Will New Luxury Community Launches Redefine Toll Brothers' (TOL) Upscale Housing Narrative?

- Toll Brothers recently announced several luxury community launches across the U.S., including the highly anticipated Toll Brothers at Storyrock in Scottsdale, Arizona, and Birch Run at New Britain in Pennsylvania, with homes in these developments priced from US$600,000 to over US$2 million.

- These launches highlight Toll Brothers' focus on expanding its footprint in the high-end housing market with offerings tailored to affluent buyers across multiple growing regions.

- We’ll examine how Toll Brothers’ accelerated rollout of new luxury communities could shape its investment outlook and growth narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 25 best rare earth metal stocks of the very few that mine this essential strategic resource.

Toll Brothers Investment Narrative Recap

To be a Toll Brothers shareholder, you need to believe in sustained demand for luxury housing, driven by limited inventory and affluent demographic trends. The company’s recent rollouts of premium communities reinforce its commitment to market expansion, but these launches do not materially affect the short-term catalyst of stabilizing order trends or alter the pressing risk, softer demand, evident in declining net agreements, continues to weigh on future revenue visibility.

The announcement of Toll Brothers at Storyrock in Scottsdale, Arizona, stands out, with homes starting from US$2 million and extensive customization options. While this expansion showcases Toll Brothers’ strength in attracting affluent buyers, it also reinforces the company’s exposure to macroeconomic fluctuations, a key factor in the ongoing risk to demand and margins as economic uncertainty lingers.

On the other hand, investors should be aware that a continued slowdown in luxury home demand...

Read the full narrative on Toll Brothers (it's free!)

Toll Brothers' outlook envisions $12.8 billion in revenue and $1.6 billion in earnings by 2028. This scenario assumes 6.2% annual revenue growth and a $0.2 billion increase in earnings from the current $1.4 billion.

Uncover how Toll Brothers' forecasts yield a $141.12 fair value, a 13% upside to its current price.

Exploring Other Perspectives

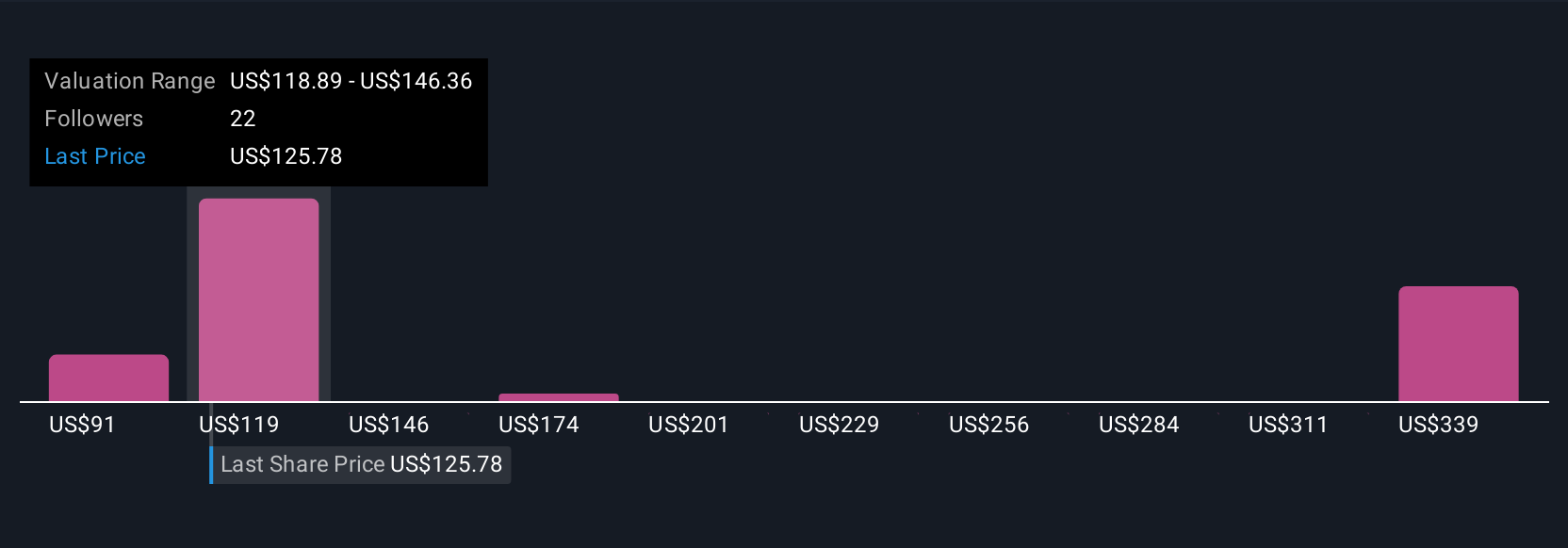

Simply Wall St Community members supplied 12 fair value estimates for Toll Brothers, ranging from US$91.41 to US$392.89 per share. With demand softness still a concern, these differences highlight the wide variety of views on what could shape the company’s results, explore several perspectives to better inform your outlook.

Explore 12 other fair value estimates on Toll Brothers - why the stock might be worth 27% less than the current price!

Build Your Own Toll Brothers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toll Brothers research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Toll Brothers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toll Brothers' overall financial health at a glance.

No Opportunity In Toll Brothers?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English