Will XPO (XPO)’s Renewed Buyback Strategy Mark a Shift in Its Capital Allocation Priorities?

- In the past week, XPO, Inc. reported second quarter 2025 earnings with US$2.08 billion in sales and US$106 million in net income, alongside a completed share buyback of 83,041 shares for US$10 million between April and June.

- An important insight is the company’s plan to resume buybacks as capital expenditures decline, pointing to improved cash flow management and a positive outlook on growing nearshoring-driven industrial demand.

- We’ll examine how XPO’s commitment to shareholder returns through resumed buybacks shapes its investment narrative moving forward.

These 19 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

XPO Investment Narrative Recap

To be a shareholder in XPO, Inc., you need to believe the company's operational improvements and expansion efforts will eventually outweigh pressures from a challenging freight market and margin headwinds. The recent news around a completed share buyback suggests an active approach to shareholder returns, but does not materially change the biggest near-term catalyst, execution on cost reductions and service center investments, or the greatest risk, which remains persistent weakness in freight demand and pressure from lower fuel surcharge revenues.

The most relevant announcement is XPO's Q2 2025 earnings report, where both revenue and net income declined compared to last year. This aligns with the core short-term risk, ongoing softness in the industrial economy and freight volumes affecting profitability. While buybacks can support the stock, sustained gains will likely depend on noticeable improvements in operational performance and growth in the company's high-margin local business.

However, despite active buybacks, investors should be aware that exposure to fluctuations in fuel prices remains a significant risk...

Read the full narrative on XPO (it's free!)

XPO's outlook anticipates $8.9 billion in revenue and $621.2 million in earnings by 2028. This scenario is based on a 3.7% annual revenue growth and a $232.2 million earnings increase from the current $389.0 million.

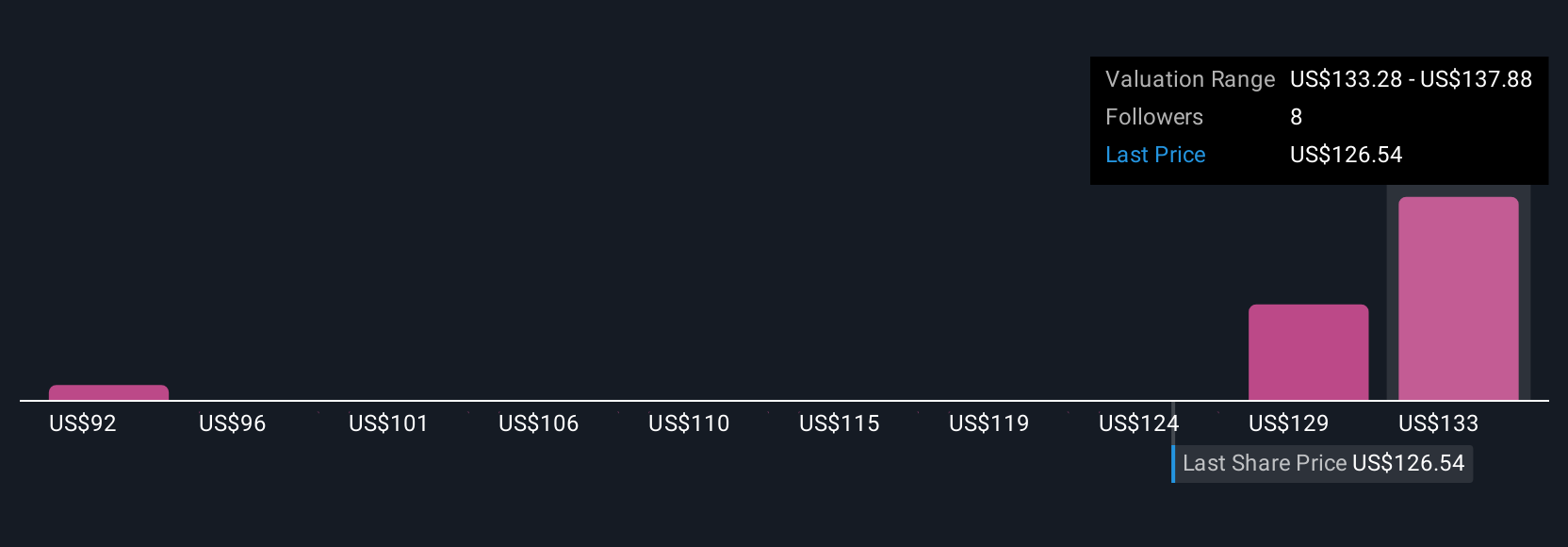

Uncover how XPO's forecasts yield a $137.12 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community members estimated XPO’s fair value between US$91.89 and US$137.12. Given the company’s focus on service center efficiencies as a growth driver, it's clear opinions can differ sharply, review several viewpoints to understand what matters most to you.

Explore 3 other fair value estimates on XPO - why the stock might be worth as much as 14% more than the current price!

Build Your Own XPO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your XPO research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free XPO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate XPO's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English