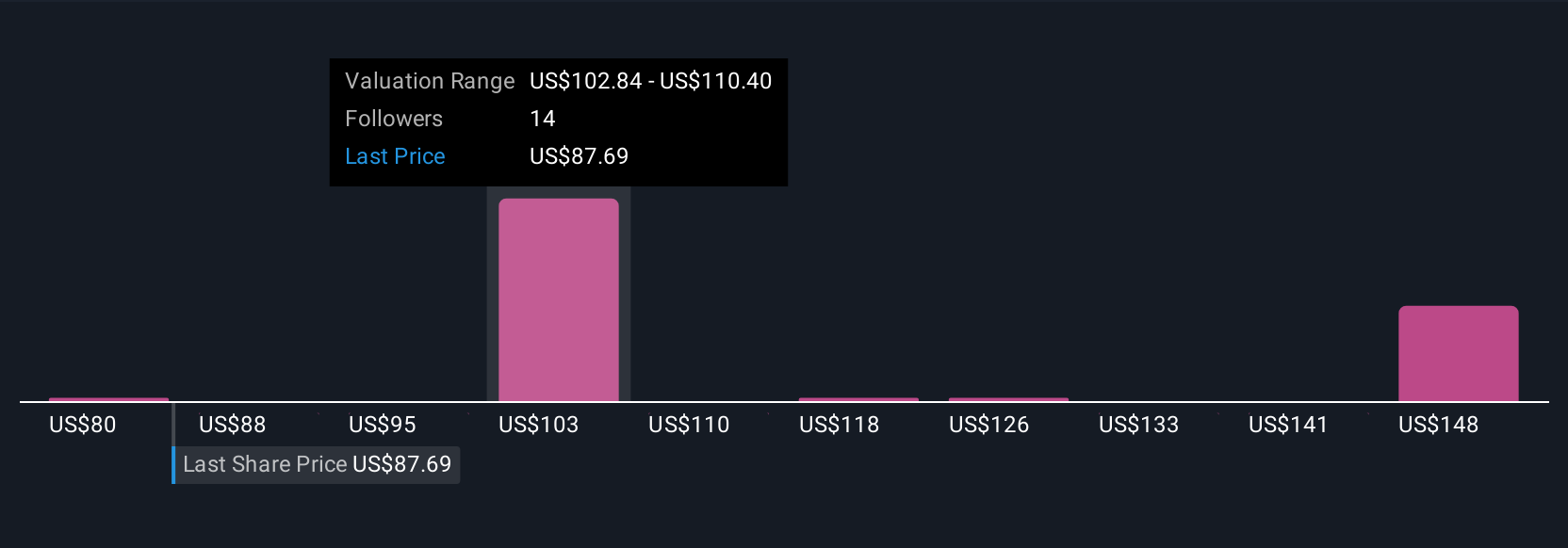

Five fair value estimates from the Simply Wall St Community span from US$80.18 to US$155.19 per share. While these viewpoints vary, many have focused on whether Allison’s expanding partnerships can offset ongoing risks from softening truck markets.

Explore 5 other fair value estimates on Allison Transmission Holdings - why the stock might be worth as much as 72% more than the current price!

Build Your Own Allison Transmission Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allison Transmission Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Allison Transmission Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allison Transmission Holdings' overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English