3 Undervalued Small Caps In Global With Insider Action To Consider

As global markets grapple with renewed tariffs and trade policy uncertainties, small-cap stocks have taken a significant hit, with indices like the Russell 2000 experiencing notable declines. Despite these challenges, the current environment may present opportunities for discerning investors to explore undervalued small-cap companies that exhibit strong fundamentals and insider activity.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.4x | 6.4x | 48.59% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 6.7x | 1.8x | 21.19% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.6x | 7.0x | 23.72% | ★★★★★☆ |

| Hemisphere Energy | 5.2x | 2.1x | 11.78% | ★★★★☆☆ |

| Sagicor Financial | 9.6x | 0.4x | -86.72% | ★★★★☆☆ |

| CVS Group | 44.6x | 1.3x | 38.78% | ★★★★☆☆ |

| A.G. BARR | 19.6x | 1.8x | 45.94% | ★★★☆☆☆ |

| SmartCraft | 42.7x | 7.6x | 36.78% | ★★★☆☆☆ |

| Chinasoft International | 25.3x | 0.8x | 8.01% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.7x | 48.99% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

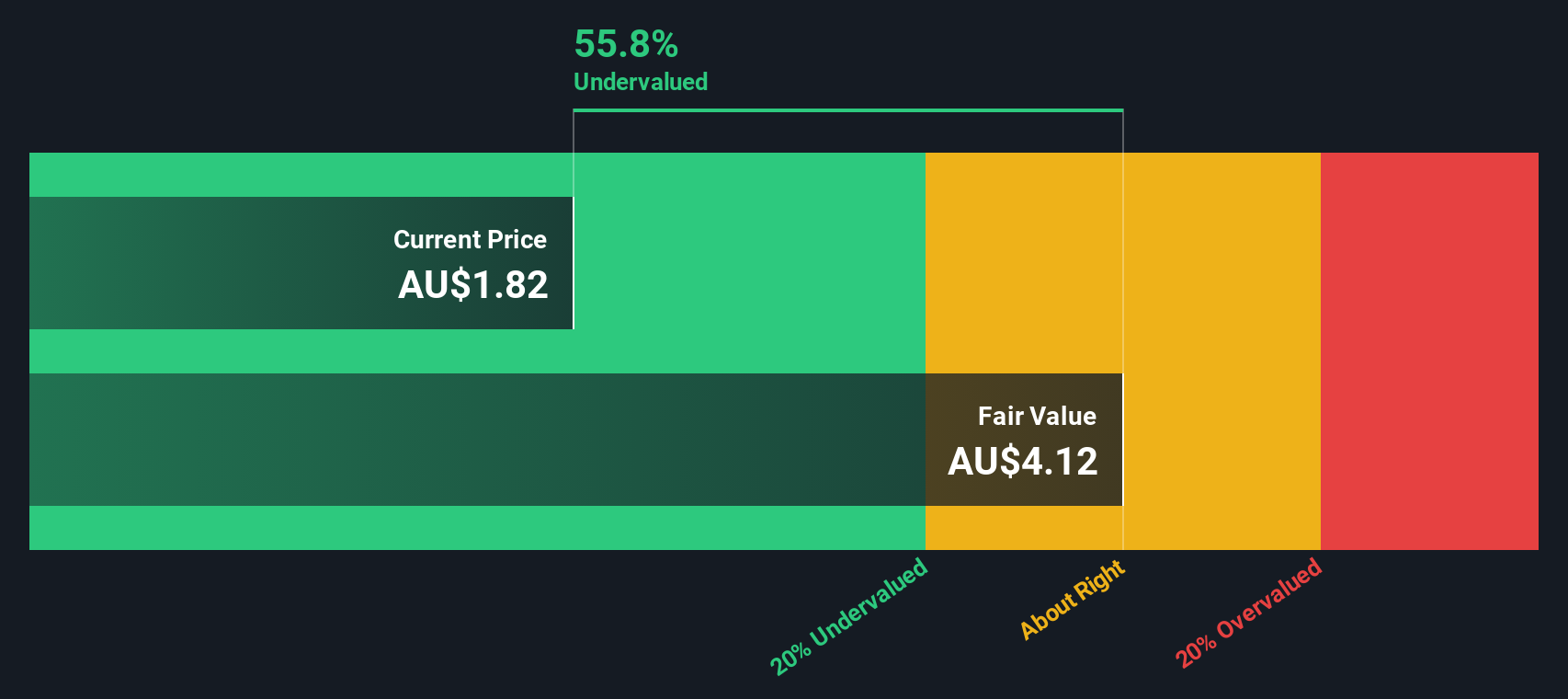

Karoon Energy (ASX:KAR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Karoon Energy is an oil and gas exploration and production company focused on the evaluation of hydrocarbons, with a market cap of A$1.53 billion.

Operations: Karoon Energy's revenue is primarily derived from the exploration and evaluation of hydrocarbons, with a recent figure reported at $776.5 million. The company's gross profit margin has shown variability, reaching 60.16% in December 2023 before adjusting to 48.82% by the end of 2024. Operating expenses have fluctuated over time, impacting overall profitability, with notable figures such as $72.2 million in December 2023 and $75.8 million in December 2024 contributing to financial outcomes alongside non-operating expenses like $179.6 million during the same period in December 2023 and $175.8 million by December 2024.

PE: 7.1x

Karoon Energy, a player in the energy sector, recently secured 100% interests in six blocks offshore Brazil, enhancing its exploration footprint. This move could position them for future growth despite their current lower profit margins of 16.4%, down from last year's 29.7%. Insider confidence is evident with recent purchases over the past year, signaling belief in potential value. The company's funding relies entirely on external borrowing, adding a layer of risk to their financial structure.

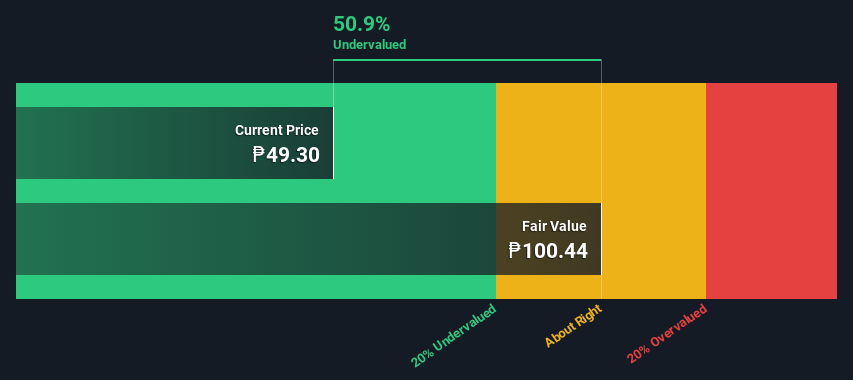

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a major financial institution in the Philippines, primarily engaged in retail and corporate banking, treasury operations, and other financial services, with a market capitalization of ₱61.56 billion.

Operations: The bank's primary revenue streams include retail banking, corporate banking, and treasury operations. Retail banking is the largest contributor with ₱33.79 billion in revenue, followed by corporate banking at ₱12.42 billion and treasury operations at ₱11.50 billion. The net profit margin has shown significant variability over the periods observed, reaching as high as 37.52% in recent quarters, reflecting changes in cost management and operational efficiency over time.

PE: 4.5x

Philippine National Bank, a smaller player in the banking sector, is currently navigating challenges with a high bad loan ratio of 6.9% and a low allowance for these loans at 91%. Despite these hurdles, revenue is expected to grow by 8.26% annually. Recent board activities include strategic leadership appointments and plans to issue bonds worth up to PHP 20 billion. Insider confidence is evident as an executive holds shares, suggesting belief in future prospects despite current financial pressures.

China Lesso Group Holdings (SEHK:2128)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: China Lesso Group Holdings is a leading industrial group in China specializing in the production and sale of building materials and interior decoration products, with operations primarily focused on plastics and rubber.

Operations: The company's revenue primarily comes from the Plastics & Rubber segment, with a recent revenue figure of CN¥27.03 billion. The cost of goods sold (COGS) stands at CN¥19.73 billion, contributing to a gross profit margin of 26.99%. Operating expenses are reported at CN¥3.42 billion, while non-operating expenses amount to CN¥2.19 billion, impacting net income which is recorded at CN¥1.68 billion with a net income margin of 6.23%.

PE: 7.9x

China Lesso Group Holdings, a small company in the construction materials sector, recently declared a final dividend of HK 20 cents per share for 2024. Insider confidence is evident as CEO Manlun Zuo purchased over 6 million shares worth approximately HK$26.99 million, increasing their holdings by over 40%. Despite relying on external borrowing for funding, the company's earnings are projected to grow by about 12% annually. Recent leadership changes aim to bolster North American sales and new energy storage initiatives.

Seize The Opportunity

- Click through to start exploring the rest of the 102 Undervalued Global Small Caps With Insider Buying now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English