Will the Latest Dividend Increase Shape American States Water's (AWR) Commitment to Shareholder Value?

- On July 29, 2025, the Board of Directors at American States Water approved an increase in the third quarter 2025 cash dividend to US$0.5040 per share, up from US$0.4655 per share, payable on September 3 to shareholders of record by August 15.

- This marks another step in the company's pattern of regular dividend increases, a factor that investors often watch as an indicator of financial health and management’s confidence in future cash flows.

- We will now examine how this recent dividend increase shapes American States Water’s broader investment narrative, especially its commitment to long-term shareholder value.

Find companies with promising cash flow potential yet trading below their fair value.

American States Water Investment Narrative Recap

To own American States Water, you need to believe in steady, long-term value from regulated utilities, resilience in a challenging operating environment, and consistent shareholder returns through dividends. The new dividend hike signals management’s ongoing commitment to rewarding shareholders, but its direct impact on the current short-term catalyst, successful execution of infrastructure investments authorized by regulators, remains limited, as the dividend change doesn’t directly address operational or regulatory risks.

Among recent announcements, the California Public Utilities Commission’s approval for substantial infrastructure investments stands out as central to the company’s growth prospects. This regulatory support enables American States Water to channel significant capital towards water utility upgrades, which could improve both service reliability and future cash flows, key factors driving both the company’s earnings potential and investor confidence around its long-term catalysts.

But on the other hand, investors should be aware that higher operating and interest costs remain a risk to margins, especially if...

Read the full narrative on American States Water (it's free!)

American States Water's narrative projects $698.7 million in revenue and $151.0 million in earnings by 2028. This requires 4.7% yearly revenue growth and a $28.5 million earnings increase from $122.5 million currently.

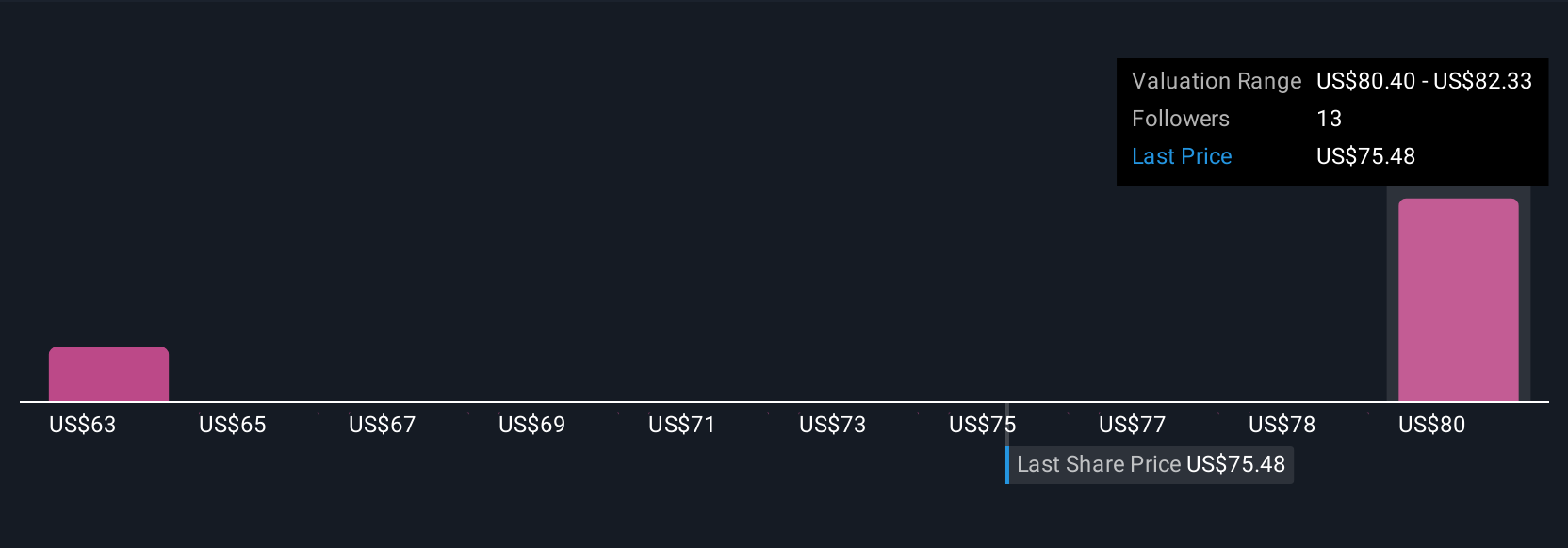

Uncover how American States Water's forecasts yield a $82.33 fair value, a 10% upside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community contributors range from US$63.01 to US$82.33 per share, showing a wide gap in outlooks. With investment spending recently greenlit by regulators, this difference in views can have important implications for how you assess future earnings and capital returns.

Explore 2 other fair value estimates on American States Water - why the stock might be worth as much as 10% more than the current price!

Build Your Own American States Water Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American States Water research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free American States Water research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American States Water's overall financial health at a glance.

No Opportunity In American States Water?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English