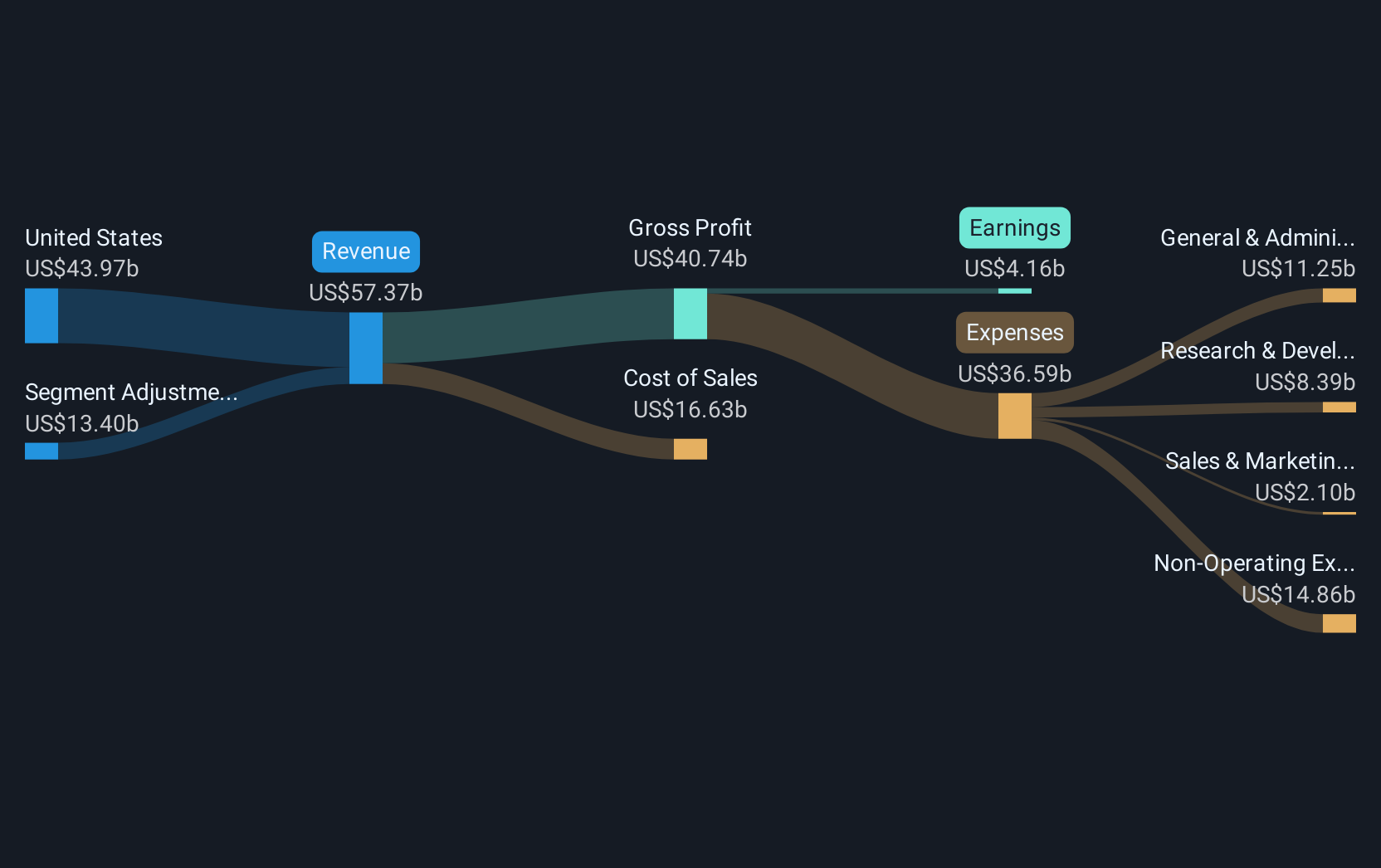

AbbVie (ABBV) Reports Increased Sales But Lower Net Income For Q2 2025

AbbVie (ABBV) recently revealed mixed financial Q2 2025 results with increased sales but a drop in net income and EPS, alongside strategic pursuits such as potential acquisitions and new product developments. Despite these developments, AbbVie's share price remained flat over the past month. This modest movement could reflect broader market trends influenced by macroeconomic concerns such as Trump's tariff announcements and a weaker-than-expected jobs report, which led to broader market declines. AbbVie's developments, while significant, appeared to neither bolster nor impede the company's stock performance significantly within this flat market context.

We've identified 4 possible red flags for AbbVie that you should be aware of.

The recent mixed financial results from AbbVie, featuring increased sales alongside a drop in net income and EPS, highlight the company's ongoing balancing act in managing biosimilar competition and economic challenges. Potential acquisitions and product developments, especially in obesity and oncology, underscore efforts to bolster future revenue streams. However, their immediate impact appears limited, as reflected in the recent flat share price movement. This is in contrast to AbbVie’s total return over the past five years, which stands at 149.72% when including dividends, demonstrating sustained long-term growth and resilience in a competitive market.

Over the past year, AbbVie underperformed the US market but surpassed the US Biotechs industry, which saw a decline. This performance mismatch highlights AbbVie's operational strengths amidst sectoral challenges. Looking forward, the current developments, including pipeline expansions and acquisitions, could influence future revenue and earnings forecasts positively, contingent on overcoming competitive pressures and potential tariff implications. With the current share price at US$189.02, it remains approximately 11.14% below the analyst consensus price target of US$210.08, suggesting potential room for price appreciation if the company's growth strategies materialize effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English