Surging Earnings and U.S. Expansion Could Be a Game Changer For Savers Value Village (SVV)

- Savers Value Village reported its second quarter and six-month 2025 earnings, with quarterly sales rising to US$417.21 million and net income doubling to US$18.92 million compared to a year earlier.

- This performance highlights strong momentum from ongoing store expansion in the U.S., even as new locations initially pressure profitability due to higher costs.

- We'll explore how this recent earnings momentum and successful U.S. store expansion could influence the company's previously outlined investment narrative.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Savers Value Village Investment Narrative Recap

To be a shareholder in Savers Value Village, you need confidence in its ability to drive sustainable growth by expanding its U.S. footprint and maintaining momentum in new store openings, while balancing the short-term impact of higher costs and margin pressures. The latest earnings, featuring strong sales and profit growth, affirm this momentum, but do not significantly change the core short-term catalyst of U.S. store ramp-up or the central risk from rising costs and compressed margins.

The company's decision to raise its full-year sales and income guidance immediately following the Q2 results stands out as directly relevant. This shift supports the idea that recent performance could help offset pressure from near-term earnings headwinds as new stores mature and operational efficiencies from expansion come into play.

But against this optimism, investors should also keep a close eye on the less obvious risk of weakening Canadian same-store sales and what it could mean for revenue trends if...

Read the full narrative on Savers Value Village (it's free!)

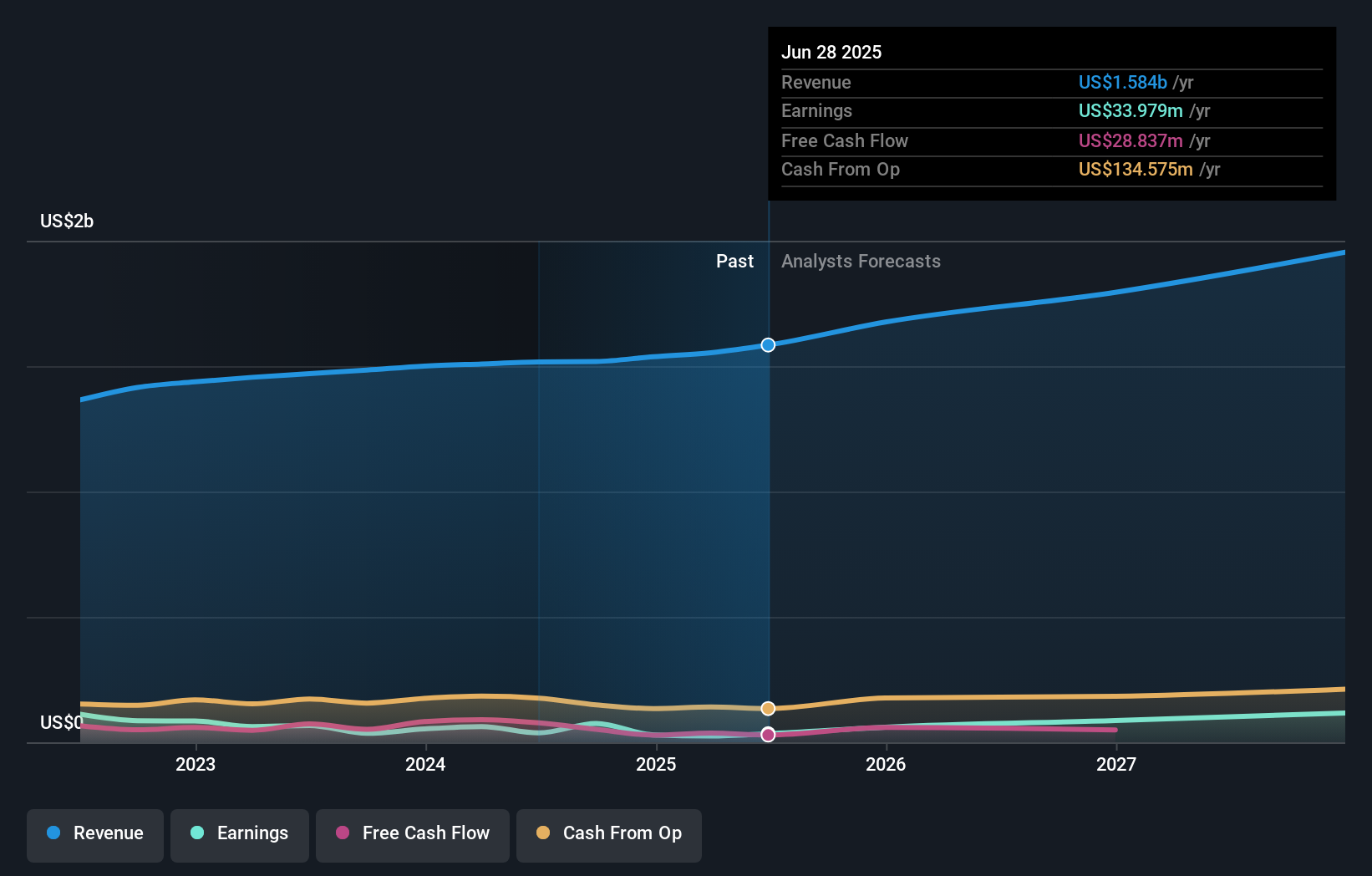

Savers Value Village's narrative projects $1.9 billion revenue and $140.7 million earnings by 2028. This requires 7.4% yearly revenue growth and a $115.9 million earnings increase from $24.8 million today.

Uncover how Savers Value Village's forecasts yield a $13.12 fair value, a 26% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community currently shows just one fair value estimate for Savers Value Village at US$3.00, well below recent share prices. As new store openings put pressure on near-term profits, viewpoints on this stock can vary widely so check out different analyses.

Explore another fair value estimate on Savers Value Village - why the stock might be worth as much as $3.00!

Build Your Own Savers Value Village Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Savers Value Village research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Savers Value Village research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Savers Value Village's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English