The Bull Case For Teekay Tankers (TNK) Could Change Following Q2 Earnings Miss and Revenue Decline

- Teekay Tankers Ltd. recently reported its second quarter 2025 earnings, revealing a significant year-on-year reduction in revenue to US$232.87 million and net income to US$62.61 million, both falling short of analyst estimates, and declared a cash dividend of US$0.25 per share payable on August 22, 2025.

- Despite ongoing efforts to renew its fleet and maintain shareholder dividends, the company’s results highlighted ongoing revenue headwinds and a divergence from broader industry growth expectations.

- We’ll examine how the earnings shortfall and revenue decline impacts Teekay Tankers’ outlook, including its renewed focus on fleet upgrades.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 25 companies in the world exploring or producing it. Find the list for free.

Teekay Tankers Investment Narrative Recap

To be a shareholder in Teekay Tankers, you need to believe in the company's ability to manage ongoing earnings and revenue declines while executing on its fleet renewal plans. The recent earnings shortfall does not materially change the near-term catalyst of improving fleet efficiency, but it does amplify the biggest risk: weaker tanker demand linked to shifting global trade flows and oil consumption patterns.

Among recent company announcements, the Q2 2025 earnings release stands out as highly relevant. Ongoing headwinds in revenue and net income reinforce the significance of Teekay Tankers' renewed focus on modernizing its fleet, which remains central to any potential margin improvements or operational resilience going forward.

By contrast, investors should be aware that persistent drops in tanker tonne-mile demand could...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers' narrative projects $471.1 million in revenue and $247.7 million in earnings by 2028. This requires a 24.5% yearly revenue decline and a decrease in earnings of $83.1 million from the current $330.8 million.

Uncover how Teekay Tankers' forecasts yield a $53.33 fair value, a 18% upside to its current price.

Exploring Other Perspectives

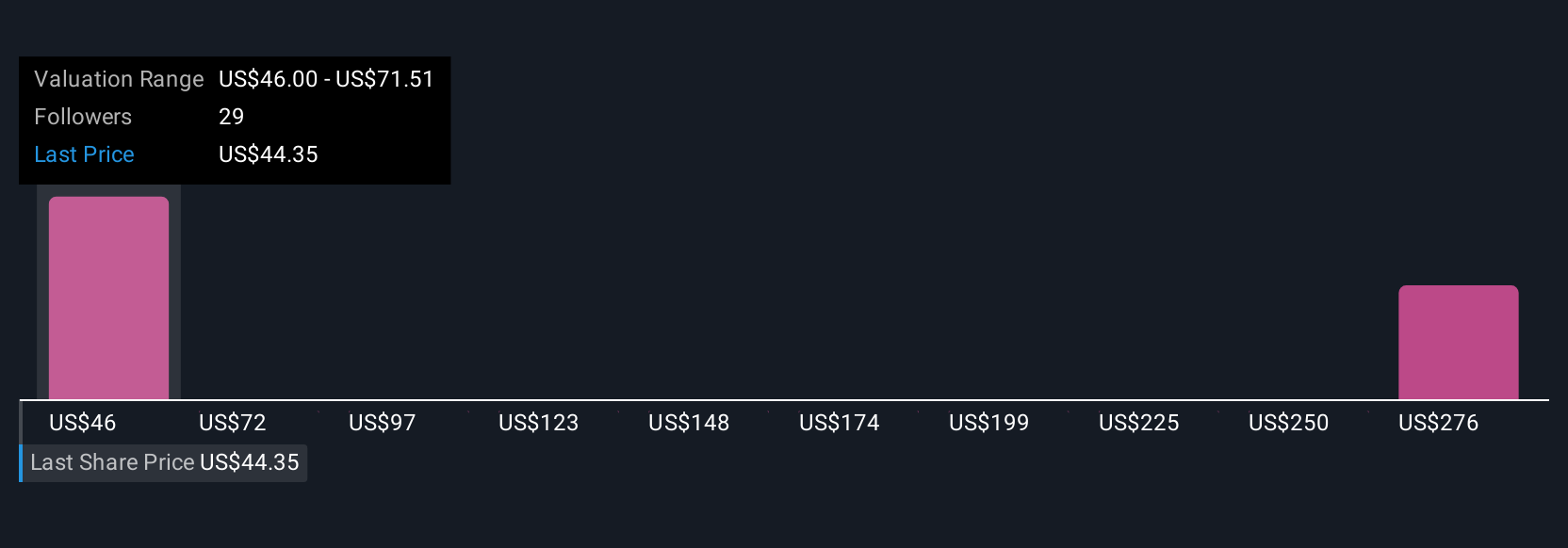

Three individual valuations from the Simply Wall St Community range widely from US$46 to US$322,794, covering nearly seven buckets. Yet, with revenues forecast to decline over the next three years, consider how these broad outlooks might reflect uncertain demand trends.

Explore 3 other fair value estimates on Teekay Tankers - why the stock might be worth just $46.00!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English