Will Kenvue's (KVUE) Dividend Hike Shape Perceptions of Its Capital Allocation Strategy?

- Kenvue Inc. recently announced that its Board of Directors approved a 1.2% increase to its quarterly dividend, raising it to US$0.2075 per share, payable on August 27, 2025, to shareholders of record as of August 13, 2025.

- This dividend hike signals management’s confidence in Kenvue’s ability to generate consistent cash flow and maintain shareholder value even as the company progresses post-separation from Johnson & Johnson.

- We’ll now examine how Kenvue’s increased dividend payment could influence the company’s investment narrative and shareholder outlook.

We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kenvue Investment Narrative Recap

For investors considering Kenvue, the core belief is in the company’s ability to sustain strong cash flows and defend its market-leading consumer health brands following the separation from Johnson & Johnson. The recent 1.2% dividend increase reflects management’s commitment to returning capital to shareholders, yet it is unlikely to have a material impact on the biggest short-term catalyst, execution of cost savings and operational efficiencies, or on near-term risks such as muted organic sales growth and margin pressures from global headwinds.

Among recent developments, Kenvue’s continued share repurchase activity stands out alongside the dividend increase. Completing the buyback of 14.2 million shares signals ongoing efforts to boost shareholder returns, but does not change the fact that organic sales growth remains modest and faces uncertainty from potential supply chain vulnerabilities.

However, investors should be mindful that, despite management’s positive signals, there are still significant risks if efficiency gains or revenue initiatives fall short and...

Read the full narrative on Kenvue (it's free!)

Kenvue is projected to reach $16.7 billion in revenue and $2.2 billion in earnings by 2028. This outlook assumes a 3.0% annual revenue growth rate and a $1.1 billion increase in earnings from the current level of $1.1 billion.

Uncover how Kenvue's forecasts yield a $23.80 fair value, a 10% upside to its current price.

Exploring Other Perspectives

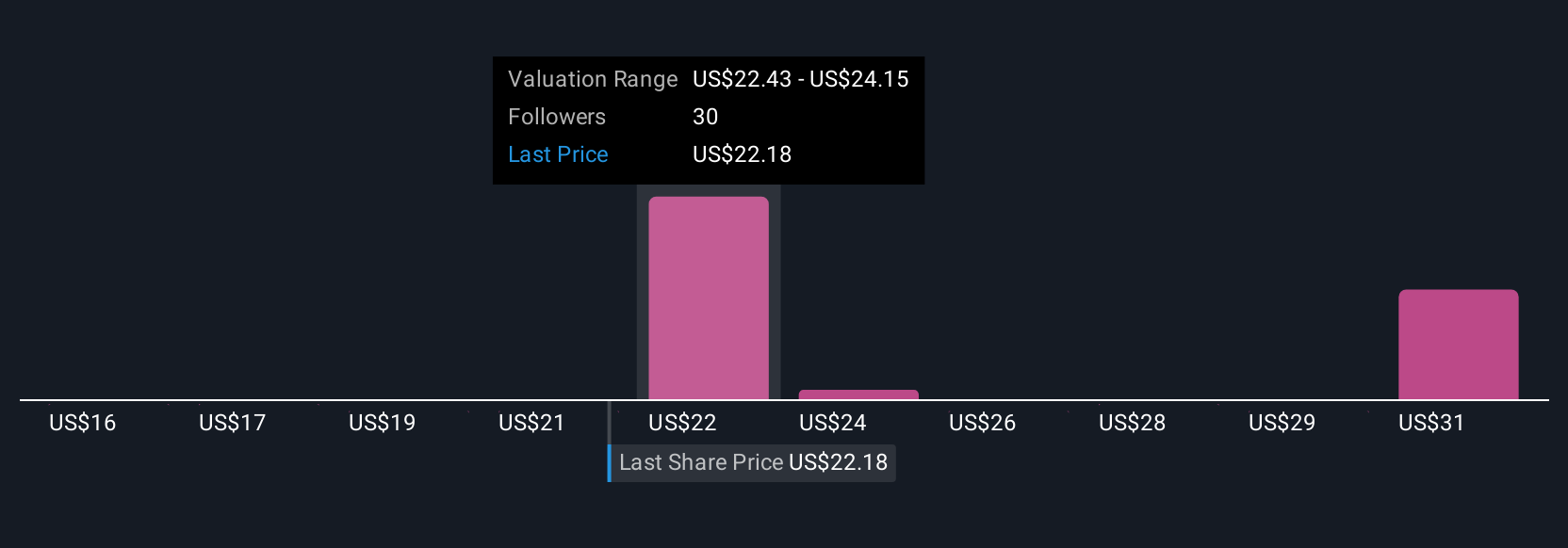

Six different fair value estimates from the Simply Wall St Community span US$15.58 to US$32.85 per share. While many see upside, persistent slow organic sales growth could limit how quickly Kenvue delivers towards consensus expectations, explore several community views to understand these contrasting opinions.

Explore 6 other fair value estimates on Kenvue - why the stock might be worth 28% less than the current price!

Build Your Own Kenvue Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kenvue research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kenvue research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kenvue's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 25 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 21 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English