How BlackRock’s (BLK) New Active Infrastructure ETF Strengthens Its Global Diversification Strategy

- On July 31, 2025, BlackRock launched the iShares Infrastructure Active ETF, offering global exposure to 50-60 listed infrastructure companies spanning sectors such as transportation, energy, and logistics through an actively managed ETF structure.

- This ETF capitalizes on rising long-term global infrastructure investment trends driven by data center expansion, energy independence, and supply chain modernization, while highlighting BlackRock’s ability to identify and implement emerging sector opportunities.

- We will explore how this new ETF launch supports BlackRock’s efforts to diversify product offerings and capture infrastructure investment growth worldwide.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

BlackRock Investment Narrative Recap

If I were a BlackRock shareholder, I would need to believe in the company’s ability to grow by expanding its diversified investment offerings and capitalizing on long-term global trends, especially its push into infrastructure and alternatives. The launch of the iShares Infrastructure Active ETF broadens BlackRock’s exposure to growth sectors, but does not materially alter the biggest near-term catalyst, which remains continued institutional demand for alternatives, nor does it reduce the key risk of sustained fee compression impacting overall margins. One announcement that stands out is BlackRock’s recent quarterly cash dividend declaration of US$5.21 per share, reinforcing the company’s ongoing commitment to returning value to shareholders as it invests heavily in new products and platforms. This consistency in dividends sits alongside efforts to capture new growth, providing a measure of stability even as the industry contends with increasing pressure on margins from fee competition. But in contrast, what investors should be aware of is the persistent risk that margin pressure from industry-wide fee declines could offset...

Read the full narrative on BlackRock (it's free!)

BlackRock's outlook anticipates $29.1 billion in revenue and $9.0 billion in earnings by 2028. This scenario relies on a 10.4% annual revenue growth rate and a $2.6 billion increase in earnings from the current $6.4 billion.

Uncover how BlackRock's forecasts yield a $1158 fair value, a 4% upside to its current price.

Exploring Other Perspectives

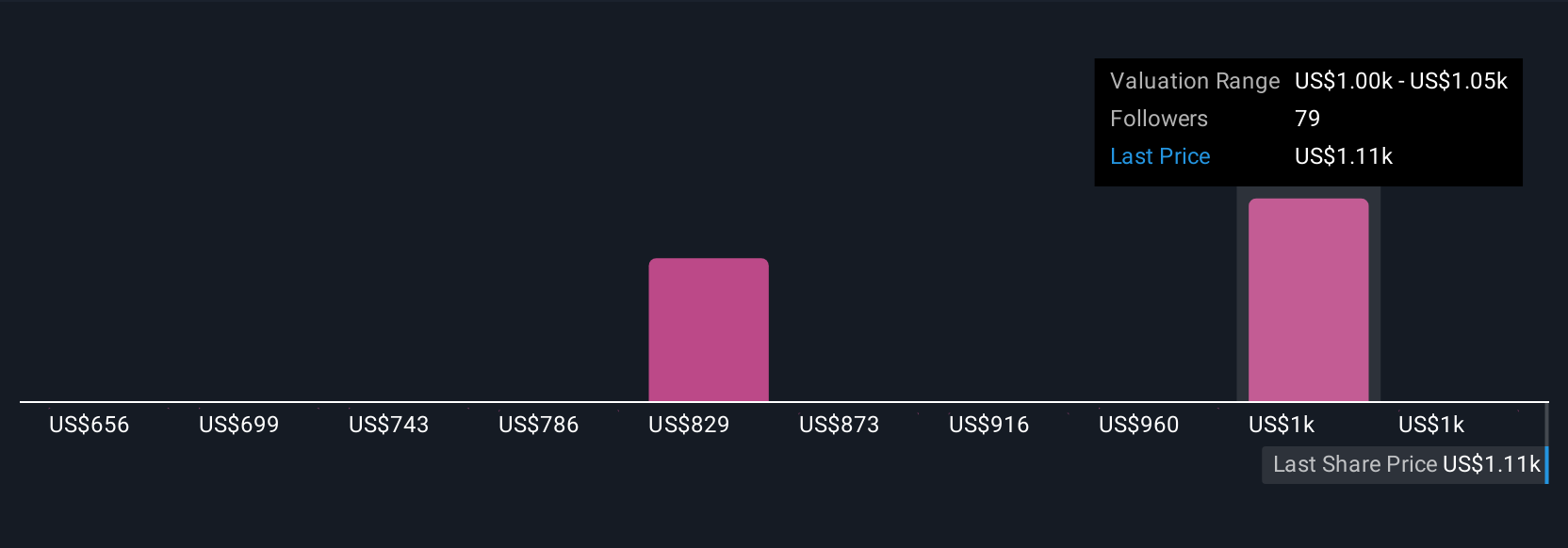

Sixteen private investors in the Simply Wall St Community placed fair value estimates for BlackRock ranging from US$679.55 to US$1,391.79 per share. While many are optimistic about long-term opportunities in alternatives and infrastructure, fee compression remains a risk that could weigh on future earnings growth and profitability, see how their contrasting views compare to analyst models.

Explore 16 other fair value estimates on BlackRock - why the stock might be worth as much as 25% more than the current price!

Build Your Own BlackRock Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BlackRock research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BlackRock research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BlackRock's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English