HIMS Stock Plunges Following Q2 Earnings Miss, Gross Margin Down

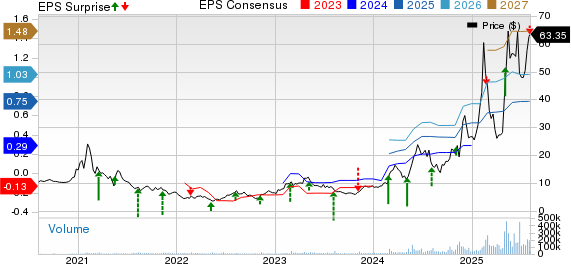

Hims & Hers Health, Inc. HIMS delivered an earnings per share (EPS) of 17 cents in second-quarter 2025 compared with the year-ago period’s EPS of 6 cents. However, the metric missed the Zacks Consensus Estimate by a penny.

HIMS’ Revenues in Detail

Hims & Hers registered revenues of $544.8 million in the second quarter, up 72.6% year over year. The figure missed the Zacks Consensus Estimate by 1.5%.

Solid revenues from the Online channel drove the top line despite being partially offset by Wholesale revenues.

Shares of this company lost nearly 12.9% in today’s pre-market trading.

Hims & Hers’ Segment Details

Hims & Hers’ operations consist of two channels — Online Revenues and Wholesale Revenues.

In the quarter under review, Online Revenues of $536.9 million reflected a surge of 74.9% year over year on a reported basis.

During the reported quarter, subscribers were 2.4 million (up 30.8% year over year). This was primarily driven by increased traffic to Hims & Hers’ platform (through websites and mobile applications), resulting from its marketing activities and improved onsite and customer onboarding experiences and consumer adoption of the company’s personalized offerings across its business, including GLP-1 weight loss offerings.

Monthly online revenue per average subscriber increased 29.8% year over year to $74 in the second quarter, primarily resulting from subscriber uptake of personalized offerings across Hims & Hers’ business, including its GLP-1 weight loss offering, along with changes in product mix.

Wholesale Revenues totaled $7.9 million, down 9.7% year over year.

HIMS’ Margin Analysis

In the second quarter, Hims & Hers’ gross profit increased 62.2% year over year to $416.2 million. However, the gross margin contracted 491 basis points (bps) to 76.4%.

Marketing expenses jumped 50.3% year over year to $217.9 million, while technology and development expenses increased 102.9% year over year to $37.8 million. General and administrative expenses rose 65.9% year over year to $67.3 million, while operations and support expenses increased 60.4% year over year to $66.5 million. Operating expenses of $389.5 million increased 58.6% year over year.

Operating profit totaled $26.7 million, reflecting a 142.3% surge from the year-ago quarter. The operating margin in the second quarter expanded 141 bps to 4.9%.

Hims & Hers’ Financial Position

Hims & Hers exited second-quarter 2025 with cash and cash equivalents and short-term investments of $1.14 billion compared with $322.7 million at the first-quarter end.

Cumulative net cash provided by operating activities at the end of second-quarter 2025 was $89.9 million compared with $79.4 million a year ago.

HIMS’ Outlook

Hims & Hers has provided its revenue outlook for the third quarter and reiterated the same for 2025.

The company projects revenues for the third quarter of 2025 in the range of $570 million to $590 million, reflecting an uptick of 42-47% year over year. The Zacks Consensus Estimate is pegged at $583.3 million.

For the full year, the company continues to project revenues in the range of $2.3 billion to $2.4 billion (representing growth of 56-63% from 2024 levels). The Zacks Consensus Estimate is pegged at $2.35 billion.

Our Take on Hims & Hers

Hims & Hers’ robust improvement in the top and bottom lines and strength in its Online revenue channel in second-quarter 2025 were promising. The increase in subscribers and monthly online revenue per average subscriber during the quarter was encouraging. The expansion of the operating margin during the quarter bodes well.

In July, HIMS closed its acquisition of ZAVA, expanding its presence in the U.K. and establishing a foundation in other strategic markets such as Germany, Ireland and France. Per management, the acquisition will likely accelerate the company’s ability to expand into markets beyond Europe. In 2026, Hims & Hers expects to enter Canada with an initial focus on a holistic weight loss program, timed to align with the anticipated first-ever availability of generic semaglutide globally. These raise our optimism about the stock.

However, Hims & Hers’ lower-than-expected results in the second quarter of 2025 and lower Wholesale revenues were disappointing. The gross margin contracted due to rising product costs, which do not bode well for the stock.

HIMS’ Zacks Rank and Other Key Picks

Hims & Hers currently carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space that have announced quarterly results are GE HealthCare Technologies Inc. GEHC, West Pharmaceutical Services, Inc. WST and Boston Scientific Corporation BSX.

GE HealthCare, sporting a Zacks Rank #1 (Strong Buy), reported second-quarter 2025 adjusted EPS of $1.06, beating the Zacks Consensus Estimate by 16.5%. Revenues of $5.01 billion outpaced the consensus mark by 0.7%. You can see the complete list of today’s Zacks #1 Rank stocks here.

GE HealthCare has a long-term estimated growth rate of 5.8%. GEHC’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 12.5%.

West Pharmaceutical reported second-quarter 2025 adjusted EPS of $1.84, beating the Zacks Consensus Estimate by 21.9%. Revenues of $766.5 million surpassed the Zacks Consensus Estimate by 5.4%. It currently flaunts a Zacks Rank #1.

West Pharmaceutical has a long-term estimated growth rate of 8.4%. WST’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 16.8%.

Boston Scientific reported second-quarter 2025 adjusted EPS of 75 cents, beating the Zacks Consensus Estimate by 4.2%. Revenues of $5.06 billion surpassed the Zacks Consensus Estimate by 3.5%. It currently carries a Zacks Rank #2.

Boston Scientific has a long-term estimated growth rate of 14%. BSX’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 8.1%.

Only $1 to See All Zacks' Buys and Sells

We're not kidding.

Several years ago, we shocked our members by offering them 30-day access to all our picks for the total sum of only $1. No obligation to spend another cent. Thousands have taken advantage of this opportunity.

Thousands did not - they thought there must be a catch. Yes, we do have a reason. We want you to get acquainted with our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, that closed 256 positions with double- and triple-digit gains in 2024 alone.

See Stocks Now >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX): Free Stock Analysis Report

West Pharmaceutical Services, Inc. (WST): Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS): Free Stock Analysis Report

GE HealthCare Technologies Inc. (GEHC): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English