Assessing Allegiant Travel: Insights From 8 Financial Analysts

Providing a diverse range of perspectives from bullish to bearish, 8 analysts have published ratings on Allegiant Travel (NASDAQ:ALGT) in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 6 | 1 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 1 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

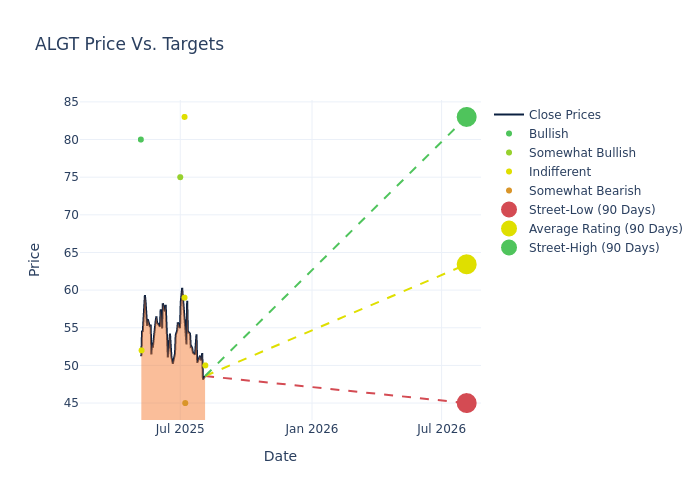

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $63.62, a high estimate of $85.00, and a low estimate of $45.00. This current average reflects an increase of 1.68% from the previous average price target of $62.57.

Decoding Analyst Ratings: A Detailed Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive Allegiant Travel. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Christopher Stathoulopoulos | Susquehanna | Raises | Neutral | $50.00 | $45.00 |

| Andrew Didora | B of A Securities | Lowers | Underperform | $45.00 | $50.00 |

| Ravi Shanker | Morgan Stanley | Lowers | Equal-Weight | $83.00 | $85.00 |

| Thomas Wadewitz | UBS | Lowers | Neutral | $59.00 | $60.00 |

| Duane Pfennigwerth | Evercore ISI Group | Announces | Outperform | $75.00 | - |

| Ravi Shanker | Morgan Stanley | Lowers | Equal-Weight | $85.00 | $93.00 |

| Thomas Wadewitz | UBS | Raises | Neutral | $60.00 | $45.00 |

| Brandon Oglenski | Barclays | Lowers | Equal-Weight | $52.00 | $60.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Allegiant Travel. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Allegiant Travel compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Allegiant Travel's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Allegiant Travel's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Allegiant Travel analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Allegiant Travel: A Closer Look

Allegiant Travel Co is a leisure travel company focused on providing travel and leisure services and products to residents of under-served cities in the United States. It operates a low-cost, low utilization passenger airline marketed to leisure travelers in under-served cities, allowing it to sell air transportation both on a stand-alone basis and bundled with the sale of air-related and third-party services and products. In addition, it provides air transportation under fixed-fee flight arrangements. In connection with its leisure travel focus, the company has opened Sunseeker Resort Charlotte Harbor, equipped with several guestrooms and food and beverage outlets. The company's operating segments are the Airline, which generates maximum revenue, and Sunseeker Resort.

Allegiant Travel: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Allegiant Travel's remarkable performance in 3M is evident. As of 31 March, 2025, the company achieved an impressive revenue growth rate of 6.5%. This signifies a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Industrials sector.

Net Margin: Allegiant Travel's net margin is impressive, surpassing industry averages. With a net margin of 4.47%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Allegiant Travel's ROE stands out, surpassing industry averages. With an impressive ROE of 2.84%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Allegiant Travel's ROA excels beyond industry benchmarks, reaching 0.7%. This signifies efficient management of assets and strong financial health.

Debt Management: Allegiant Travel's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.88.

How Are Analyst Ratings Determined?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English