CRM vs. NOW: Which Workflow Automation Stock Has More Upside?

ServiceNow NOW and Salesforce CRM are leading workflow automation platforms, helping enterprises streamline operations through cloud-based software and AI-powered tools. Platforms provided by these companies are widely used by large enterprises to drive efficiency and improve service delivery.

Salesforce powers front-office workflows such as lead management, customer service and campaign automation. ServiceNow is known for automating internal workflows across IT service management, employee onboarding and case resolution.

With enterprise workflows becoming more complex, demand for automation continues to rise. Per Mordor Intelligence report, the global workflow automation market is valued at $23.77 billion for 2025 and is projected to grow to $37.45 billion by 2030, reflecting a CAGR of 9.52%. Both CRM and NOW are well-positioned to benefit as businesses accelerate the adoption of AI-driven workflow platforms.

NOW or CRM — Which of these workflow automation stocks has the greater upside potential? Let’s find out.

The Case for ServiceNow

ServiceNow has been benefiting from the rising adoption of its workflows as enterprises scale digital operations. The platform supports automation across IT, HR, finance, procurement, legal and support, helping customers drive efficiency and reduce time to value.

Momentum in large deals continues to remain strong. ServiceNow closed 89 transactions with more than $1 million in net new annual contract value (ACV), including 11 deals over $5 million. The number of customers contributing over $5 million in ACV rose to 528, up from 508 in the previous quarter. Clients spending over $20 million grew 30% year over year, signaling deeper enterprise commitment.

NOW’s expanding portfolio has been a key catalyst. The Core Business Suite, launched in May 2025, brings AI-native capabilities to core business functions. It connects workflows across departments and helps improve execution in areas like procurement and legal. Advancements in AI continue to expand the platform's value. In July, ServiceNow introduced Agentic Workforce Management, designed to support supervised task execution by AI agents across IT and operations. AI agents were also added to Security and Risk offerings through partnerships with Microsoft and Cisco to help accelerate threat detection and automate incident response.

For the third quarter of 2025, subscription revenues are projected between $3.26 billion and $3.265 billion, suggesting year-over-year growth in the range of 20%-20.5% on a GAAP basis. At cc, subscription revenues remain flat at 19.5%. The Zacks Consensus Estimate for third-quarter subscription revenues is pegged at $3.26 billion, up 20.2% year over year, implying sustained enterprise demand.

The Case for Salesforce

Salesforce continues to see broad adoption of its platform as enterprises connect sales, service, marketing and analytics workflows under one system. CRM’s Customer 360 architecture integrates core applications with real-time data and AI, helping enterprises unify engagement and scale digital operations. Acquisitions such as Informatica, Zoomin and Own Company add capabilities in data integration, content automation, and documentation intelligence.

Adoption remains strong across large enterprise accounts. In the first quarter, more than half of Salesforce’s top 100 deals included six or more clouds. Nearly 60% of those deals featured both Data Cloud and AI, underscoring growing demand for integrated applications with embedded intelligence. Current remaining performance obligations stood at $29.6 billion, up 12% year over year, reflecting continued investment in multi-cloud deployments.

CRM’s product portfolio remains a key driver. Agent force allows enterprises to deploy AI agents for task execution across sales, service, and marketing. These agents are powered by Data Cloud, which enables real-time data activation across systems. Salesforce has extended its ecosystem through integrations with Snowflake, Databricks, Google BigQuery, and Amazon Redshift to support zero-copy data access and streamline AI workflows.

Salesforce expects second-quarter sales between $10.11 and $10.16 billion. It now anticipates Subscription and Support revenues to increase approximately 9.5%, up from the previously announced growth rate of 8.5% on a year-over-year basis. The Zacks Consensus Estimate for second-quarter Subscription and support revenue is pegged at $9.6 billion, up 9.6% year over year. The consensus mark for the second-quarter RPO’s is pegged at $59.84 billion, up 11.8% year over year. Salesforce remains positioned to benefit from rising enterprise demand for unified AI platforms that bring together applications, automation and data on a single foundation.

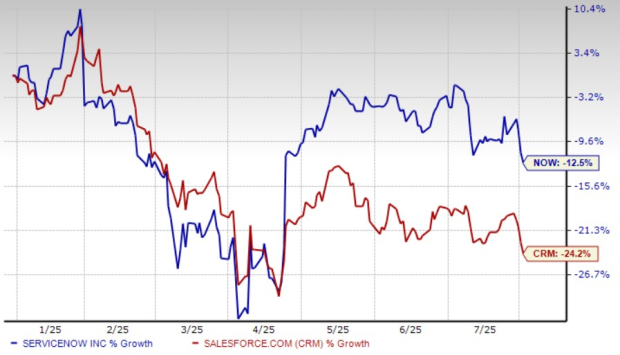

Price Performance and Valuation of NOW and CRM

In the year-to-date period, NOW shares have lost 12.5% and CRM shares have declined 24.2%.

NOW and CRM Stock Performance

Image Source: Zacks Investment Research

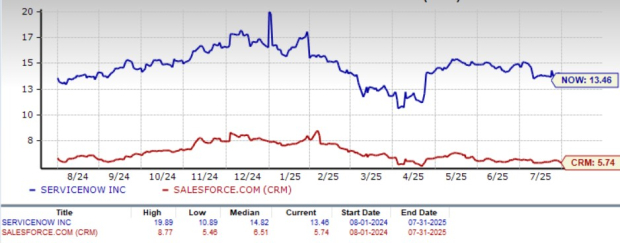

Valuation-wise, NOW and CRM shares are currently overvalued as suggested by a Value Score of F and D, respectively.

In terms of the forward 12-month Price/Sales, NOW shares are trading at 13.46X, which is higher than CRM’s 5.74X.

NOW and CRM Valuation

Image Source: Zacks Investment Research

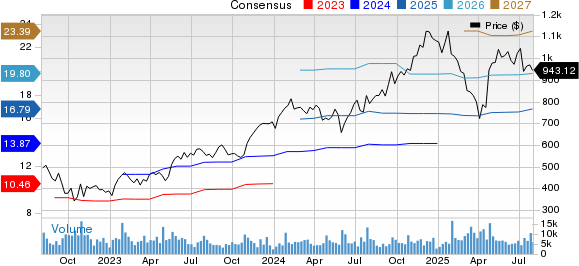

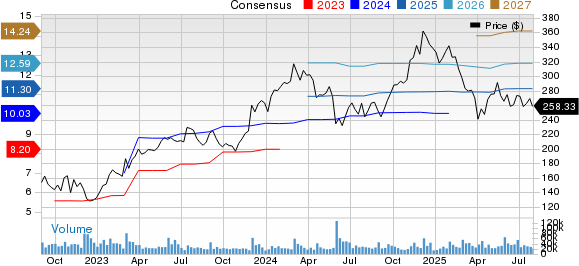

How Do Earnings Estimates Compare for NOW & CRM?

The Zacks Consensus Estimate for NOW’s 2025 earnings is pegged at $16.79 per share, which has increased 1.51% over the past 30 days, indicating an a 20.62% rise year over year.

The Zacks Consensus Estimate for CRM’s fiscal 2026 earnings is pegged at $11.30 per share, which has remained unchanged over the past 30 days, indicating an a 10.78% increase year over year.

Conclusion

Both ServiceNow and Salesforce are positioned to benefit from rising enterprise investment in AI-driven workflow automation, amid challenging macroeconomic conditions and lingering concerns related to tariffs. NOW’s strong portfolio, acquisitions, and rich partner base are noteworthy compared to Salesforce, which is suffering from stiff competition and challenging macroeconomic conditions.

ServiceNow, with a Zacks Rank #3 (Hold), currently has an edge over Salesforce, which has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is a little-known satellite-based communications firm. Space is projected to become a trillion dollar industry, and this company's customer base is growing fast. Analysts have forecasted a major revenue breakout in 2025. Of course, all our elite picks aren't winners but this one could far surpass earlier Zacks' Stocks Set to Double like Hims & Hers Health, which shot up +209%.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Salesforce Inc. (CRM): Free Stock Analysis Report

ServiceNow, Inc. (NOW): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English