How Investors May Respond To Ally Financial (ALLY) Doubling Down on AI and Core Business Focus

- Ally Financial Inc. recently reported strong Q2 2025 results, completed the sale of its credit card business, advanced its proprietary generative AI platform for over 10,000 employees, and raised new capital through two senior note issuances totaling more than US$600 million.

- These developments signal Ally’s intensified emphasis on digital transformation, core business focus, and enhancing operational efficiency by integrating leading-edge technology and solidifying its balance sheet.

- To assess how these changes may influence Ally’s outlook, we’ll examine how wide-scale AI adoption could shift its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Ally Financial Investment Narrative Recap

To own Ally Financial stock, an investor needs to believe in the company's ability to leverage its digital banking scale, deepen efficiency through AI, and defend its leading auto lending business even as industry models shift. The recent Q2 results, AI rollout, and capital raises reinforce strategy execution, but do not materially change the key short-term catalyst: capturing profitable auto loan growth amid margin pressures. The biggest risk remains the company's heavy exposure to auto finance, particularly as consumer credit conditions remain unpredictable.

Among recent announcements, Ally's rollout of its enterprise AI platform, Ally.ai, to all 10,000 employees stands out as most relevant. This move reflects ongoing investment in digital tools aimed at boosting efficiency, a critical lever as Ally faces both rising competition and cyclical risks in consumer lending. With the industry focusing sharply on cost control, Ally’s expanding use of AI could be important in supporting margins during periods of economic uncertainty.

By contrast, investors should also be aware of heightened credit risk if consumer loan losses rise faster than...

Read the full narrative on Ally Financial (it's free!)

Ally Financial's narrative projects $9.6 billion in revenue and $1.8 billion in earnings by 2028. This requires 12.0% annual revenue growth and a $1.55 billion increase in earnings from the current $249.0 million.

Uncover how Ally Financial's forecasts yield a $45.94 fair value, a 23% upside to its current price.

Exploring Other Perspectives

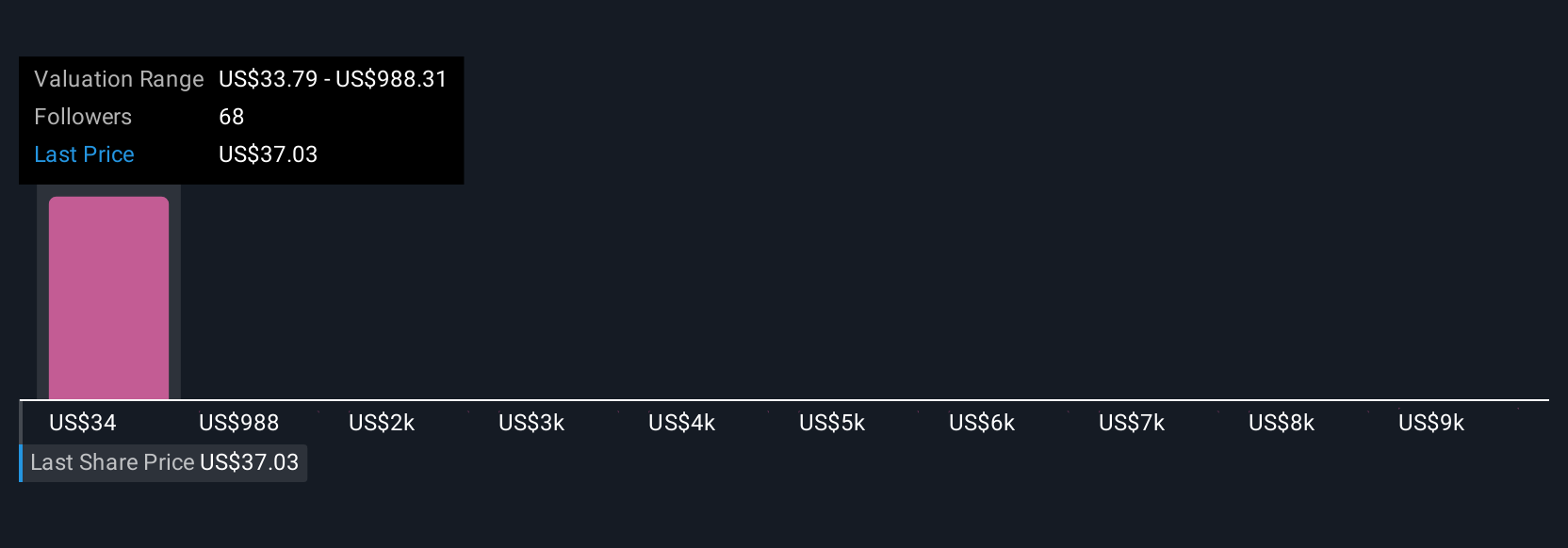

Simply Wall St Community members set fair values for Ally Financial from as low as US$33.79 to as high as US$9,578.94, across 11 estimates. This wide range reflects very different outlooks, especially as the company’s focus on digital transformation remains central to its future performance.

Explore 11 other fair value estimates on Ally Financial - why the stock might be a potential multi-bagger!

Build Your Own Ally Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ally Financial research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Ally Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ally Financial's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English