Oklo’s (OKLO) New Power Partnerships Might Change the Case for Investing in Next-Gen Data Centers

- Oklo Inc. recently announced two major partnerships with Liberty Energy and Vertiv to co-develop integrated nuclear-powered solutions for data centers, combining advanced reactor technology, natural gas power, and modular energy management systems.

- This collaboration is poised to address the rapidly rising energy and cooling needs of hyperscale and AI-focused data centers, showcasing a flexible transition path from conventional to zero-carbon nuclear power.

- We'll examine how Oklo's integrated approach to powering data centers enhances its investment narrative amid growing demand for sustainable energy.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Oklo's Investment Narrative?

For Oklo, much of the investment case rests on whether you see its partnerships and licensing efforts as a credible route to commercializing advanced nuclear reactors for data-heavy sectors. The latest partnerships with Liberty Energy and Vertiv offer signs that Oklo is gaining traction with real-world power buyers, providing critical proof-of-concept opportunities and widening its customer pipeline. While these announcements have driven a very large recent price rally, Oklo’s most immediate catalysts, regulatory approvals and demonstration project milestones, remain unchanged at their core. The partnerships, though positive for commercial validation and integration, are unlikely to be immediately material to near-term revenue: Oklo still has no sales, is not expected to be profitable over the next three years, and remains reliant on licensing progress with federal regulators. That said, these deals help counter one of Oklo’s biggest risks: whether anyone will buy, or trust, a first-of-its-kind nuclear solution, and position the company to capitalize if regulatory and execution hurdles are cleared. But the steep valuation and ongoing lack of revenue signal another risk investors need to weigh carefully.

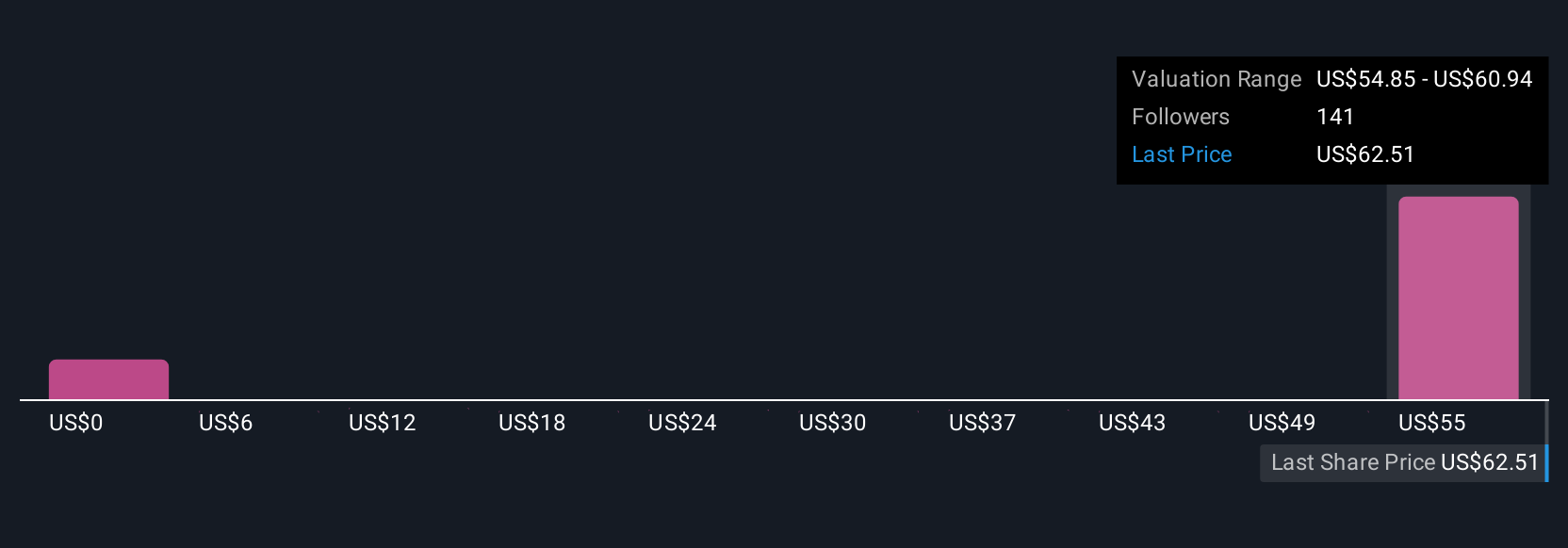

The valuation report we've compiled suggests that Oklo's current price could be inflated.Exploring Other Perspectives

Explore 41 other fair value estimates on Oklo - why the stock might be worth as much as $62.53!

Build Your Own Oklo Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oklo research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Oklo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oklo's overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English