How to Buy KO for a 2% Discount, or Achieve a 17% Annual Return

Selling cash secured puts on stocks an investor is happy to take ownership of is a great way to generate some extra income. A cash-secured put involves writing an at-the-money or out-of-the-money put option and simultaneously setting aside enough cash to buy the stock. The goal is to either have the put expire worthless and keep the premium, or to be assigned and acquire the stock below the current price. It’s important that anyone selling puts understands that they may be assigned 100 shares at the strike price.

Why Trade Cash Secured Puts?

Selling cash secured puts is a bullish trade but slightly less bullish than outright stock ownership. If the investor was strongly bullish, they would prefer to look at strategies like a long call, a bull call spread, or a poor man’s covered call. Investors would sell a put on a stock they think will stay flat, rise slightly, or at worst not drop too much.

Cash secured put sellers set aside enough capital to purchase the shares and are happy to take ownership of the stock if called upon to do so by the put buyer. Naked put sellers, on the other hand, have no intention of taking ownership of the stock and are purely looking to generate premium from option selling strategies.

The more bullish the cash secure put investor is, the closer they should sell the put to the current stock price. This will generate the most amount of premium and also increase the chances of the put being assigned. Selling deep-out-of-the-money puts generates the smallest amount of premium and is less likely to see the put assigned.

KO Cash Secure Put Example

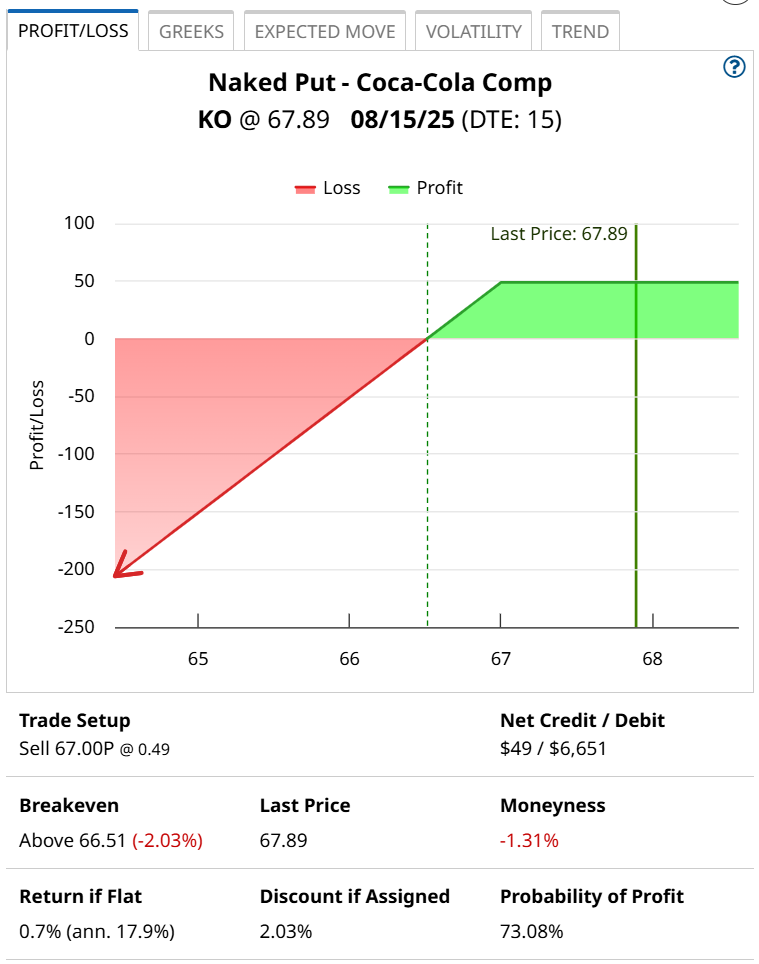

Yesterday, with Coca-Cola (KO) trading at $67.89, the August put option with a strike price of $67 was trading around $0.49. Traders selling this put would receive $49 in option premium. In return for receiving this premium, they have an obligation to buy 100 shares of KO for $67. By August 15, if KO is trading for $65, or $60, or even $500, the put seller still has to buy 100 shares at $67.

But, if KO is trading above $67, the put option expires worthless, and the trader keeps the $49 option premium. The net capital at risk is equal to the strike price of $67, less the $0.49 in option premium. So, if assigned, the net cost basis will be $66.51. That’s a 2.03% discount from the price it was trading yesterday.

If KO stays above $67, the return on capital is:

$49 / $6,651 = 0.70% in 15 days, which works out to 17.9% annualized.

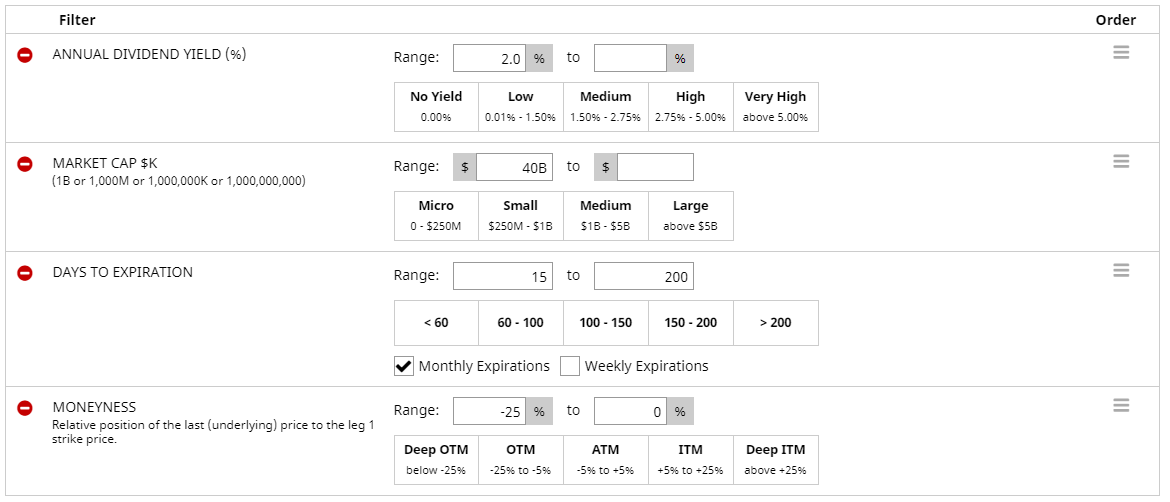

Either the put seller achieves an 17.9% annualized return or gets to buy a high yielding stock for a 2.03% discount. You can find other ideas like this using the Naked Put Screener. Below you can see some parameters that you might consider for running this screener. Feel free to tweak them as you see fit.

Company Details

The Barchart Technical Opinion rating is a 24% Sell with a Strengthening short term outlook on maintaining the current direction.

Of 23 analysts covering KO, 20 have a Strong Buy rating, 2 have a Moderate Buy rating and 1 has a Hold rating.

Implied volatility is currently 16.45% compared to a 12-month high of 30.61% and a low of 12.29%. The IV Percentile is 32% and the IV Rank is 22.72%.

The Coca-Cola Company's strong brand equity, marketing, research and innovation help it to garner a major market share in the non-alcoholic beverage industry. The company is making investments in healthier alternatives like coffee, sparkling water and sports drinks. The roll out of Coca-Cola Energy, Coca-Cola Plus Coffee, Powerade Ultra and Powerade Power Water are some additions on these lines. The company's portfolio includes beverage products, spanning from sodas to energy drinks. In addition to its sparkling soft drinks, the company sells a large range of still beverages including water, enhanced water, juices and juice drinks, sports drinks, ready-to-drink teas, coffees and dairy and energy drinks. Most of the company's beverages are manufactured, sold and distributed by independent bottling partners. Coca-Cola currently reports operating results under the following segments - Europe, Middle East and Africa; Latin America; North America; Asia Pacific; Global Ventures; Bottling Investments and Corporate.

Summary

While this type of strategy requires a lot of capital, it is a great way to generate an income from stocks you want to own. If you end up being assigned, you can sit back and collect the nice 3.05% dividend on offer from KO. You can do this on other stocks as well, but remember to start small until you understand a bit more about how this all works.

Risk averse traders might consider buying an out-of-the-money put to protect the downside.

Please remember that options are risky, and investors can lose 100% of their investment.

This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

On the date of publication, Gavin McMaster did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English