Colgate-Palmolive (CL) Reports Q2 US$5 Billion Sales, Adjusts 2025 Guidance

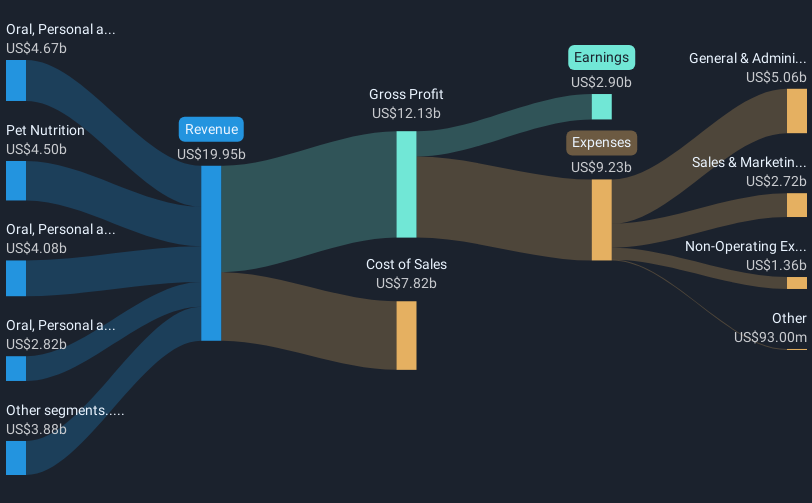

Colgate-Palmolive (CL) reported stable second-quarter earnings growth with a slight year-over-year net income increase and a modest rise in earnings per share, despite a decrease in first-half total sales. The company's stock experienced a 5% decline over the last week, amid a broader market downturn influenced by investor reactions to new tariffs and a weak jobs report. These external economic factors likely contributed to Colgate-Palmolive's stock performance, despite its stable corporate results and cautious sales growth expectations for 2025, which are impacted by foreign exchange and a strategic exit from private label pet sales.

Colgate-Palmolive has 1 risk we think you should know about.

Amid a challenging market environment, Colgate-Palmolive's recent stable earnings growth, despite falling sales, underscores its resilience. However, the stock's 5% decline over the past week highlights the market's sensitivity to broader economic issues such as tariffs and employment figures. These factors may cloud the potential revenue and earnings improvements anticipated from Colgate's innovation-centered strategies and category-focused efforts. While the company's renewed focus on premium product launches and supply chain enhancements aims to bolster profit margins, these ambitions could be tempered by the current economic backdrop and regional challenges in markets like China and Latin America.

Over a longer-term, five-year horizon, Colgate-Palmolive's total shareholder return, including dividends, sits at 24.20%. While this figure suggests a positive performance, it's crucial to recognize the annual performance discrepancy, where the broader US market saw a return of 16.8% and the Household Products industry experienced a decline of 9.3%. This variance places Colgate-Palmolive in a mixed light when compared to these benchmarks, especially for investors evaluating its long-term appeal. Currently, Colgate's stock trades at US$83.85, reflecting a potential upside of approximately 17.6% from the analyst consensus price target of US$98.53, though individual analyst perspectives range from US$85 to US$108. Considering these factors, investors should assess whether the company's forecasted growth aligns with their expectations and how it might influence its valuation in an evolving market landscape.

Assess Colgate-Palmolive's future earnings estimates with our detailed growth reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English